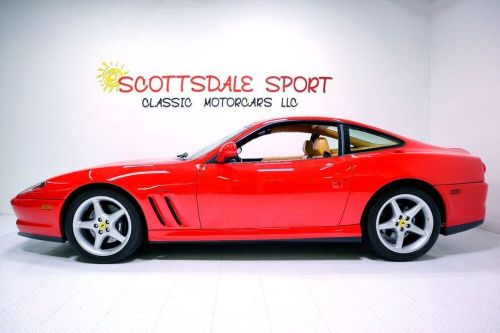

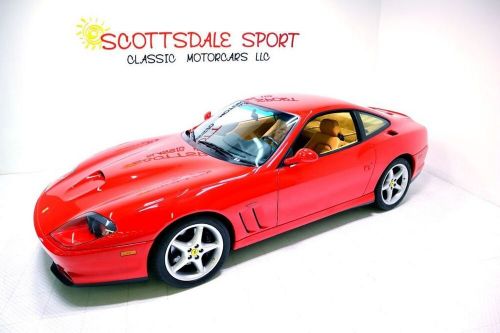

1999 Ferrari 550 Maranello * Only 13,996 Original Owner Miles!! on 2040-cars

Scottsdale, Arizona, United States

Vehicle Title:Clean

Body Type:Coupe

Transmission:Manual

Fuel Type:Gasoline

VIN (Vehicle Identification Number): ZFFZR49AXX0115832

Mileage: 13996

Make: Ferrari

Model: 550

Trim: * ONLY 13,996 ORIGINAL OWNER MILES!!

Warranty: Unspecified

Exterior Color: Rosso Corsa

Interior Color: Beige

Number of Cylinders: 12

Doors: 2

Engine Description: 5.5L V12

Ferrari 550 for Sale

2001 ferrari 550 barchetta pininfarina(US $649,900.00)

2001 ferrari 550 barchetta pininfarina(US $649,900.00) 2000 ferrari 550 2 door coupe(US $76,300.00)

2000 ferrari 550 2 door coupe(US $76,300.00) 2000 ferrari 550 base coupe 2-door(US $44,100.00)

2000 ferrari 550 base coupe 2-door(US $44,100.00) 1999 ferrari 550(US $41,000.00)

1999 ferrari 550(US $41,000.00) 2000 ferrari 550(US $53,700.00)

2000 ferrari 550(US $53,700.00) 2000 ferrari 550 550 maranello(US $48,400.00)

2000 ferrari 550 550 maranello(US $48,400.00)

Auto Services in Arizona

Village Automotive INC ★★★★★

Victory Auto Body ★★★★★

Thunderbird Automotive Services #2 ★★★★★

Thiem Automotive Specialist ★★★★★

Shuman`s Auto Clinic ★★★★★

Show Low Ford Inc ★★★★★

Auto blog

FCA delays distribution of Ferrari shares

Sat, May 2 2015Even if you can't afford an actual Ferrari, soon you can own a part of the famous company thanks to its upcoming initial public offering. FCA will put 10 percent of the Prancing Horse on the market in the third quarter of this year. However to reap extra money for 2015's bottom line, the rest of the sports-car maker's stock will remain undistributed for a little longer. According to Automotive News, the strategy is quite simple to understand. FCA is holding off until the first quarter of 2016 to divvy up the remaining Ferrari stock to shareholders. By doing so, the automaker gets to claim 80 percent of the Prancing Horse's profits for its 2015 financial numbers. While FCA is already showing strong results through Q1 2015, being able to add extra cash on the balance sheet is always a plus. FCA hasn't set a specific date for the IPO, but Ferrari stock was announced to be traded in the US and possibly on a European exchange, as well. According to Automotive News, FCA currently owns 90 percent of the company, and Piero Ferrari has the remaining 10 percent, which he isn't selling. Related Video:

Ferrari California T gets sharper edge with Handling Speciale package

Fri, Jan 22 2016It's been about two years since Ferrari updated the California to T-spec with a 3.9-liter, flat-plane crank, twin-turbocharged engine, and we found it to be a suitable change – rewarding to drive, and compelling to experience. Now Ferrari has introduced a new handling option, which will debut at the upcoming Geneva Motor Show in March, which should add a sharper edge to the roadster. Like most handling packages, the springs and dampers get the most attention. The magnetorheological dampers fitted to the conventional California T get changes that increase their response time to changing road conditions. As before, damper settings are controlled via the steering wheel manettino, and the most aggressive change is to be found in the Sport setting. The front springs are stiffer – 16 percent up front, 19 percent in the rear – which will aid body control in all axes. Ferrari claims that, overall, the setup only marginally reduces the ride comfort. It'll take driving a Handling Speciale-equipped car to find out. The changes go beyond just handling hardware. Shifts are faster in Sport mode, both in automatic and manual modes, thanks to recalibrated transmission logic. Ferrari's engineers also found some additional corner exit speed by tweaking the F1-Trac stability control system's programming. The company claims this tweak also helps with acceleration on bumpy surfaces. Cosmetically, the California Ts with the Handling Speciale package will feature a matte grille, a rear diffuser with matte-painted fences, and matte black tailpipes. A special-edition plaque, located in the cabin, is also standard, Finally, in a very Italian move, the exhaust note has been recalibrated "to underline the performance gains." That is to say, if you don't happen to have a skidpad handy to do a direct measurement of the increase in cornering capability – which, it should be noted, Ferrari doesn't quantify – the sportier sound will serve as a psychological reminder. There's no claim that the new exhaust system changes the engine's output – cars so equipped make the same 553 hp at 7500 RPM as the model we tested back in 2014. Look for the Handling Speciale package to debut at the Geneva Motor Show.

What's the smarter investment, Ferrari stock or a Ferrari?

Sun, Jul 26 2015Fiat Chrysler Automobiles is gearing up to spin Ferrari off into its own company, and float some of its shares on the stock market. But buying and trading in Ferrari stock could face a rather unlikely competitor from within. As Bloomberg points out, the values held by classic Ferraris keeps going up, and by no small margin. Even something as relatively humble as the 80s-era Testarossa, for example, has nearly doubled in value over the past year alone. Meanwhile the value of some models – particularly those built in the 1950s, 60s, and 70s – have skyrocketed nearly seven-fold since 2006. Just look at the 250 GTO, one of the most coveted of classic Ferraris among collectors: not taking inflation into account, they were worth thousands in the late 60s, were already selling for hundreds of thousands in the 1980s, and by now are trading hands – on the rare occasion when they do trade hands – for tens of millions. One sold in 2004 for $10 million, and another in 2013 for over $50 million. Those kinds of increases can make a vintage Ferrari seem like a sound investment. That might make it difficult for Ferrari's stock to compete. The company hopes investors will view it as a luxury goods manufacturer along the likes of Prada, Hermes, or Louis Vuitton Moet Hennessy, the stocks of which tend to increase in value at a greater rate than those of most automakers. But even the best of those luxury stocks have merely doubled in value since 2006, compared to the aforementioned seven-fold increase enjoyed by some classic Ferraris over the same period. Add to that the prospect of actually getting to enjoy owning a classic Ferrari – albeit at the risk of damaging it and hindering its value – and the idea of investing in Maranello's products instead of its stock can seem like a much more enticing prospect. Related Video: