1956 Ford Victoria Custom on 2040-cars

Wallkill, New York, United States

Vehicle Title:Clear

Year: 1956

Make: Ford

Drive Type: rear wheel

Model: Fairlane

Mileage: 6,275

Trim: 2dr

|

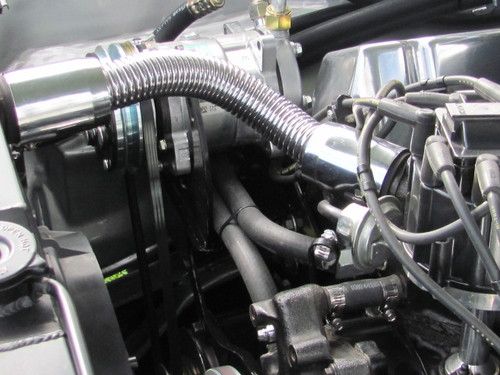

1956 FORD FAIRLANE VICTORIA 2DR HDT ORIGINALLY APPLE VALLEY CAR. ALUMNBSOLUTELY NO RUST OF ANY PANEL,THIS CAR IS LIKE IT CAME FROM FORD MOTOR CO. 460 CUBIC ENGINE ALL CHROMED OUT WITH HOLLY 4 BARREL CARB.DUAL EXHAUST SMITTY MUFFLERS NICE SOUND.COMPLETE NEW REBUILT C-4 AUTOMATIC TRANS BY TCI. POWER DISK BRAKES FRT,DRUM REAR,POWER STEERING WITH CHROME IDIOT TILT COLUMN & CHROME STEERING WHEEL. DUAL ELECTRIC FANS COMPLETE CAR INSULATED WITH DYNO PAD,COMPLETE WIRING BY E-Z WIRING, 2 SPEED ELECTRIC WIPERS WITH NEW ARMS & WIPER BLADES. NEW AM-FM 6 DISC RADIO SOUND SYSTEM BUILT FOR 1956 FORDS IN DASH. AIR & HEAT BY SOUTHERN AIR UNDER DASH,QUICK SILVER FLOORSHIFT SETUP, COMPLETE NEW INTERIERO INCLUDING SEATS & CARPET. 4 BRAND NEW DIAMOND BACK WIDE WHITE WALLS 215-75/15 NEW 1957 CADDY WHEEL COVERS. ELECTRIC DOOR OPENERS WITH HIDDEN BUTTONS, TRUNK LID ELECTRIC WITH SAFTY CABLE. BATTERY IN TRUNK WITH OUTSIDE SHUTOFF. NOSED & DECKED, 1956 MERCURY STATION WAGON TAILIGHTS AND MERCURY MONCLAIR UPPER DOOR & QUARTER MLDINGS. TUBE GRILLE ,1955 FORD CHROME EYEBROW MLDING AROUND HEADLAMP DOORS. BUYER RESPONSIBLE FOR SHIPPING OR PICKUP. PLEASE CALL 845-742-1513. |

Ford Fairlane for Sale

1963 ford fairlane 500, daily driver with 302 motor & c4 trans!(US $6,499.00)

1963 ford fairlane 500, daily driver with 302 motor & c4 trans!(US $6,499.00) 1957 ford fairlane 500 2 door convertible sunliner 45,422 low miles project car

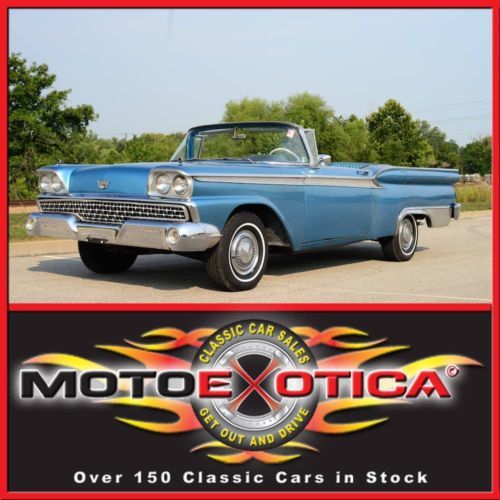

1957 ford fairlane 500 2 door convertible sunliner 45,422 low miles project car 1959 ford fairlane retractable! hard to find classic, 292 v8, auto, no reserve!!(US $15,900.00)

1959 ford fairlane retractable! hard to find classic, 292 v8, auto, no reserve!!(US $15,900.00) 1964 ford fairlane 500 4.7l 4 dr white exterior red interior(US $3,850.00)

1964 ford fairlane 500 4.7l 4 dr white exterior red interior(US $3,850.00) One of a kind vintage 1962 ford fairlane 500 2 door coup classic prototype.

One of a kind vintage 1962 ford fairlane 500 2 door coup classic prototype. 1957 ford custom sedan grand national stock car

1957 ford custom sedan grand national stock car

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

Subprime financing on the rise in new car sales, leasing too

Fri, 07 Dec 2012We all remember the financial crisis that began several years back. At its core was a splurge of subprime lending for housing loans. The housing bubble burst, triggering a collapse of the mortgage-backed securities market. Apparently, those types of loans still exist in the automotive industry, and the market share for these types of "nonprime, subprime, and deep subprime," loans has grown 13.6 percent compared to the third quarter a year ago.

According to an Automotive News report, high-risk lending expanded to 24.8 percent of total loans in Q3, up from 21.9 percent for this time last year. As this level increased, average credit scores of borrowers dropped to 755, down from 763 a year ago. In that time, the average financing amount increased $90 per vehicle, to $25,963.

At 818, Volvo maintains the highest per-owner credit score, while Mitsubishi has the lowest, at 694. The highest rate of borrowers was at Toyota, with 14 percent of the market, followed by Ford with 13.1 percent and Chevrolet at 11.1.

Detroit automakers mulling helping DIA avoid bankruptcy looting

Tue, 13 May 2014It's not really a secret that the city of Detroit is in lots and lots of trouble. Even with an emergency manager working to guide it through bankruptcy, a number of the city's institutions remain in very serious danger. One of the most notable is the Detroit Institute of Arts, a 658,000-square-foot behemoth of art that counts works from Van Gogh, Picasso, Gauguin and Rembrandt (not to mention a version of Rodin's iconic "The Thinker," shown above) as part of its permanent collection.

Throughout the bankruptcy, the DIA has been under threat, with art enthusiasts, historians and fans of the museum concerned that its expansive collection - valued between $454 and $867 million by Christie's - could be sold by the city to help square its $18.5-billion debt.

Now, though, Detroit's hometown automakers could be set to step up and help save the renowned museum. According to a report from The Detroit News, the charitable arms of General Motors, Ford and Chrysler could be set to donate $25 million as part of a DIA-initiated campaign, called the "grand bargain." As part of the deal, the DIA would seek $100 million in corporate donations as part of a larger attempt at putting together an $816-million package that would be paid to city pension funds over 20 years. Such a move would protect the city's art collection from being sold off.

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.049 s, 7947 u