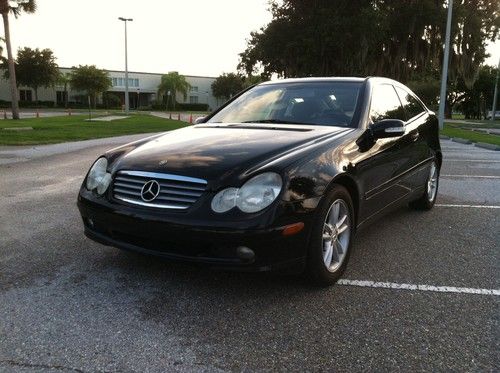

2003 Mercedes-benz C240 Sedan 4-door 2.6l Only 77k Miles !!! on 2040-cars

Maspeth, New York, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:2.6L 2597CC V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Mercedes-Benz

Model: C240

Warranty: Vehicle does NOT have an existing warranty

Trim: Base Sedan 4-Door

Options: Sunroof, Leather Seats

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 77,245

Power Options: Air Conditioning, Cruise Control, Power Windows

Exterior Color: Black

Interior Color: Gray

Number of Cylinders: 6

Number of Doors: 4

Mercedes-Benz C-Class for Sale

2002 mercedes-benz c230 kompressor, 6 speed, clean!!!(US $4,300.00)

2002 mercedes-benz c230 kompressor, 6 speed, clean!!!(US $4,300.00) 2013 mercedes-benz c250 coupe damaged salvage runs! economical only 2k miles!!(US $15,900.00)

2013 mercedes-benz c250 coupe damaged salvage runs! economical only 2k miles!!(US $15,900.00) 1999 mercedes-benz c230 kompressor sedan 4-door 2.3l(US $5,100.00)

1999 mercedes-benz c230 kompressor sedan 4-door 2.3l(US $5,100.00) 2007 black 2.5l sport!(US $17,750.00)

2007 black 2.5l sport!(US $17,750.00) 2000 c230k kompressor 1 owner supercharged only 79k clean car & title no reserve

2000 c230k kompressor 1 owner supercharged only 79k clean car & title no reserve 2002 mercedes-benz c32 amg base sedan 4-door 3.2l

2002 mercedes-benz c32 amg base sedan 4-door 3.2l

Auto Services in New York

Websmart II ★★★★★

Wappingers Auto Tech ★★★★★

Wahl To Wahl Auto ★★★★★

Vic & Al`s Turnpike Auto Inc ★★★★★

USA Cash For Cars Inc ★★★★★

Tru Dimension Machining Inc ★★★★★

Auto blog

Mercedes warms up the SLC

Sat, Jun 6 2015The Mercedes-Benz SLC moniker was once thought to be revived for the vehicle that became the Mercedes-AMG GT, but the German luxury brand is now rumored to use the name for its upcoming refresh for the SLK. Our spies recently snapped some shots of the updated hardtop convertible testing while not wearing much camouflage. These photos suggest not to expect any significant changes in styling for the refreshed SLK. The lower portion of the front bumper has a single center opening, and the grille gets the latest iteration of Mercedes' single-bar design. The camouflage offers more concealment at the rear, but there's clearly something to hide. The exhausts are better incorporated in the shape, as well. Mercedes is also expected to update the SLK's powertrains with the refresh into the SLC. There could be an AMG Sport version to slot between the regular model and full-bore AMG. Like the C450 AMG Sport, this one might use the brand's 3.0-liter, twin-turbo V6 with 362 horsepower. Related Video:

The best Super Bowl car commercials from the last 5 years

Wed, Jan 28 2015If you've been dipping into the Autoblog feed over the past days and weeks, you wouldn't even have to be a sports fan to know the Super Bowl is coming up. Automakers have been teasing their spots for the big game, dropping them days early, fully-formed onto the Internet and otherwise trying to amp up the multi-million-dollar outlays that they've made for air time on the biggest advertising day of the year. And, we're into it. The lead up to the Super Bowl is almost akin to a mini auto show around these parts; with automakers being amongst the most prolific advertisers on these special Sundays. The crop of ads from 2015 looks as strong as ever, but we thought we'd take a quick look back at some of our favorite spots from the last five years. Take a look at our picks – created from a very informal polling of Autoblog editors and presented in no particular order – and then tell us about your recent faves, in Comments. Chrysler, Imported From Detroit Chrysler, Eminem and a lingering pan shot of "The Fist" – it doesn't get much more Motown than 2011's Imported From Detroit. With the weight of our staffers hailing from in and around The D, it's no wonder that our memories still favor this epic Super Bowl commercial (even though the car it was shilling was crap). Imported really set the tone for later Chrysler ads, too, repeated the formula: celebrity endorsement + dramatic copy + dash of jingoism = pulled car-guy heartstrings. Mercedes-Benz, Soul teaser with Kate Upton One of our favorite Super Bowl commercials (and yours, based on the insane number of views you logged) didn't even technically air during the game. Mercedes-Benz teased its eventual spot Soul with 90-seconds worth of Kate Upton threatening to do her best Joy Harmon impression. (Teaser indeed.) It doesn't win points for cleverness, use of music, acting, or any compelling carness, but it proved that Mercedes' advertisers knew how to make a splash in the Internet Age. And, hey, it's still classier than every GoDaddy commercial. Kia, A Dream Car. For Real Life Like the Mercedes video above, the initial draw here is a pretty lady; in this case the always stunning Adriana Lima. But this Kia commercial really delivers the extra effort we expect while scarfing crabby snacks and homemades, too. First of all, Motley Crue. Second, a cowboy on a bucking rhino. Enjoy yet again.

2014 Mercedes-Benz SLS AMG Black Series [w/video]

Fri, 15 Nov 2013The biggest misconception about the Mercedes-Benz SLS AMG Black Series is that it's simply a higher-performing version of the SLS GT - a closer look, or better yet, a few hot laps on a high-speed racing circuit, reveals that is anything but the case.

Launched in the States in mid-2011, the standard SLS GT is a 583-horsepower, all-aluminum, gull-wing coupe with performance that positions it near the top of the exotic segment. While the AMG team at Mercedes-Benz could have left it alone, their experience with the SLS AMG GT3 race car said there was room for improvement, so they devised the SLS Black Series. The transformation from SLS GT to SLS Black Series is extensive, with no fewer than 17 different significant enhancements.

The engine mapping, crankshaft, connecting rods, valve-train, intake, exhaust and cooling are all modified and the engine's redline bumps up from 7,200 to 8,000 rpm, which pushes output of the hand-built 6.3-liter V8 to 622 horsepower. The power steering receives a new ratio, a coil-over AMG Adaptive Performance suspension is installed along with underbody braces, the track is widened, two-piece carbon-ceramic brakes replace iron rotors at each corner and a lightweight titanium exhaust is fitted beneath. The AMG Speedshift seven-speed dual-clutch gearbox is modified and an electronically controlled AMG rear differential lock ensures the power goes to the pavement. Last on the mechanical upgrades are new lightweight forged wheels (10x19 inches front and 12x20 inches rear) wrapped in special R-compound Michelin Pilot Sport Cup tires.