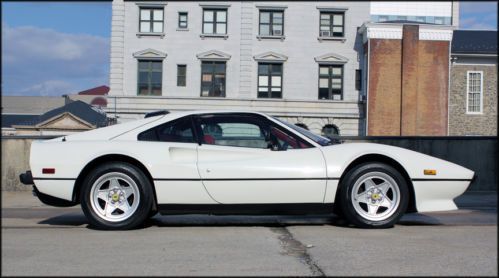

1980 Ferrari 308 Gtsi - Black On Tan! - $30k In Records - 37k Miles! - Video! on 2040-cars

Saint Louis, Missouri, United States

Ferrari 308 for Sale

'76 308 gtb, u.s model, 68k, 2 owner o.c car from new, books & tools.(US $59,500.00)

'76 308 gtb, u.s model, 68k, 2 owner o.c car from new, books & tools.(US $59,500.00) 1975 308 gt4 - california

1975 308 gt4 - california 1982 ferrari 308 gtsi euro only 30,943km! show quality blue sera! books & tools!(US $37,995.00)

1982 ferrari 308 gtsi euro only 30,943km! show quality blue sera! books & tools!(US $37,995.00) 1985 ferrari 308 gtb qv bianco/red recent major rare(US $57,995.00)

1985 ferrari 308 gtb qv bianco/red recent major rare(US $57,995.00) 1977 308gtb ~ major service just completed

1977 308gtb ~ major service just completed 1982 ferrari gtsi rare silver red low miles service all manuals and docs(US $46,595.00)

1982 ferrari gtsi rare silver red low miles service all manuals and docs(US $46,595.00)

Auto Services in Missouri

Wicked Stickers ★★★★★

Vietti Collision Center ★★★★★

Valvoline Instant Oil Change ★★★★★

Team 1 Auto Body & Glass ★★★★★

Talley`s Collision Repair Service ★★★★★

Tallant`s Auto Body & Hot Rod Shop ★★★★★

Auto blog

Drive goes sideways, shreds tires in a Ferrari F12 Berlinetta

Thu, 24 Oct 2013Ferrari has built a monster with its F12 Berlinetta, a V12-powered grand tourer that has the looks of a supermodel and the firepower of a small country. And while it's been on the scene for a minute, Drive's Chris Harris wasn't going to turn down the opportunity to hoon a 740-horsepower prancing horse around the scenic Anglesey Circuit in Wales.

In fact, not only was Ferrari nice enough to loan Harris the F12, but it threw in an extra four sets of tires, just for him to destroy while taking moving pictures. The resulting video is indeed one to watch, not just because of the ample amounts of slow-motion drifting, but because Harris, as always, does a great job of making the viewer feel like they're actually along for the ride. Take a look below for the latest video from Drive.

Fiat Chrysler starts production of ventilator components in Italy

Sat, Apr 4 2020MILAN — Fiat Chrysler has begun producing ventilator parts to help Italy's Siare Engineering boost its output of the medical equipment needed to treat patients during the coronavirus crisis, the carmaker said on Friday. Carmakers around the world are ramping up production of critical healthcare products and machines to respond to the enormous demand during the pandemic. Italy, the epicenter of the virus outbreak in Europe, had asked Siare to triple its normal monthly production as a part of government efforts to increase the number of intensive care beds. FCA said that with the support of luxury group Ferrari and holding company Exor, which controls both carmakers, it had produced the first electrovalves, a key part in ventilators, at its plant in Cento, in northern Italy. The Cento plant is usually used to produces high-performance car engines for the global market. It had been closed because of the coronavirus but has partially reopened for this project. "With the additional supply of electrovalves from Cento, Siare estimates that it will be able to reduce total production time for ventilators by as much as 30-50%", the statement said. In addition to the production of the electrovalves, a team of specialists from FCA is also working alongside Siare staff at their production facility near the city of Bologna. "The objective is to help increase Siare's total production, with a gradual scaling up of daily output beginning from the first week of April", FCA said.

2016 Ferrari FF mule sounds super snarly in Fiorano testing

Wed, Jan 14 2015There are innumerable advantages to a company having its own test track on premises like Ferrari has with Fiorano. The Scuderia may not be able to test its Formula One machinery much on the track these days, what with the limitations placed by the FIA, but the factory can still use the circuit to wring out the road-going machinery it has under development – to say nothing of opportunities for visiting customers, journalists and VIPs. But it also means that the paparazzi know where to look to see what the company has in the works. In this case, supercar videographer extraordinaire Marchettino caught a Ferrari FF prototype running some hot laps around Fiorano. But to what end, exactly, we don't know. With the 458 expected to be updated shortly, the twelve-cylinder, four-seat, all-wheel-drive FF will soon be the oldest model in the company's lineup (introduced as it was in 2011), which would ostensibly put it next in line for a refresh. There've been rumors of a more elegant roofline to replace the hatchback, and even an eight-cylinder version to bring the model down-market slightly – although that might bring it too close to the California T. We'll have to wait and see what Ferrari has in store for its first and only all-wheel-drive model. But as you can hear for yourself in the video above, the exhaust sounds pretty raunchy, even by Maranello standards.