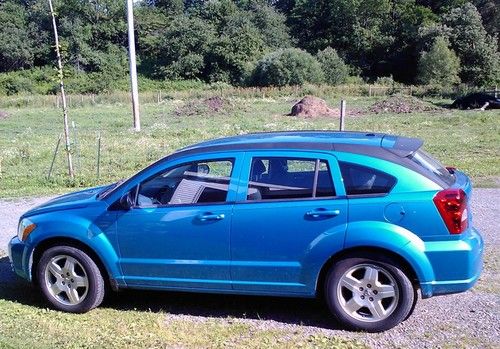

2007 Dodge Caliber Sxt Hatchback 4-door 2.0l on 2040-cars

Smithland, Kentucky, United States

Engine:2.0L 1998CC 122Cu. In. l4 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Hatchback

Fuel Type:GAS

For Sale By:Private Seller

Exterior Color: Silver

Make: Dodge

Interior Color: Gray

Model: Caliber

Trim: SXT Hatchback 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: CD Player

Number of Cylinders: 4

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 118,702

2007 Dodge Caliber SXT

Gets 30+ MPG!!

We are selling because we purchased something bigger to drive after having a baby. It runs and drives great.

Tires are approx. 50%, It does need rear brakes installed as they squeak a little.

There are some minor upholstery stains.

Overall a great car!

Dodge Caliber for Sale

2011 dodge caliber mainstreet hatchback 4-door 2.0l(US $10,500.00)

2011 dodge caliber mainstreet hatchback 4-door 2.0l(US $10,500.00) R/t alloy wheels clean we finance great gas mileage car

R/t alloy wheels clean we finance great gas mileage car 2011 dodge caliber 4dr hb mainstreet

2011 dodge caliber 4dr hb mainstreet 2010 dodge caliber mainstreet hatchback 4-door 2.0l low miles(US $11,499.00)

2010 dodge caliber mainstreet hatchback 4-door 2.0l low miles(US $11,499.00) Dodge caliber sxt, 5 speed 1.8l 4 cyl. super condition, only 25,775 miles(US $13,500.00)

Dodge caliber sxt, 5 speed 1.8l 4 cyl. super condition, only 25,775 miles(US $13,500.00) 2007 dodge 4dsd(US $8,500.00)

2007 dodge 4dsd(US $8,500.00)

Auto Services in Kentucky

Weinle Auto Sales East ★★★★★

Troy`s Wrecker Service ★★★★★

Tony`s Body Shop ★★★★★

TH Auto Body ★★★★★

Simpsonville Automotive ★★★★★

Ritze`s Auto Service ★★★★★

Auto blog

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

No wing, no Hemi. This Dodge Charger Daytona is two-tone and tufted

Mon, Oct 7 2019In between the Dodge Charger Daytona's 1969 debut as a wild, winged NASCAR warrior and the current 2020 Charger SRT Hellcat Widebody Daytona 50th Anniversary Edition with its monster 717-hp Hemi V8, the nameplate had some ... less-glorious years. The nameplate first resurfaced in 1975, when the Charger moved into the "personal luxury" space as a riff on the Chrysler Cordoba. This 1975 Charger Daytona might not be the model's heyday, but damn if this clean machine, surfaced by Barnfinds.com, isn't striking in its own Me Decade kind of way. And this low-miles example is on offer right now on eBay motors. Outside, this dynamic Dodge sports two-tone silver and blue paint, alloy wheels with white-letter tires, and a power sunroof. Inside, we find high-backed split-bench seats with button-tufted vinyl (no "rich Corinthian leather" here). Raising the miles-long hood reveals a 400-cubic-inch, 4-bbl V8, which for 1975 packed 190 horsepower. A far cry from today's 717 horses, perhaps, but still an upgrade over the Charger's standard 360-cubic-inch V8. It may not be the car that pops immediately to mind when someone says, "Charger Daytona," but with less than 12,000 miles showing, this mid-Seventies example is a time warp to a lesser-known era for the marque. Featured Gallery 1975 Dodge Charger Daytona Dodge Coupe Classics

Make Your Dodge Durango Even Better | MoPar Options for R/T, SRT | 2018 Chicago Auto Show

Fri, Feb 9 2018Fiat Chrysler is showing new performance add-ons for the 2018 Dodge Durango R/T and SRT models at the Chicago Auto Show, including the familiar Dodge dual center stripes and a new Mopar exhaust system. The 475-horsepower SRT model, which is powered by a 6.4-liter Hemi V8, will also offer a lowering spring kit and a carbon-fiber instrument panel. Chicago Auto Show Dodge Autoblog Minute Videos Original Video SRT