2005 Ferrari 360 F1 Spider Yellow Black Daytonas Shields Only 12000 Miles on 2040-cars

Cleveland, Ohio, United States

Vehicle Title:Clear

Fuel Type:Gasoline

Engine:8

For Sale By:Dealer

Transmission:Automatic

Make: FERRARI

Model: 360

Mileage: 12,077

Disability Equipped: No

Exterior Color: Yellow

Doors: 2

Interior Color: Black

Drive Train: Rear Wheel Drive

Ferrari 360 for Sale

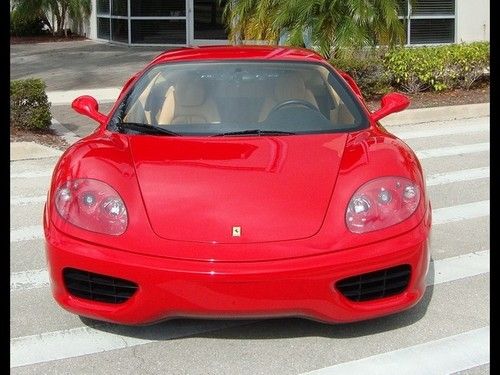

2003 ferrari 360 modena*f1*shields*red caliper*11k miles*loaded*fresh service*(US $85,900.00)

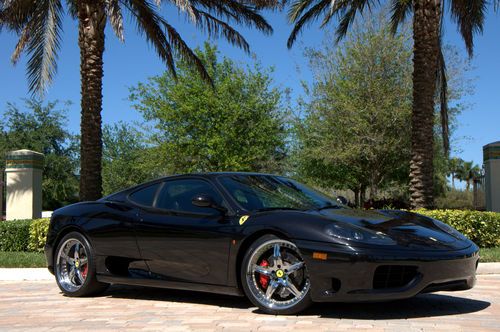

2003 ferrari 360 modena*f1*shields*red caliper*11k miles*loaded*fresh service*(US $85,900.00) V8 f1 transmission 19k(US $59,995.00)

V8 f1 transmission 19k(US $59,995.00) 360 coupe, serviced, 8k mi best of the best(US $92,900.00)

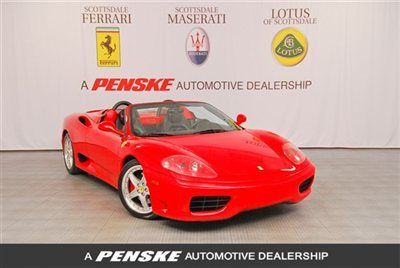

360 coupe, serviced, 8k mi best of the best(US $92,900.00) 2002 ferrari 360 spider f1,rare combo,racingseats, all services upto date,l@@k!!(US $89,991.00)

2002 ferrari 360 spider f1,rare combo,racingseats, all services upto date,l@@k!!(US $89,991.00) 2002 ferrari 360 spider-fresh major & clutch-modulars-shields-daytona's- 2003(US $85,000.00)

2002 ferrari 360 spider-fresh major & clutch-modulars-shields-daytona's- 2003(US $85,000.00) 2001 ferrari 360 spyder, brand new clutch, flywheel, and f1 gearbox...plus more(US $82,250.00)

2001 ferrari 360 spyder, brand new clutch, flywheel, and f1 gearbox...plus more(US $82,250.00)

Auto Services in Ohio

World Auto Parts ★★★★★

West Park Shell Auto Care ★★★★★

Waterloo Transmission ★★★★★

Walt`s Auto Inc ★★★★★

Transmission Engine Pros ★★★★★

Total Auto Glass ★★★★★

Auto blog

Fiat Chrysler starts production of ventilator components in Italy

Sat, Apr 4 2020MILAN — Fiat Chrysler has begun producing ventilator parts to help Italy's Siare Engineering boost its output of the medical equipment needed to treat patients during the coronavirus crisis, the carmaker said on Friday. Carmakers around the world are ramping up production of critical healthcare products and machines to respond to the enormous demand during the pandemic. Italy, the epicenter of the virus outbreak in Europe, had asked Siare to triple its normal monthly production as a part of government efforts to increase the number of intensive care beds. FCA said that with the support of luxury group Ferrari and holding company Exor, which controls both carmakers, it had produced the first electrovalves, a key part in ventilators, at its plant in Cento, in northern Italy. The Cento plant is usually used to produces high-performance car engines for the global market. It had been closed because of the coronavirus but has partially reopened for this project. "With the additional supply of electrovalves from Cento, Siare estimates that it will be able to reduce total production time for ventilators by as much as 30-50%", the statement said. In addition to the production of the electrovalves, a team of specialists from FCA is also working alongside Siare staff at their production facility near the city of Bologna. "The objective is to help increase Siare's total production, with a gradual scaling up of daily output beginning from the first week of April", FCA said.

This $7-million Ferrari LaFerrari is the most expensive modern car ever sold at auction

Mon, Dec 5 2016The Ferrari LaFerrari is already one of the most extreme, high-performance, road-going cars ever built. And now, it's also the most expensive modern car ever sold at auction. Ferrari, along with RM Sotheby's and the National Italian American Foundation's Earthquake Relief Fund, officially sold the car as part of a charity auction benefiting the reconstruction efforts in central Italy. Total price? A whopping $7 million. Ferrari claims its extra LaFerrari – the company originally built this 500th example for its own collection – is the most expensive car from the 21st century ever sold at auction. As we mentioned in our original story from last week, all proceeds from the LaFerrari auction will benefit earthquake-ravaged central Italy. While the LaFerrari's lucky new owner can rest easy knowing their money went to a seriously good cause, they'll also get to enjoy a unique example of the final production LaFerrari. It's a simple tweak, but its Rosso Corsa paint body gets a white "dream line" on its hood and rear windshield, and the Italian tricolor on the nose. We like it, and we're guessing the citizens of central Italy will appreciate the money this special hypercar made for them. Related Video:

Jay Leno's Dodge Challenger raises $585k for USO in Scottsdale

Mon, Jan 19 2015Of all the metal moved in Scottsdale, AZ, this holiday weekend, the one you see here was hardly the most expensive. But it's noteworthy for another reason: despite being a relatively humble, second-hand 2008 Dodge Challenger SRT8, raised an impressive $565,625. That's because, first of all, it belonged to Jay Leno, and secondly because the proceeds were going to the USO. Leno donated the modern muscle car from his collection to benefit our men and women in uniform, and was on hand to present the car on stage at the Gooding & Company auction, along with USO president J.D. Crouch II and former Army chief of staff General George W. Casey, Jr. After frenzied and patriotic bidding, the gavel ultimately dropped at $360,000, accompanied by over $200,000 in additional contributions, bringing the total amount donated to the USO to over half a million. Commendable though it was, of course the Challenger didn't garner the highest bids at the auction. A 1959 Ferrari 250 GT LWB California Spider sold for $7.7 million and a 1968 Ferrari 330 GTS fetched $2.4 million. A rare 1962 Ferrari 400 Superamerica Series I Coupe Aerodinamico sold for over $4,070,000 – which, according to Sports Car Market, is the most ever paid at auction for a 400 Superamerica. And a 1966 Porsche 906 Carrera 6 also sold for a record $1.98 million. Featured Gallery Gooding Scottsdale 2015 News Source: Gooding & CompanyImage Credit: Jensen Sutta, Mike Maez/Gooding Celebrities Dodge Ferrari Porsche Auctions Classics dodge challenger srt8 gooding ferrari 400 superamerica