2014 Nissan Altima 2.5 Sv on 2040-cars

4701 Highway 501, Myrtle Beach, South Carolina, United States

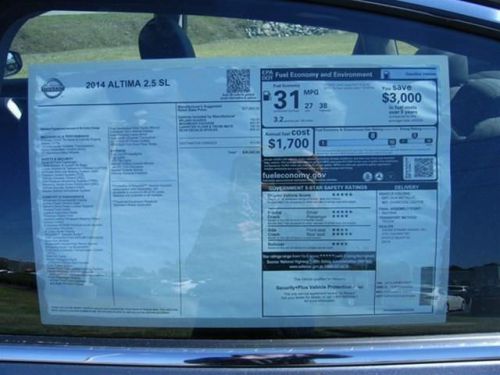

Engine:2.5L I4 16V MPFI DOHC

Transmission:Automatic CVT

VIN (Vehicle Identification Number): 1N4AL3AP9EC329025

Stock Num: N14358

Make: Nissan

Model: Altima 2.5 SV

Year: 2014

Exterior Color: Super Black

Interior Color: Beige

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 6

This vehicle has MSRP of $25,715, Gas miser!!! 38 MPG Hwy. Where are you going to stumble upon a nicer 2.5 SV at this price? Nowhere, because we've already looked to make sure!!! Runs mint! How tempting are all the options on this 2.5 SV: External Ground Lighting, Floor Mats Plus Trunk Mat (5 Piece), Splash Guards... We have Excellent selection of new Nissan Altima in stock. Please be sure to contact VICTOR, Internet Sales Manager for Professional and No Pressure purchase, additional information and/or pricing on any model Nissan that you are interested in. **** Our goal is to provide the same rich, satisfying experience online that you will receive in our dealership. We pride ourselves on delivering the exceptional treatment customers expect. **** PLEASE Contact - VICTOR Internet Sales Manager for details at 888-505-5074 Thank you for visiting our website.

Nissan Altima for Sale

2015 nissan altima 2.5 sv(US $26,540.00)

2015 nissan altima 2.5 sv(US $26,540.00) 2014 nissan altima 2.5 sl(US $27,489.00)

2014 nissan altima 2.5 sl(US $27,489.00) 2015 nissan altima 2.5 sv(US $28,925.00)

2015 nissan altima 2.5 sv(US $28,925.00) 2014 nissan altima 2.5 sl(US $30,205.00)

2014 nissan altima 2.5 sl(US $30,205.00) 2014 nissan altima 2.5 sl(US $31,020.00)

2014 nissan altima 2.5 sl(US $31,020.00) 2015 nissan altima 2.5 sl(US $31,620.00)

2015 nissan altima 2.5 sl(US $31,620.00)

Auto Services in South Carolina

Wilson Chrysler Dodge Jeep Inc ★★★★★

Wilburn Auto Body Shop At Keith Hawthorne Ford ★★★★★

Uptown Custom Paint and Collision ★★★★★

Top Quality Collision Center ★★★★★

The Glass Shoppe ★★★★★

Suddeth`s Automotive Service ★★★★★

Auto blog

Bug-eyed next-gen Nissan Titan spied testing

Fri, 28 Jun 2013It's no secret that the fullsize pickup truck market is dominated by offerings from Detroit's Big Three automakers, the Nissan Titan and Toyota Tundra not able to outdo the Ford F-150, Ram 1500 or Chevy Silverado/GMC Sierra twins. A great deal of that has to do with the fact that, while the American trucks have all undergone evolutionary updates that include a range of body styles, fuel-efficient engines and excellent technology, the Japanese offerings are, well, really old. Toyota is offering an updated Tundra for the 2014 model year, and while we haven't driven it yet, we're already betting that it's still behind the pack in terms of competitiveness - the 2013 model placed fifth out of sixth in a recent PickupTrucks.com comparison test.

At the bottom of the pack lies the Nissan Titan, a truck that hasn't received any sort of substantial update since its introduction nearly ten years ago. But that's going to change - a new truck is slated to debut for the 2015 model year, and these spy shots of a Titan mule clearly show that things are moving forward.

While this tester relies heavily on the current truck's bodywork for testing purposes, the new Titan will have a revised design, some of which is evidenced by the bug-eyed front fascia of this mule. No, the production model isn't going to look all weird (we hope), but the higher, more outboard headlight placement suggests that the new truck will be a bit wider than the current model.

Least reliable cars and trucks of 2022

Tue, Nov 15 2022Related: Most reliable cars and trucks of 2022 Â Every year, Consumer Reports ranks new cars based on their predicted reliability. We often see Toyota, Lexus, and a few other automakers near the top. But on the other side of the coin, the list of least reliable vehicles sometimes contains surprises. Â The organization surveys its members to determine the vehicles that exhibited the most problems over the prior year. Owners are asked about creaks and rattles, the durability of parts and trim, and mechanical issues. Consumer Reports assigns a weight to each problem and then uses them to create a score, with 100 being the best. Some familiar names appear on the list of least reliable vehicles (in order with the lowest predicted reliability score at the top), but there are a few eyebrow-raising models, followed by CR's score: Ford F-150 Hybrid: 4 Hyundai Kona Electric: 5 Lincoln Aviator: 8 Nissan Sentra: 9 Ford Explorer: 16 Chevrolet Bolt: 17 Chevrolet Silverado 1500/GMC Sierra 1500: 19 Jeep Gladiator: 21 Mercedes-Benz GLE: 23 Jeep Wrangler: 24 Consumer Reports noted that sedans are the most reliable vehicle category and found that trucks are far lower on the list. That said, the survey showed that trucks from American brands tended to have better reliability scores, so it’s surprising to see GMÂ’s big two and the Ford F-150 on the list. Part of their problematic ownership experience could be due to the fact that all three trucks have received recent updates, and the Ford was completely redesigned for 2022. New tech, fresh drivetrain components, and other improvements can upset the balance of reliability and make newer models look less dependable than their older counterparts. Related video: Green Chevrolet Ford GMC Hyundai Jeep Lincoln Mercedes-Benz Nissan Car Buying Truck Crossover Hatchback SUV Electric Hybrid Sedan Consumer Reports reliability

Nissan e-NV200 electric van will start FedEx testing in DC

Wed, Jan 22 2014The electric van test program that Nissan and FedEx announced today at the Washington Auto Show isn't really all that new. After all, FedEx is already testing the all-electric e-NV200 in Singapore, Japan and Germany. The news today is that FedEx will be one of the first companies to test the EV in the US, and Nissan brought a prototype to the show to gin up interest. 200 CHAdeMO stations were added in December, a monthly record. The e-NV200 uses a powertrain similar to what's in the Nissan Leaf and weighs about the same as that passenger car, but Nissan isn't talking about US performance figures quite yet. Nissan isn't even saying if the vehicle will even come to the US, but this test program sure hints that something like that is in the works. For now, all that's official is that Nissan will bring two - yes, just two - e-NV200 units to the US, letting FedEx test one in the Washington, DC area for between six to eight weeks before cycling the EVs to other companies in the US over the next year. The idea, as you may have guessed, it to gather data on how companies might use this van and let Nissan figure out if it wants to sell the e-NE200 here. The van will start being built in Barcelona, Spain this spring and is currently intended for Europe and Japan. FedEx is no stranger to greener vehicles, and has 167 EVs in its US fleet right now. Read more in the press release below. The e-NV200 can use CHAdeMO fast charging, and Nissan said today that it has helped install 570 of those DC fast chargers in the US since announcing expansion plans last year. At the time, the target was 500 chargers in 18 months, so things are progressing faster than publicly anticipated. In fact, 200 CHAdeMO stations were added in December, a monthly record. Jan. 22, 2014 Nissan and FedEx Express Put All-Electric e-NV200 to Work in Collaborative U.S. Test WASHINGTON, D.C. - FedEx Express, a subsidiary of FedEx Corp., and Nissan announced today at the Washington Auto Show that the two companies will begin testing the Nissan e-NV200, a 100 percent electric compact cargo vehicle, under real world conditions in Washington, D.C. This test marks the first time the vehicle will be running in North America. FedEx Express and Nissan have conducted similar e-NV200 tests with fleets in Japan, Singapore, the United Kingdom and Brazil. FedEx and Nissan are both committed to reducing the environmental impact of their operations worldwide.