Barabus Gps Cooled Seats on 2040-cars

Phoenix, Arizona, United States

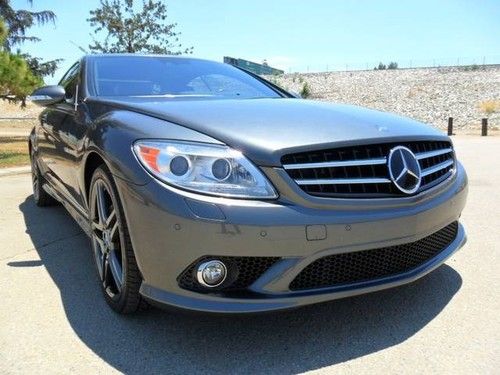

Engine:5.5L 5513CC 336Cu. In. V12 GAS SOHC Turbocharged

For Sale By:Dealer

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Mercedes-Benz

Options: Leather, Compact Disc

Model: CL600

Safety Features: Anti-Lock Brakes

Trim: Base Coupe 2-Door

Power Options: Air Conditioning, Power Windows

Drive Type: RWD

Doors: 2

Mileage: 59,989

Engine Description: 5.5L SOHC SMPI 36-VALVE T

Sub Model: CL600 2dr Cpe 5.5L

Number of Doors: 2

Exterior Color: Blue

Interior Color: Gray

Number of Cylinders: 12

Warranty: Vehicle has an existing warranty

Mercedes-Benz CL-Class for Sale

Virtually new! finance very low rates shipping!

Virtually new! finance very low rates shipping! Cl 500 designo package(US $23,000.00)

Cl 500 designo package(US $23,000.00) 2008 mercedes-benz cl550 * designo * p2 pkg. sport pkg. night vision keyless(US $51,900.00)

2008 mercedes-benz cl550 * designo * p2 pkg. sport pkg. night vision keyless(US $51,900.00) 2002 mercedes-benz cl500 base coupe 2-door 5.0l

2002 mercedes-benz cl500 base coupe 2-door 5.0l 22 stg wheels * original msrp of $116,770.00 approx. $20k in custom upgrades(US $55,000.00)

22 stg wheels * original msrp of $116,770.00 approx. $20k in custom upgrades(US $55,000.00) 2013 mercedes-benz cl550 cl550 coupe

2013 mercedes-benz cl550 cl550 coupe

Auto Services in Arizona

Xtreme Roadside ★★★★★

Xpress Automotive & Wash ★★★★★

Windshield Replacement & Auto Glass Repair Phoenix ★★★★★

West Glenn Body Shop ★★★★★

Valley Express Auto Repair ★★★★★

Valley Express Auto Repair ★★★★★

Auto blog

In case you forgot, the Dubai Police supercar fleet is the coolest

Tue, Feb 10 2015Ever wonder why the Dubai Police have a fleet of vehicles worth millions and millions and millions of dollars? Why it has a Bugatti Veyron and a Bentley Continental and a Mercedes-Benz SLS AMG with sirens and light bars? Well, here's the reason. This video shows the fleet on display on the Emirate's roads and highways, while also reaching out to the people the police are meant to protect. It's an impressive display of machinery, to be sure. Alongside the Bentley, Bugatti and Mercedes, we spy a Ferrari FF, a Brabus G-Wagen, a BMW M6, a Nissan GT-R, an Audi R8 and a McLaren MP4-12C (although the latest Dubai Police car, the Lexus RC F, is absent). The video even has a very cinematic look and feel to it, which works well with the night scenes and the blues-and-twos of the exotics cruisers. News Source: Dubai Police via YouTube Audi Bentley BMW Bugatti Ferrari McLaren Mercedes-Benz Nissan Luxury Performance Videos dubai ferrari ff mclaren 12c

Automakers want to stop the EPA's fuel economy rules change, and why that's a shortsighted move

Tue, Dec 6 2016With a Trump Administration looming, the EPA moved quickly after the election to propose finalizing future fuel economy rules last week. The auto industry doesn't like that (surprise), and has started making moves to stop the EPA. Ford CEO Mark Fields said he wanted to lobby Trump to lower the standards, and now the Auto Alliance, a manufacturer group, is saying it will join the fight against cleaner cars. The Alliance represents 12 automakers: BMW, Fiat Chrysler, Ford, GM, Jaguar Land Rover, Mazda, Mercedes-Benz, Mitsubishi, Porsche, Toyota, VW, and Volvo. Gloria Bergquist, a spokesperson for the Alliance, told Automotive News that the "EPA's sudden and controversial move to propose auto regulations eight months early - even after Congress warned agencies about taking such steps while political appointees were packing their bags - calls out for congressional action to pause this rulemaking until a thoughtful policy review can occur." The EPA was going to consider public comments through April 2017, but then said it would move the deadline to the end of December. That means that it can finalize the rules before President Obama leaves office. The director of public affairs for the Consumer Federation of America, Jack Gillis, said on a conference call with reporters last week when the EPA originally announced its decision that it is unlikely that President Trump will be able to roll back these changes. Gillis also said on the same call that any attempt by the automakers to prevent these changes would be history repeating itself. "These are the same companies that fought airbags, and now promoting the fact that every car has multiple airbags," he said. "These are the same companies that fought the crash-test program, and now are promoting the crash-test ratings published by the government. So, it's clear that they're misperceiving the needs of the American consumer." There are more reasons the Allliance's pushback is flawed. Carol Lee Rawn, the transportation program director for Ceres, said on that call that the automotive industry is a global one, and many automakers are moving to global platforms to help them meet strict fuel economy rules around the world.

Mercedes-Petronas AMG W04 launched to little fanfare, lots of pressure [w/video]

Tue, 05 Feb 2013No indoor cocktail hour for the launch of the W04, the newest chassis built by the Mercedes AMG Petronas Formula One team. Instead, Nico Rosberg and Lewis Hamilton spent a morning in photo and video sessions at the track in Jerez, Spain then paused a moment to introduce the car. The team will want the W04 to demonstrate the World Championship credentials of the team personnel and one of the team drivers, instead of the mostly humble performances we've seen over the past three years.

The W04 has been fitted with a new five-element front wing, pushrod front and pull-rod rear suspension, a second-generation Coanda exhaust and an "aggressively packaged" rear end. A small vanity panel, à la Infiniti Red Bull's RB9, covers the stepped nose.

Team principal Ross Brawn has called it "a clear step forward in design and detail sophistication," but as much as we truly respect Brawn's abilities and achievements, we heard him say similar things about the updated W03 last year before almost every race weekend from about mid-season. We really hope he's right this time, and so does the team's newest driver, Lewis Hamilton. We'll do our best to ignore the parallels of the Mercedes F1 team having signed a sponsorship deal with Blackberry, another company trying to find its way back to the top and still struggling, and just point you to the video below of the W04 in action.