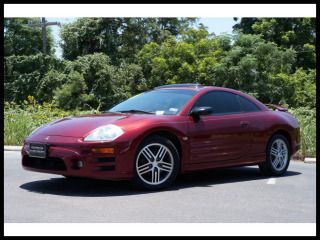

2005 Mitsubishi Eclipse 3dr Cpe Gts 3.0l Sportronic Auto on 2040-cars

San Antonio, Texas, United States

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:GAS

Power Options: Air Conditioning, Cruise Control, Power Windows

Make: Mitsubishi

Vehicle Inspection: Vehicle has been Inspected

Model: Eclipse

CapType: <NONE>

Trim: GTS Coupe 2-Door

FuelType: Gasoline

Listing Type: Pre-Owned

Drive Type: FWD

Certification: None

Mileage: 71,825

Sub Model: Cpe GTS 3.0L

BodyType: Coupe

Exterior Color: Burgundy

Cylinders: 6 - Cyl.

Interior Color: Gray

DriveTrain: FWD

Number of Doors: 2

Warranty: Unspecified

Number of Cylinders: 6

Options: Sunroof

Mitsubishi Eclipse for Sale

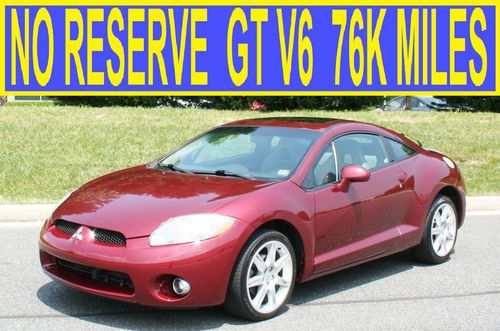

No reserve v6 gt 76k miles like 3000gt spyder celica talon 08 06 05 04 03 02 01

No reserve v6 gt 76k miles like 3000gt spyder celica talon 08 06 05 04 03 02 01 2000 mitsubishi eclipse gt (red) - new rims!(US $2,300.00)

2000 mitsubishi eclipse gt (red) - new rims!(US $2,300.00) 2006 mitsubishi eclipse gt auto htd leather sunroof 48k texas direct auto(US $13,980.00)

2006 mitsubishi eclipse gt auto htd leather sunroof 48k texas direct auto(US $13,980.00) 2001 mitsubishi eclipse gs coupe 2-door 2.4l

2001 mitsubishi eclipse gs coupe 2-door 2.4l 1996 mitsubishi eclipse gs hatchback 2-door 2.0l

1996 mitsubishi eclipse gs hatchback 2-door 2.0l Se coupe 2.4l, rim, automatic, fog lamps, orange, cloth,

Se coupe 2.4l, rim, automatic, fog lamps, orange, cloth,

Auto Services in Texas

Yale Auto ★★★★★

World Car Mazda Service ★★★★★

Wilson`s Automotive ★★★★★

Whitakers Auto Body & Paint ★★★★★

Wetzel`s Automotive ★★★★★

Wetmore Master Lube Exp Inc ★★★★★

Auto blog

Subprime financing on the rise in new car sales, leasing too

Fri, 07 Dec 2012We all remember the financial crisis that began several years back. At its core was a splurge of subprime lending for housing loans. The housing bubble burst, triggering a collapse of the mortgage-backed securities market. Apparently, those types of loans still exist in the automotive industry, and the market share for these types of "nonprime, subprime, and deep subprime," loans has grown 13.6 percent compared to the third quarter a year ago.

According to an Automotive News report, high-risk lending expanded to 24.8 percent of total loans in Q3, up from 21.9 percent for this time last year. As this level increased, average credit scores of borrowers dropped to 755, down from 763 a year ago. In that time, the average financing amount increased $90 per vehicle, to $25,963.

At 818, Volvo maintains the highest per-owner credit score, while Mitsubishi has the lowest, at 694. The highest rate of borrowers was at Toyota, with 14 percent of the market, followed by Ford with 13.1 percent and Chevrolet at 11.1.

Mitsubishi scores record global operating profits

Thu, 24 Apr 2014In the minds of many auto enthusiasts, Mitsubishi has become an afterthought. It has transformed from a company known for its turbocharged, all-wheel-drive rally machines into an automaker with a very boring lineup. Maybe we are being unfair, though. While the company doesn't have much of a performance presence anymore, the Japanese brand is doing quite well financially.

According to Reuters, Mitsubishi Motors had an operating profit of 123.4 billion yen ($1.2 billion) worldwide for the fiscal year that ended in March. That's twice as much as last year and a new all-time record for the Japanese automaker. It's even paying dividends to investors for the first time in 16 years, and its expected profit of 135 billion yen ($1.3 billion) in the new fiscal year matches a goal it had set for itself to achieve two years from now.

The automaker currently focuses much of its efforts on Southeast Asia, which accounts for about a quarter of its sales. It will put even greater attention there in the coming years with more local production, according to Reuters.

Mitsubishi pondering $2B share sale?

Sun, 15 Sep 2013Mitsubishi makes the brilliantly fast, wonderfully fun Lancer Evolution. Outside of that road-going rally car, the rest of the range is pretty poor - the new Outlander isn't bad, but the subcompact Mirage looks like might've been competitive five years ago, while the Galant and Lancer have suffered from serial neglect.

This hasn't just lead to rumors of Mitsu's death in America; the subsidiary of the massive Mitsubishi Group has been in trouble at home, too. It was bailed out by three other Mitsubishi Group companies - Mitsubishi UFJ Financial, Mitsubishi Heavy Industries and Mitsubishi Corporation - between 2004 and 2005, according to Bloomberg. Now, it's attempting to extricate itself from "emergency mode," as analyst Koichi Sugimoto told the financial site, adding that "they're still in the very early stages of recovery."

As part of the bailout, Mitsubishi issued its three saviors billions of dollars of preferred shares, which don't have voting rights. The problem is, Mitsubishi hasn't issued dividend payments since 1998, and these stocks aren't exactly competing with Apple or Google, in terms of value. In other words, they're mostly worthless. With a public offering, Mitsubishi is expecting to raise 200 billion yen, or about $2 billion, in order to reduce the number of preferred shares. If all goes according to plan, it will wipe out preferred shares by March of 2014, or the end of fiscal year 2013.