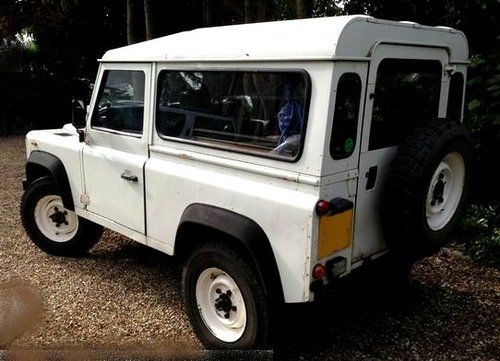

1986 Land Rover Defender 110 Tdci Csw A/c Lhd on 2040-cars

Lions Bay, British Columbia, Canada

Body Type:SUV

Vehicle Title:Clear

Engine:2.4 TDCi

Fuel Type:Diesel

For Sale By:Private Seller

Make: Land Rover

Model: Defender

Trim: 110 CSW

Options: 4-Wheel Drive

Power Options: Air Conditioning

Drive Type: LHD

Mileage: 52,500

Exterior Color: Black

Disability Equipped: No

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 4

1986 Land Rover Defender 110

Left hand drive

2.4 TDCi engine and 6 speed manual transmission

Air Conditioning

Santorini metallic black (recently resprayed)

Black interior

Aluminium steering guard

Safari Snorkel

Defender XS side steps

Defender XS silver grill and light surrounds

Black roof rack

The Defender is fitted with steel wheels but alloy wheels are available upon request

The body and chassis are both rust / corrosion free

This Defender is currently registered in Lions Bay Vancouver Canada but can also be purchased with a US title if preferred.

Land Rover Defender for Sale

1997 land rover defender 90, 32000km,located in canada,truly as new(US $39,999.00)

1997 land rover defender 90, 32000km,located in canada,truly as new(US $39,999.00) Fully restoed nut and bolt 100 point car like new ready to show

Fully restoed nut and bolt 100 point car like new ready to show 1994 land rover defender 90 soft top, exc. condition, two new tops

1994 land rover defender 90 soft top, exc. condition, two new tops Land rover defender county 6/7 seater -shipping service

Land rover defender county 6/7 seater -shipping service 1987 land rover defender 90 2.5 turbo

1987 land rover defender 90 2.5 turbo 1997 land rover defender 90 white(US $41,000.00)

1997 land rover defender 90 white(US $41,000.00)

Auto blog

Land Rover, Toyota big winners in ALG top resale value awards

Tue, 18 Nov 2014

"Residual value is important for automakers and consumers because it's a complete indicator of the vehicle's future value." - Larry Dominique

Toyota and Land Rover took home the top brand honors in ALG's 2015 Residual Value Awards, which will be presented this week at the Los Angeles Auto Show.

The UK votes for Brexit and it will impact automakers

Fri, Jun 24 2016It's the first morning after the United Kingdom voted for what's become known as Brexit – that is, to leave the European Union and its tariff-free internal market. Now begins a two-year process in which the UK will have to negotiate with the rest of the EU trading bloc, which is its largest export market, about many things. One of them may be tariffs, and that could severely impact any automaker that builds cars in the UK. This doesn't just mean companies that you think of as British, like Mini and Jaguar. Both of those automakers are owned by foreign companies, incidentally. Mini and Rolls-Royce are owned by BMW, Jaguar and Land Rover by Tata Motors of India, and Bentley by the VW Group. Many other automakers produce cars in the UK for sale within that country and also export to the EU. Tariffs could damage the profits of each of these companies, and perhaps cause them to shift manufacturing out of the UK, significantly damaging the country's resurgent manufacturing industry. Autonews Europe dug up some interesting numbers on that last point. Nissan, the country's second-largest auto producer, builds 475k or so cars in the UK but the vast majority are sent abroad. Toyota built 190k cars last year in Britain, of which 75 percent went to the EU and just 10 percent were sold in the country. Investors are skittish at the news. The value of the pound sterling has plummeted by 8 percent as of this writing, at one point yesterday reaching levels not seen since 1985. Shares at Tata Motors, which counts Jaguar and Land Rover as bright jewels in its portfolio, were off by nearly 12 percent according to Autonews Europe. So what happens next? No one's terribly sure, although the feeling seems to be that the jilted EU will impost tariffs of up to 10 percent on UK exports. It's likely that the UK will reciprocate, and thus it'll be more expensive to buy a European-made car in the UK. Both situations will likely negatively affect the country, as both production of new cars and sales to UK consumers will both fall. Evercore Automotive Research figures the combined damage will be roughly $9b in lost profits to automakers, and an as-of-yet unquantified impact on auto production jobs. Perhaps the EU's leaders in Brussels will be in a better mood in two years, and the process won't devolve into a trade war. In the immediate wake of the Brexit vote, though, the mood is grim, the EU leadership is angry, and investors are spooked.

Jaguar Land Rover posts profitable quarter amidst big yearly losses

Mon, May 20 2019Jaguar has posted its first profit in quite some time, as the financial quarter ending on March 31 brought in a net income of $151.6 million. However, that is the light in the end of the tunnel, as full year results through March showed a $4.58 billion loss (GBP3.6 billion). The losses are again attributable to declining sales in China, with a whiff of the still-lingering Brexit process. While JLR's annual U.S. sales were up 8.1 percent, and U.K. sales improved by 8.4%, overall sales came down 5.8% to 578,915 vehicles. For April, Chinese sales nearly halved as they dropped by 46 percent. Earlier this year, JLR's woes caused its owner Tata Motors to post the biggest ever quarterly loss in Indian corporate history, at nearly $4 billion. JLR's CEO Ralf Speth stated that the company is "reducing complexity" and transforming its business by cost savings and cash flow improvements, citing the fourth-quarter profits as an example of the ongoing turnaround. Speth said JLR has already managed to deliver $1.59 billion (GBP1.25 billion) of efficiencies and savings. JLR says its turnaround program, dubbed Charge, will drive it to at least $3.18 billion (GBP2.5 billion) of investment, working capital and profit improvements by March 2020, and that it currently has $4.84 billion (GBP3.8 billion) of cash. Speth continued that JLR will "go forward as a transformed company that's leaner and fitter," and that the sustained investment in new products and technologies will drive future demand. There has been earlier speculation of Tata Motors selling JLR to the PSA Group, but as Autocar reports, Tata's financial chief again refuted these rumors. JLR also announced today that its CFO of 11 years, Ken Gregor is stepping down after 22 years with the company, and that he will be succeeded by JLR's Chief Transformation Officer, Adrian Mardell.