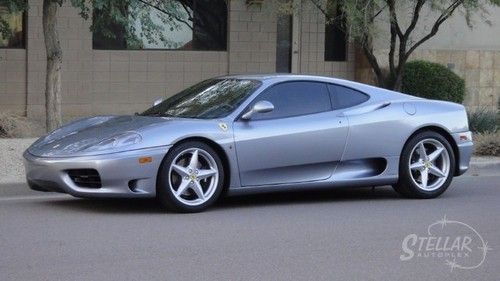

2002 Ferrari 360 Modena Spider Manual Only 13k Miles on 2040-cars

Anaheim, California, United States

For Sale By:Dealer

Engine:3.6L 3586CC V8 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Manual

Warranty: Vehicle does NOT have an existing warranty

Make: Ferrari

Model: 360

Power Options: Air Conditioning, Power Door Locks, Power Windows

Trim: Spider Convertible 2-Door

Doors: 2

Drive Type: RWD

Engine Description: 3.6L V8 FI DOHC 40V

Mileage: 13,012

Number of Doors: 2

Sub Model: Spider

Exterior Color: Flat White

Number of Cylinders: 8

Interior Color: Black

Ferrari 360 for Sale

Novitec twin supercharger 2 intercool red f1,upgrades $164k 707hp,458,430,599gto(US $108,999.00)

Novitec twin supercharger 2 intercool red f1,upgrades $164k 707hp,458,430,599gto(US $108,999.00) 2005 ferrari 360 spider f1 v8 400 hp pw scuderia daytona leather pdl challenge

2005 ferrari 360 spider f1 v8 400 hp pw scuderia daytona leather pdl challenge 2004 ferrari 360 modena spider convertible

2004 ferrari 360 modena spider convertible 2004 ferrari 360 spider - black on black - low miles - mint condition(US $119,000.00)

2004 ferrari 360 spider - black on black - low miles - mint condition(US $119,000.00) 2004 ferrari 360 modena f1 daytona scuderia fresh service all books 11,206 miles

2004 ferrari 360 modena f1 daytona scuderia fresh service all books 11,206 miles 01 360 f1 modena * shields * calipers * modulars * stitching * tubi * serviced!!(US $89,900.00)

01 360 f1 modena * shields * calipers * modulars * stitching * tubi * serviced!!(US $89,900.00)

Auto Services in California

Zenith Wire Wheel Co ★★★★★

Yucca Auto Body ★★★★★

World Famous 4x4 ★★★★★

Woody`s & Auto Body ★★★★★

Williams Auto Care Center ★★★★★

Wheels N Motion ★★★★★

Auto blog

Ferrari auctioning one-off LaFerrari for Italian earthquake relief

Tue, Nov 29 2016Ferrari is about as Italian as Italian gets, so it's no surprise that the company is launching an initiative to help the victims of this year's two major central Italian earthquakes. And it involves a LaFerrari. Ferrari, RM Sotheby's, and the National Italian American Foundation's Earthquake Relief Fund are partnering up to auction off a one-off LaFerrari from the company's own collection at the upcoming Finali Mondiali on December 3. All proceeds from the auction will go to the reconstruction efforts in central Italy following August's magnitude 6.2 quake and the string of quakes that hit late last month. If you're heading to the Daytona International Speedway for Finali Mondiali and have seven-figure's worth of cash burning a hole in your finely lined pockets, it's worth mentioning what you could bid on. The LaFerrari in question wears the company's traditional Rosso Corsa, but sports white accents down its body and an Italian tricolor on its nose. Ferrari says bespoke interior stylings complement the one-of-a-kind exterior treatment. The special LaFerrari will cross the block at RM Sotheby's on December 3. Related Video:

The limited-run Ferrari J50 is the coolest 488 Spider you can't buy

Tue, Dec 13 2016Ferrari is really good at celebrating things. In recognition of 50 years of selling cars in Japan, the company is building a few one-off versions of the 488 Spider, called the J50. That's our kind of anniversary present. Just 10 of these cars will be built, and each will be customized to the taste of its owner. The J50 gets a 681-horsepower version of the 488's 3.9-liter twin-turbo V8 and of course wraps it all in different bodywork. The interior gets some custom attention as well, with different trim but most of the normal parts from the 488 Spider. It's not shown here, but there's a two-piece carbon-fiber targa roof that stows behind the seats and is supported by the matte carbon roll hoops. Design highlights include a polycarbonate bubble over the engine, a channel that wraps the front end and the sides, a chopped windshield and side glass, and a fantastic looking rear diffuser. The front end reminds us of some old GM aero concepts, but in the best way possible. If you want one, you're probably already too late. Ferrari likely offered these to its best Japanese customers before the car was even unveiled. You have 50 years to save up for the next one; better luck next time. Related Video: Featured Gallery Ferrari J50 Ferrari Convertible Luxury Performance Supercars ferrari 488 spider

Ford GT40 makes historic return to racing at Goodwood

Wed, 23 Oct 2013Is there a more iconic, American racecar than the Ford GT40? That may be a discussion for another day (although by all means, tell us how wrong we are in Comments), but this video of heaps of GT40s running in the Goodwood Revival races certainly has us thinking that Ford's Ferrari-killer might just be the best racer the Land Of The Free and Home Of The Brave has ever come up with.

That's completely ignoring the fact that the GT40 was largely developed by Brits using American money, but that's besides the point (there was also a rather brash Texan, who had a big role later in development). The resulting vehicle was dominant, besting the cars of Il Commendatore from 1966 to 1969, although it should be noted that Ford's GT40 was unable to beat Ferrari in its first two Le Mans outings in 1964 and 1965.

Those four years of dominance, which started with Ford sweeping the podium, were enough to establish the GT40's legend. And now, here we are almost 50 years later, celebrating the mid-engined monsters at Goodwood, in their first ever one-make race. Take a look below for the entire video.