2014 Fiat 500c Pop on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

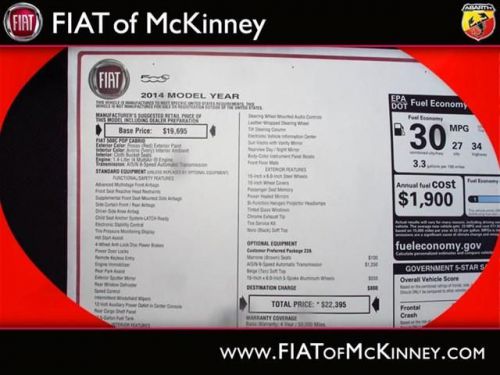

Engine:1.4L I4 16V MPFI SOHC

VIN (Vehicle Identification Number): 3C3CFFDR2ET258171

Stock Num: 14F195

Make: Fiat

Model: 500C Pop

Year: 2014

Exterior Color: Red

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 12

All the right ingredients!! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $1,500!! All the right ingredients!! How comforting is it knowing you are always prepared with this terrific-looking 500c. Safety equipment includes: ABS, Traction control, Passenger Airbag, Curtain airbags, Knee airbags - Driver...FEATURES INCLUDE: wireless phone connectivity - BLUE&ME, Power locks, Power windows, Convertible roof - Power, Air conditioning...

Fiat 500 for Sale

2014 fiat 500l trekking(US $22,645.00)

2014 fiat 500l trekking(US $22,645.00) 2014 fiat 500l trekking(US $22,787.00)

2014 fiat 500l trekking(US $22,787.00) 2014 fiat 500l trekking(US $22,787.00)

2014 fiat 500l trekking(US $22,787.00) 2014 fiat 500l trekking(US $23,545.00)

2014 fiat 500l trekking(US $23,545.00) 2014 fiat 500l trekking(US $23,995.00)

2014 fiat 500l trekking(US $23,995.00) 2014 fiat 500l trekking(US $24,016.00)

2014 fiat 500l trekking(US $24,016.00)

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

Interested, then not: Marchionne not 'chasing' a VW merger

Tue, Mar 14 2017Update (March 15, 2017) : Automotive News reports that FCA CEO Sergio Marchionne, regarding the suggested VW and FCA merger, said in a press conference "I have no interest." He also said that he "will not call Matthias," the CEO of VW. He did add that he would be willing to entertain anything VW brings up, but he has "no intention of chasing him." Despite this, Marchionne still took a moment to reinforce his favorable stance concerning mergers and consolidation. Last week, Volkswagen's CEO Matthias Mueller effectively shut down Fiat Chrysler CEO Sergio Marchionne's idea of the two automakers merging. However, it seems Mueller has softened, if only just, to the idea. According to Reuters, the CEO said in a press conference he is "not ruling out a conversation." However, he did say that he would like Marchionne to discuss with him directly the possibility rather than to the media. Though this statement certainly doesn't mean such a merger is happening, it's far more open than when he said outright the company isn't in any talks with anyone at the moment. His new stance also indicates that there may be people (lawyers, accountants, etc.) behind the scenes working out possible ways a merger could work. And even though this new development makes the prospect of a merger between the two companies a bit less bleak, it's still a long way from the "will they, won't they" relationship between GM and FCA. FCA's pursuit of GM involved emailing CEO Mary Barra and the threats of a hostile takeover, the latter of which resulted in some awkward statements about hugs. Only time will tell if VW becomes open enough for Marchionne to talk about hugs again. Related Video:

Just 45% of Fiat dealers are profitable, and they're angry about it

Mon, 07 Oct 2013<

On average, Fiat dealers have only been selling about 17 cars a month.

We've been wondering for some time how Fiat dealers in North America have been getting along with just one model range in their showrooms up until recently. Franchisees spent millions building, stocking and manning sleek new 'studio' showrooms, only to have but a single model to sell, the cherubic 500. And even with its many derivatives, the Cinquecento is still an inexpensive model with its attendant lower margins. Perhaps it should come as no surprise then, that just 45 percent of US Fiat dealers are said to be profitable.

Federal judge orders Barra and Manley to try to resolve GM racketeering lawsuit

Tue, Jun 23 2020DETROIT — A federal judge in Detroit on Tuesday ordered the chief executives of automakers General Motors and Fiat Chrysler Automobiles to meet by July 1 to try to resolve GM's racketeering lawsuit. U.S. District Court Judge Paul Borman called on GM CEO Mary Barra and FCA CEO Mike Manley to meet in person to try to resolve a case that could drag on for years. "What a waste of time and resources now and for the years to come in this mega-litigation if these automotive leaders and their large teams of lawyers are required to focus significant time-consuming efforts to pursue this nuclear-option lawsuit if it goes forward," Borman said at the end of a hearing during which FCA asked the judge to dismiss GM's lawsuit. Borman said instead, the companies need to focus on building cars and keeping people employed at a time when the coronavirus has hurt the U.S. economy and the country is also dealing with issues of racial injustice after the death of George Floyd, a Black man whose death in police custody in Minneapolis triggered worldwide protests. GM filed the racketeering lawsuit against FCA last November, alleging its rival bribed United Auto Workers (UAW) union officials over many years to corrupt the bargaining process and gain advantages, costing GM billions of dollars. GM is seeking "substantial damages" that one analyst said could total at least $6 billion. Barra and Manley should meet, taking into account social distancing to keep them safe, to "explore and indeed reach a sensible resolution," Borman said in the hearing, which was broadcast online. It is common for judges to order parties to try to resolve disputes out of court. But it is unusual that the chief executives of two big companies be instructed to meet face-to-face, not just to settle their differences but also to serve a greater good. A GM spokesman said the No. 1 U.S. automaker has a strong case and "we look forward to constructive dialogue with FCA consistent with the courtÂ’s order.” FCA had no immediate comment. Borman said he wanted to hear from Barra and Manley personally at noon on July 1 to provide him with results from their discussion. FCA shares were up 6.1% at $10.24 in New York and GM shares were down 0.5% at $26.25 on Tuesday afternoon. Government/Legal Chrysler Fiat GM