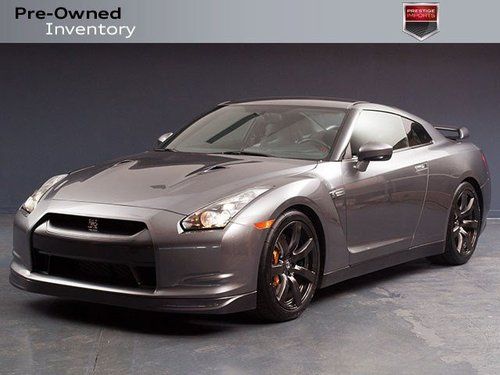

2014 nissan gt-r 2dr cpe premium(US $110,875.00)

2014 nissan gt-r 2dr cpe premium(US $110,875.00) 2013 premium new turbo 3.8l v6 24v automatic coupe bose

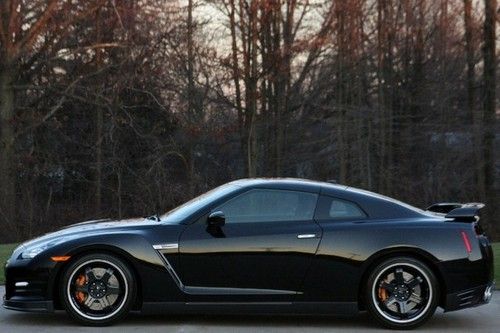

2013 premium new turbo 3.8l v6 24v automatic coupe bose Deep blue pearl premium! we accept all trades! no reserve!!!(US $99,995.00)

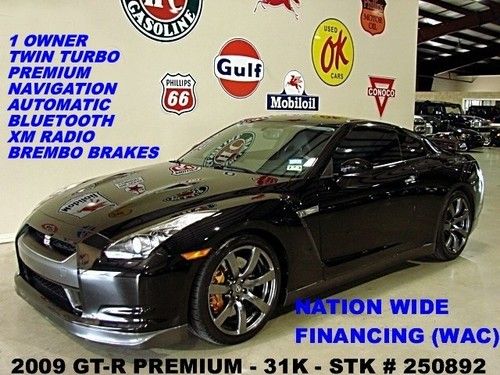

Deep blue pearl premium! we accept all trades! no reserve!!!(US $99,995.00) Nissan : 2009 gt-r premium pkg twin turbo awd coupe 9888 miles 1-va. owner sharp

Nissan : 2009 gt-r premium pkg twin turbo awd coupe 9888 miles 1-va. owner sharp Black edition new coupe 3.8l nav cd awd turbocharged active suspension mp3(US $99,999.00)

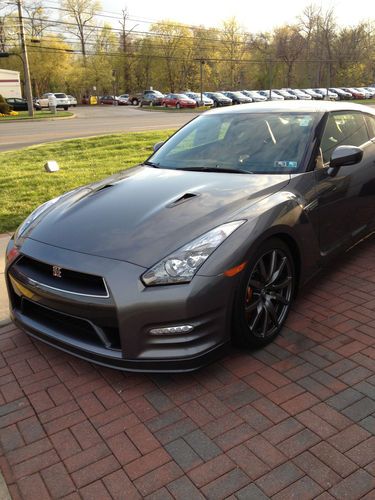

Black edition new coupe 3.8l nav cd awd turbocharged active suspension mp3(US $99,999.00) 2012 nissan gt-r premium coupe 2-door 3.8l(US $84,900.00)

2012 nissan gt-r premium coupe 2-door 3.8l(US $84,900.00) 2010 nissan gt-r awd twin turbo 485hp fresh trade! priced to sell fast!!!!!!!(US $67,491.00)

2010 nissan gt-r awd twin turbo 485hp fresh trade! priced to sell fast!!!!!!!(US $67,491.00) 2012 nissan gt-r 2dr cpe premium(US $82,000.00)

2012 nissan gt-r 2dr cpe premium(US $82,000.00) 2013 gtr black edition 3k miles,1.99% financing(US $92,950.00)

2013 gtr black edition 3k miles,1.99% financing(US $92,950.00) 2010 nissan gt-r *just serviced* new tires*(US $72,995.00)

2010 nissan gt-r *just serviced* new tires*(US $72,995.00) 2014 nissan gt-r 2dr cpe premium(US $110,875.00)

2014 nissan gt-r 2dr cpe premium(US $110,875.00) '12 gtr black edition, 670 original miles, perfect!(US $93,000.00)

'12 gtr black edition, 670 original miles, perfect!(US $93,000.00) 2014 nissan gt-r 2dr cpe black edition(US $120,615.00)

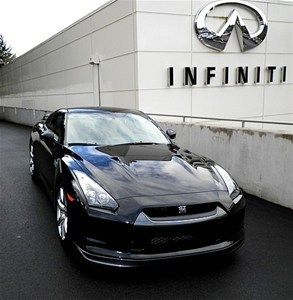

2014 nissan gt-r 2dr cpe black edition(US $120,615.00) 2009 nissan gt-r

2009 nissan gt-r 2014 nissan gt-r premium leather twinturbo v6 bose awd nav 545hp paddle shifters

2014 nissan gt-r premium leather twinturbo v6 bose awd nav 545hp paddle shifters 3.8l leather navigation awd low miles new tires one owner clean carfax

3.8l leather navigation awd low miles new tires one owner clean carfax 1980 nissan gtr(US $48,000.00)

1980 nissan gtr(US $48,000.00) 2014 nissan gt-r premium pearl white/black reserve set below sticker price

2014 nissan gt-r premium pearl white/black reserve set below sticker price 2014 nissan gtr's 11 to choose from***(US $94,928.00)

2014 nissan gtr's 11 to choose from***(US $94,928.00) Super silver premium edition!(US $89,900.00)

Super silver premium edition!(US $89,900.00) Gtr~premium model~navigation~serviced~30 pics~best $$ on ebay(US $59,550.00)

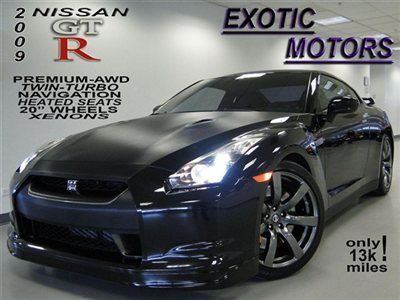

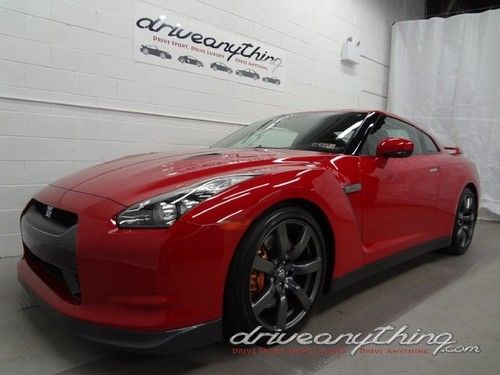

Gtr~premium model~navigation~serviced~30 pics~best $$ on ebay(US $59,550.00) 2009 nissan gt-r premium awd! twin-turbo nav heated-sts bose xenon 480hp 20"whls(US $65,900.00)

2009 nissan gt-r premium awd! twin-turbo nav heated-sts bose xenon 480hp 20"whls(US $65,900.00) 2014 nissan gtr premium awd twin turbo we finance(US $100,875.00)

2014 nissan gtr premium awd twin turbo we finance(US $100,875.00) 14 new pearl white gtr 3.8l v6 twin turbo awd dual clutch 545 hp coupe*florida

14 new pearl white gtr 3.8l v6 twin turbo awd dual clutch 545 hp coupe*florida 2014 gt-r prem(US $94,928.00)

2014 gt-r prem(US $94,928.00) New 2013 nissan gt-r black edition(US $95,000.00)

New 2013 nissan gt-r black edition(US $95,000.00) New 2014 nissan gt-r premium(US $98,000.00)

New 2014 nissan gt-r premium(US $98,000.00) 2009 nissan gt-r, gtr, bone stock, 1 owner, clean carfax! we finance!(US $61,888.00)

2009 nissan gt-r, gtr, bone stock, 1 owner, clean carfax! we finance!(US $61,888.00) Black edition(US $90,950.00)

Black edition(US $90,950.00) 2010 nissan gt-r premium coupe 2-door 3.8l(US $88,500.00)

2010 nissan gt-r premium coupe 2-door 3.8l(US $88,500.00) 2009 premium 3.8l auto black obsidian(US $64,997.00)

2009 premium 3.8l auto black obsidian(US $64,997.00) 2014 nissan gt-r coupe premium(US $101,995.00)

2014 nissan gt-r coupe premium(US $101,995.00) 2009 nissan gt-r premium coupe 2-door 3.8l(US $64,980.00)

2009 nissan gt-r premium coupe 2-door 3.8l(US $64,980.00) 2009 nissan gt-r, gtr, jotech stage 4, 735whp pump gas! we finance!(US $109,888.00)

2009 nissan gt-r, gtr, jotech stage 4, 735whp pump gas! we finance!(US $109,888.00) 2014 nissan gt-r leather suede 545hp bose awd

2014 nissan gt-r leather suede 545hp bose awd Pearl white skyline premium gtr financing black leather warranty navigation used(US $93,779.00)

Pearl white skyline premium gtr financing black leather warranty navigation used(US $93,779.00) 2009 nissan gtr with only 7,781 miles

2009 nissan gtr with only 7,781 miles 12 nissan gtr black-series awd 4k bose navi heat-sts rear-cam keyless(US $91,995.00)

12 nissan gtr black-series awd 4k bose navi heat-sts rear-cam keyless(US $91,995.00) 2014 nissan gt-r 2dr cpe black edition

2014 nissan gt-r 2dr cpe black edition Stunning gtr premium black on black with only 70 miles like new!!(US $93,750.00)

Stunning gtr premium black on black with only 70 miles like new!!(US $93,750.00) 2009 base 3.8l auto black obsidian(US $69,900.00)

2009 base 3.8l auto black obsidian(US $69,900.00) 2010 premium auto, florida car! one owner! new tires(US $74,997.00)

2010 premium auto, florida car! one owner! new tires(US $74,997.00) Only 1500 miles gtr gt-r premium bose nav navigation 20" low miles extra clean(US $74,988.00)

Only 1500 miles gtr gt-r premium bose nav navigation 20" low miles extra clean(US $74,988.00) Deep blue pearl premium! we accept all trades! no reserve!!!

Deep blue pearl premium! we accept all trades! no reserve!!! 2010 gt-r premium used coupe turbo 3.8l v6 24v automatic bose only 5,698 miles!(US $74,995.00)

2010 gt-r premium used coupe turbo 3.8l v6 24v automatic bose only 5,698 miles!(US $74,995.00) Brand new 2014 nissan gtr awd, no reserve!!!!! below invoice!!!!!!!!!

Brand new 2014 nissan gtr awd, no reserve!!!!! below invoice!!!!!!!!! 2009 gt-r premium,awd,twin turbo,nav,htd lth,bose,20in wheels,31k,we finance!!(US $62,900.00)

2009 gt-r premium,awd,twin turbo,nav,htd lth,bose,20in wheels,31k,we finance!!(US $62,900.00) 2009 nissan gt-r(US $69,000.00)

2009 nissan gt-r(US $69,000.00) 2009 nissan gt-r awd navigation blue-tooth we finance bose low miles supercar

2009 nissan gt-r awd navigation blue-tooth we finance bose low miles supercar 2009 alpha 9 nissan gt-r premium coupe 2-door 3.8l - built motor and trans(US $114,999.00)

2009 alpha 9 nissan gt-r premium coupe 2-door 3.8l - built motor and trans(US $114,999.00) 2009 nissan gtr ams alpha 10+ kit(US $135,000.00)

2009 nissan gtr ams alpha 10+ kit(US $135,000.00) 2009 nissan gtr , black , low miles(US $66,999.00)

2009 nissan gtr , black , low miles(US $66,999.00) 2010 nissan gt-r super clean

2010 nissan gt-r super clean 2013 nissan gt-r

2013 nissan gt-r 2014 nissan gt-r track edition rare limited edition!

2014 nissan gt-r track edition rare limited edition! Gtr prem 17k miles!! nav bose 18kservice servcrecrds dochist books keys 2ownrs(US $69,950.00)

Gtr prem 17k miles!! nav bose 18kservice servcrecrds dochist books keys 2ownrs(US $69,950.00) 2014 nissan gt-r(US $105,589.00)

2014 nissan gt-r(US $105,589.00) 2010 nissan gt-r premium coupe 2-door 3.8l(US $67,900.00)

2010 nissan gt-r premium coupe 2-door 3.8l(US $67,900.00) New!!! 2014 gt-r jet black premium summer tires for $95,988!!!(US $95,988.00)

New!!! 2014 gt-r jet black premium summer tires for $95,988!!!(US $95,988.00) 09 nissan gt-r for sale 1-owner 630hp(US $67,000.00)

09 nissan gt-r for sale 1-owner 630hp(US $67,000.00)

Nissan GT-R Price Analytics

About Nissan GT-R

Auto blog

Join Autoblog editors for a full video tour of the 2019 Detroit Auto Show

Thu, Jan 17 2019The 2019 North American International Auto Show might have been a little more quiet than past years, but there were still some pretty major reveals, including the Toyota Supra, new Ford Explorer, Shelby GT500, Subaru WRX STI S209 and Kia Telluride. We also saw some lovely concepts like the Nissan IMs and Lexus LC Convertible. Senior Editor Alex Kierstein, Consumer Editor Jeremy Korzeniewski and Senior Green Editor John Beltz Snyder join me, Associate Editor Reese Counts — with Social Media Manager Michael Dylan Ferrara behind the camera — on a long walk through the show. We discuss cars, poke around the stands, dress a bloody wound and answer your questions in the Facebook comments. For more Detroit coverage, you can check out Autoblog's picks for the best in show, listen to our podcast or look at the best images from all the reveals. Finally, don't forget to watch Editor-in-Chief Greg Migliore hand over our 2019 Technology of the Year award. Related Video: Green Detroit Auto Show Acura Cadillac Chevrolet Ford GM Hyundai Infiniti Kia Lexus Nissan RAM Subaru Toyota Volkswagen Truck Convertible Coupe Crossover Hatchback Minivan/Van SUV Videos Sedan facebook 2019 detroit auto show live

2019 Detroit Auto Show Special | Autoblog Podcast #568

Wed, Jan 16 2019This week's Autoblog Podcast is a special one, recorded from Cobo Center in Detroit, site of the 2019 North American International Auto Show (NAIAS). Editor-in-Chief Greg Migliore is first joined by Senior Editor Alex Kierstein and Consumer Editor Jeremy Korzeniewski to talk about the Toyota Supra, Ford Shelby GT500 and Subaru STI S209. Then Senior Editor, Green, John Snyder and Associate Editor Joel Stocksdale join Greg to discuss the Nissan IMs Concept, new Ford Explorer and Kia Telluride, before going over the Editors' Picks for the best cars of the Detroit Auto Show. Autoblog Podcast #568 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2020 Toyota Supra 2020 Ford Mustang Shelby GT500 2019 Subaru WRX STI S209 Nissan IMs Concept 2020 Ford Explorer (including ST and Hybrid) 2020 Kia Telluride Best in Show: 2019 Detroit Auto Show Editors' Picks Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Nissan expands Ghosn probe to more countries, executive Munoz under scrutiny, sources say

Fri, Jan 11 2019BEIJING — Nissan Motor Co Ltd has broadened its investigation into ousted chairman Carlos Ghosn to include dealings that took place in the United States, India and Latin America, three people with knowledge of the inquiry said. In one aspect of their internal probe, company investigators are looking into decisions made in the United States by Jose Munoz who led Nissan's North American operations from 2014 to 2018, the people said. Munoz was recently placed on a leave of absence due to the probe, they added. Nissan said this month that Munoz, its chief performance officer and widely seen within the industry as close to Ghosn, was on leave "to allow him to assist the company by concentrating on special tasks arising from recent events." Munoz is not cooperating with investigators, two of the people with knowledge of the probe said, both describing his actions as "stonewalling". One of the sources described Munoz, who currently heads Nissan's China operations, as a "person of interest" in the probe, adding that it was not clear whether he would be accused of any wrongdoing. Munoz, 53, did not reply to Reuters requests for comment. The people with knowledge of the probe spoke to Reuters on condition of anonymity due to the sensitivity of the matter. A lawyer for Ghosn, Motonari Otsuru, said in an emailed comment: "I am unaware of this." Some of the questions put to Munoz relate to dealer franchise rights, one of the sources said. Other questions relate to contracts with parts suppliers and service providers that Munoz approved when he was at the helm of Nissan's U.S. operations, another source said. The sources said the findings made as part of the probe into Ghosn's affairs in the U.S. market are being shared with prosecutors. Tokyo prosecutors declined to comment. Nissan has said its internal investigation had uncovered "substantial and convincing evidence of misconduct" by Ghosn and that its scope is expanding. Ghosn, once the most celebrated executives in the auto industry and the anchor of Nissan's alliance with France's Renault SA, has been charged with under-reporting his income. On Friday, he was also charged with aggravated breach of trust, accused of shifting personal investment losses worth 1.85 billion yen ($17 million) to Nissan. In his first public appearance since his Nov.

Ex-Nissan chairman Carlos Ghosn indicted, may remain in jail for months

Fri, Jan 11 2019TOKYO — Nissan's ex-chairman Carlos Ghosn was charged Friday with breach of trust, according to the Tokyo District Court, making the star executive's release unlikely for months. Ghosn, arrested Nov. 19, was earlier charged with falsifying financial reports in underreporting his income by about 5 billion yen ($44 million) over five years through 2015. Ghosn; Greg Kelly, another Nissan executive; and Nissan as a legal entity also were charged Friday with additional underreporting of income, from 2015 through mid-2018. Ghosn's lawyer Motonari Ohtsuru said he would request that Ghosn be granted release on bail. His detention period for the breach of trust allegations was due to expire Friday. Kelly and Nissan were not charged with breach of trust. Those allegations center on Ghosn's handling of investment losses and payments made to a Saudi businessman. Ghosn, 64, says he's innocent. Suspects in Japan are routinely held for months until trials start, and Tokyo prosecutors maintain that Ghosn, a Brazilian-born Frenchman of Lebanese ancestry, is a flight risk. Earlier this week Ghosn told a Tokyo court he was innocent, in his first public appearance since his arrest, and appealed for his detention to end. But the court rejected that request. "I have a genuine love and appreciation for Nissan," Ghosn told the court. "In all of my efforts on behalf of the company, I have acted honorably, legally and with the knowledge and approval of the appropriate executives inside the company." He said the compensation was never decided on, the investment deal never resulted in any losses to Nissan, and the payments to the Saudi businessman were for legitimate services related to dealers and investments in the Gulf. Ghosn, who appeared much thinner than before his arrest, came down with a fever the day after his court appearance, but has since recovered, Ohtsuru, the lawyer, said. His wife Carole Ghosn issued a statement overnight out of Paris, expressing concern over his sickness. "I am pleading with the Japanese authorities to provide us with any information at all about my husband's health. We are fearful and very worried his recovery will be complicated while he continues to endure such harsh conditions and unfair treatment," she said. Apart from prosecutors, only embassy officials and Ghosn's lawyers are allowed to visit him. Such visits were canceled Thursday but resumed Friday.

Carlos Ghosn appears in court: 'I am wrongly accused'

Tue, Jan 8 2019TOKYO — Former Nissan Chairman Carlos Ghosn told a Tokyo court on Tuesday that he was innocent, defending his honor in his first public appearance since he was arrested on Nov. 19 and charged with false financial reporting. "Your honor, I am innocent of the accusations against me," Ghosn told the judge, speaking firmly and calmly as he read from a statement. "I am wrongfully accused." Prosecutors have charged Ghosn, who led a dramatic turnaround at the Japanese automaker over the past two decades, with falsifying financial reports in underreporting his income by about 5 billion yen ($44 million) over five years through 2015. They also say he is suspected of having Nissan temporarily take on his investment losses from the financial crisis. Seen for the first time since his November arrest, Ghosn was wearing a dark suit without a tie, and plastic slippers, and looked thinner and with gray hair. He rebutted the allegations against him point-by-point and said he had the option to leave Nissan but had decided to stay on. "A captain doesn't jump ship during a storm," he told the court in a strong voice. The veteran auto executive, a familiar face at the World Economic Forum and other elite gatherings, was handcuffed and led into the courtroom with a rope around his waist as the hearing began. Officers uncuffed him and seated him on a bench. Presiding judge Yuichi Tada then read out the charges and said Ghosn, a Brazilian-born Frenchman of Lebanese ancestry, was considered a flight risk — he was arrested on his arrival in Tokyo by private jet — and might try to hide evidence. In Japan, suspects are routinely held without bail, often due to fears about evidence tampering. During Tuesday's hearing, Go Kondo, one of Ghosn's lawyers, argued he was not a flight risk. "He's widely known so it's difficult for him to escape. There is no risk that the suspect will destroy evidence," he said. Facing the courtroom, Ghosn spoke proudly of the automaker's — and his own — achievements, such as reviving iconic models like the GT-R and the Z, expanding operations in China, Russia, Brazil and India and pioneering electric cars and autonomous driving. "I have a genuine love and appreciation for Nissan," he said. Ghosn has been held in spartan conditions at a Tokyo detention facility since he was taken into custody. In keeping with Japanese regulations, he has been allowed visits only from his lawyers and consular officials.

More than half of Mazdas sold in 2018 are CX-5s, and other interesting sales facts

Mon, Jan 7 2019Last year was a seriously good year for carmakers. Overall, more vehicles were sold than in 2017, and the total number wasn't far off of the all-time record in 2016. Digging deeper into the numbers, you'll find some pretty usual stuff including the Ford F-Series still being the bestselling pickup truck in America, and a continued trend toward crossovers. But there are also some oddball factoids tucked in these sales reports, some that defy the trends, and some that are extremes of the public's buying preferences. We've compiled several interesting tidbits from last year's sales right here for your enjoyment. More than half of Mazda's sales were of CX-5s Yes, over half of all Mazda sales were of this one model. The company sold 300,325 cars in America last year, and 150,622 of them were CX-5 crossovers, or 50.1 percent. Just for emphasis, that means the other 49.8 percent of Mazda's sales were split among five other models, the Miata, 3, 6, CX-3 and CX-9. Breaking that down further, the second-best seller was the Mazda3 at 64,638, which isn't even half of the CX-5's sales. People are crazy for Mazda's middle crossover. Volkswagen actually sold more cars than crossovers It's clear that the crossover is the future king of car sales. For most mainstream brands, it already is. Chevy, Ford, Honda, Toyota, Subaru, Mazda and Nissan all sold more crossovers and SUVs than they did conventional sedans and hatchbacks. There are holdouts, though, and one of them is Volkswagen. At the end of 2018, the company sold 189,343 cars and 164,721 crossovers in the U.S. So that's one win for the classic car set, and it's justification for VW to maintain its car line for the foreseeable future. It's a bit of a hollow victory, though. Look closer and you'll see that car sales were down 28 percent from 2017, when VW sold 262,029 cars. Crossovers, on the other hand, jumped 112 percent from 2017 when 77,647 crossovers moved through U.S. dealers. So expect the tables to turn very soon. Mustang is still the muscle-car sales king, but Challenger is the only one to improve Once again, the Ford Mustang topped the muscle-car sales charts, beating out the Dodge Challenger and Chevy Camaro. Ford moved 75,842 of the ponies in 2018, while Dodge sold 66,716 Challengers for second place, and Chevy sold 50,963 Camaros to bring up the rear.

Carlos Ghosn's son predicts surprises at ex-Nissan chief's day in court

Mon, Jan 7 2019PARIS — The son of former Nissan chairman Carlos Ghosn said in an interview published Sunday that people will be surprised when his father, detained since Nov. 19 for allegedly falsifying financial reports, recounts his version of events to a Tokyo court on Tuesday. Anthony Ghosn, 24, told France's Journal du Dimanche that his father — who will remain detained until at least Jan. 11 — will get 10 minutes to talk at the hearing, being held at his own request. "For the first time, he can talk about his version of the allegations against him," Anthony Ghosn said in the interview with the weekly paper Journal du Dimanche. "I think everyone will be rather surprised hearing his version of the story. Until now, we've only heard the accusers." The son has no direct contact with his father, and gets information via lawyers. He said his father, who for decades was a revered figure in the global auto industry, has lost about 10 kilograms (22 pounds) eating three bowls of rice daily, but he reads books and "he resists." Ghosn refuses to cave in, said his son, contending that he would be freed from detention if he admitted guilt to the prosecutor. "But for seven weeks, his decision has been quite clear ... He won't give in," Anthony Ghosn said, adding that he would be wearing prison clothes and handcuffs in court. Countering media portrayals, he insisted his father, a Brazilian-born Frenchman of Lebanese ancestry, is "not obsessed by money." "He always told us that money is but a means to help those you love, but not an end unto itself." Ghosn is charged with underreporting his pay by about 5 billion yen ($44 million) in 2011-2015, and faces a breach of trust allegation. He led Nissan Motor Co. for two decades and helped save the Japanese automaker from near bankruptcy. He remains head of France's Renault car company, which owns 43 percent of Nissan. Another Nissan executive, Greg Kelly, was arrested on suspicion of collaborating with Ghosn on the underreporting of income and was freed Dec. 25 on 70 million yen ($635,600) bail after more than a month in detention.Related Video:

Carlos Ghosn to make first public appearance in seven weeks on Tuesday

Sat, Jan 5 2019Ousted Nissan chairman Carlos Ghosn is set to make his first public appearance in seven weeks at a Tokyo court on Tuesday after he requested an open hearing to hear the reason for his continued detention. Ghosn has been held in a detention center since his Nov. 19 arrest on allegations of financial misconduct, which was followed by re-arrests over further allegations. The hearing will take place at 10:30 local time (0130 GMT) on Jan. 8, the Tokyo District Court said on Friday. The reason behind the timing of Ghosn's request was not clear. Earlier this week, the court approved an extension to Ghosn's detention until Jan. 11, after re-arrest by prosecutors who accuse him of aggravated breach of trust in transferring personal investment losses to Nissan. Those allegations center on the use of company funds to pay a Saudi businessman who is believed to have helped him out of financial difficulties, sources said last week. According to an article from The New York Times, Ghosn and his family assert that he is innocent. In remarks Ghosn made while under detention in Japan, he is reported to have said through his lawyer, "I want to have my position heard and restore my honor in court." Former Nissan executive Greg Kelly, who has been charged with conspiring to under-report Ghosn's income, has been released on bail after the court ruled against extending his detention while he awaits trial. Ghosn's arrest was followed by his removal from roles at Nissan and Mitsubishi. The case has rocked the auto industry and strained Nissan's ties with French partner Renault where Ghosn still remains chairman and chief executive. Renault has launched a search for an interim chief to fill Ghosn's roll at the French company as he deals with these legal cases in Japan. The arrest has also put some of the practices of Japan's criminal justice system under international scrutiny, including keeping suspects in detention for long periods and prohibiting defense lawyers from being present during interrogations. (Reuters contributed to this report.)Related Video:

2019 Tokyo Auto Salon features one of the coolest auctions we've seen

Thu, Jan 3 2019In just over a week, the Tokyo Auto Salon will host one of the coolest auctions we've seen in years. Jalopnik spotted BH Auction's listings, and it's a cornucopia of hot machinery you won't typically find at American auctions like Gooding & Company or Barrett Jackson. While Japanese cars make up most of the listings, Ferrari, Porsche, BMW and even Dodge all have at least one car going up for auction. We won't include everything here, but you can check out the full list on BH Auction's website. There are 50 lots at the auction, including nine Nissan Skylines, nine Ferraris and two Porsche Carrera GTs. Some of our other favorites include a Honda S800 coupe, a Toyota Miniace truck, a Mitsubishi Willys Jeep and a 1955 Mercedes-Benz 300 SL gullwing with the V8 from a W124 Mercedes-Benz E60 AMG that's estimated to sell for between $1.25 million and $1.5 million. Related Video: News Source: BH Auction via Jalopnik Audi Dodge Ferrari Honda Mitsubishi Nissan Porsche Toyota Auctions Autoblog Minute nissan skyline mercedes-benz 300 sl

Carlos Ghosn's jail time extended, as family says he was framed

Mon, Dec 31 2018TOKYO — Former Nissan chairman Carlos Ghosn will be detained at least through Jan. 11, the Tokyo District Court said Monday, as the once-revered auto industry figure faces allegations that have marked a stunning downfall. Ghosn, who led Nissan Motor Co. for two decades and helped save the Japanese automaker from near bankruptcy, was arrested Nov. 19 on suspicion of falsifying financial reports. He also faces a breach of trust allegation, for which his detention had been approved previously through Jan. 1. The Tokyo District Court said in a statement that it had approved prosecutors' request for a 10-day extension. Ghosn has been charged in the first set of allegations, about under-reporting Ghosn's pay by about 5 billion yen ($44 million) in 2011-2015. Related: Top 10 automotive stories of 2018 Those close to Ghosn and his family say he is asserting his innocence as the alleged underreported amount of money was never really decided or paid, and Nissan never suffered any monetary losses from the alleged breach of trust. It is unclear when Ghosn may be released on bail. Tokyo prosecutors consider Ghosn, a Brazilian-born Frenchman of Lebanese ancestry, a flight risk. In Japan, formal charges can mean a suspect will get detained for months, sometimes until the trial starts, because of fears of tampered evidence. Some experts are puzzled that the allegations against Kelly and Ghosn are about underreporting income from Nissan. Nissan is in charge of filing such financial reports, not individual executives. Over the weekend, The New York Times published an article, "The Rise and Fall of Carlos Ghosn," describing his arrest as well as his almost legendary ascendance as the outsider who saved Nissan: "He was a person who was above the clouds," said one Nissan employee. But it's clear from the article that his autocratic style has long rankled the Japanese. In a sidebar, the NYT also covered accusations from Ghosn's daughters that Nissan had set him up for a fall, part of a mutiny against his explorations of a merger between Nissan and Renault. They point out that Hiroto Saikawa, the chief executive of Nissan, complained about the nature of the alliance in the first news conference following Ghosn's arrest. "Wow," daughter Caroline Ghosn said. "He didn't even waste a breath. He didn't even try to cover up the fact that the merger had something to do with this." The NYT articles included Ghosn family photos showing a softer side to the stern auto executive.