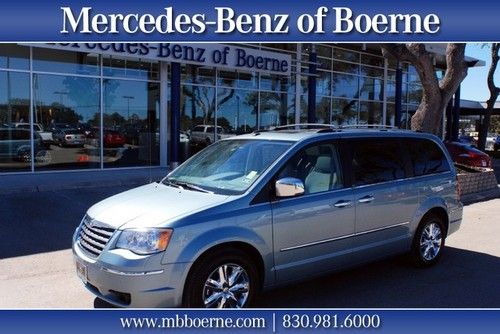

2008 Town & Country Limited, Dvd/tv/cd/mp3, Back Up Camera, Sunroof, No Reserve! on 2040-cars

Marietta, Georgia, United States

Chrysler Town & Country for Sale

1999 chrysler town and country

1999 chrysler town and country 1-owner 2003 chrysler town & country ex 3.8l v6 new tires cleanest around(US $5,990.00)

1-owner 2003 chrysler town & country ex 3.8l v6 new tires cleanest around(US $5,990.00) 2013 chrysler town & country touring leather dvd backup cam power doors(US $24,500.00)

2013 chrysler town & country touring leather dvd backup cam power doors(US $24,500.00) Handicapped wheelchair accessible disabled driver van with tie downs one owner(US $12,000.00)

Handicapped wheelchair accessible disabled driver van with tie downs one owner(US $12,000.00) 2010 chrysler limited

2010 chrysler limited 2013 chrysler town & country touring dvd rear cam 36k texas direct auto(US $20,980.00)

2013 chrysler town & country touring dvd rear cam 36k texas direct auto(US $20,980.00)

Auto Services in Georgia

Youmans Chevrolet Co ★★★★★

Xtreme Window Tinting ★★★★★

Valvoline Instant Oil Change ★★★★★

Tribble`s Automotive Inc ★★★★★

Top Dollar for Junk Cars ★★★★★

Sun Shield Window Tinting ★★★★★

Auto blog

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.

Jeep still working to improve Cherokee's 9-speed auto

Tue, Feb 3 2015Fiat Chrysler is hoping an upcoming software update will stem the tide of consumer complaints surrounding its nine-speed automatic transmission. Owners of the 2014 Jeep Cherokee have reported a number of problems on the National Highway Traffic Safety Administration's SaferCar.gov website, since the new model and its troubled gearbox arrived way back in October 2013. The software update is "intended to keep the vehicle performing as intended, and to prevent durability issues from occurring in the future," an FCA spokesperson told Automotive News, and will be available to owners of both the 2014 to 2015 Jeep Cherokee and the 2015 Chrysler 200, which also uses the 9AT. While FCA will be notifying consumers of the update, owners can also request the software reflash if they happen into their dealer before then. Despite the widely documented problems with the transmission, the only complaints on NHTSA's website relate to the 2014 Cherokee – neither the 2015 Jeep nor the 200 have received any complaints. That bodes well as FCA prepares to begin deliveries of the 2015 Jeep Renegade and launch the Fiat 500X, both of which pair the 9AT with the 2.4-liter Tigershark four-cylinder. "We have had to do an inordinate amount of intervention on that transmission, surely beyond what any of us had forecast," FCA CEO Sergio Marchionne told Automotive News. "There are things that we have done – that we continue to do. Our proactive customer care intervention has actually increased in intensity on these vehicles in 2014, especially in the second half." What's fascinating about the 9AT's problems are that they haven't been the fault of manufacturer ZF, but have related to software that wasn't "mature" and had "teething problems," Marchionne has said previously, AN reports. With the lack of criticism for the 9AT in 2015 models and this pending software update, though, here's hoping that FCA has finally figured out its fuel-sipping gearbox. Related Video:

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.