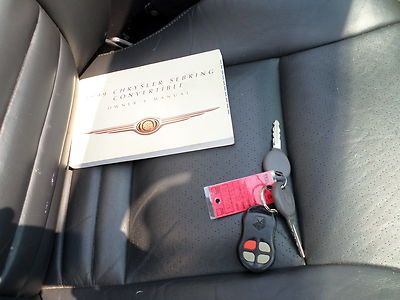

No Reserve 1999 Chrysler Sebring Convertible Loaded on 2040-cars

Hackettstown, New Jersey, United States

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle does NOT have an existing warranty

Make: Chrysler

Model: Sebring

Options: Convertible

Trim: JXi Convertible 2-Door

Safety Features: Anti-Lock Brakes

Power Options: Power Locks

Drive Type: FWD

Mileage: 187,040

Vehicle Inspection: Inspected (include details in your description)

Sub Model: 2dr Converti

Number of Doors: 2 Generic Unit (Plural)

Exterior Color: Gold

Interior Color: Black

Number of Cylinders: 6

Chrysler Sebring for Sale

2006 chrysler sebring convertible touring edition nice car no reservelowmillage(US $3,950.00)

2006 chrysler sebring convertible touring edition nice car no reservelowmillage(US $3,950.00) 2004 chrysler sebring convertible touring must see !(US $7,521.00)

2004 chrysler sebring convertible touring must see !(US $7,521.00) 2002 chrysler sebring limited convertible nice car no reserve good millage(US $3,300.00)

2002 chrysler sebring limited convertible nice car no reserve good millage(US $3,300.00) 1998 chrysler sebring jx convertible 2-door 2.4l

1998 chrysler sebring jx convertible 2-door 2.4l 1996 chrysler sebring jxi convertible with no reserve

1996 chrysler sebring jxi convertible with no reserve Beautiful sebring convertible(US $5,500.00)

Beautiful sebring convertible(US $5,500.00)

Auto Services in New Jersey

Woodstock Automotive Inc ★★★★★

Windrim Autobody ★★★★★

We Buy Cars NJ ★★★★★

Unique Scrap & Auto - USA ★★★★★

Turnersville Pre-Owned ★★★★★

Trilenium Auto Recyclers ★★★★★

Auto blog

Ferrari families have 'agreement' to prevent takeover

Thu, Oct 22 2015With its initial public offering already a massive success, Ferrari is now officially a publicly traded company on the New York Stock Exchange. While anyone can buy those shares, don't expect investors to take control away from some of the top owners of the Prancing Horse anytime soon. To maintain their power, Enzo Ferrari's son, Piero, and Exor chairman John Elkann will sign a deal guaranteeing themselves nearly half of the automaker's voting rights, Bloomberg reports. As part of this arrangement, shareholders that agree to hang onto Ferrari stock for at least three years would receive additional voting rights in the company, and that would give Piero and Elkann a combined 48.7 percent of the automaker by banding together. While not quite complete control, the move should be enough to prevent a takeover of the business. "We have an agreement among the families to protect our interests in Ferrari," Piero said to Bloomberg. This agreement won't really become a concern until next year because only 10 percent of Ferrari will be traded for now. FCA will distribute another 80 percent to its shareholders in early 2016, and Elkann's Exor will be getting the largest portion of the Prancing Horse in the spin-off. Meanwhile, Piero holds the remaining 10 percent but has absolutely no intention to sell his stake in his father's business. The newly public Ferrari will push to grow volume with a goal of moving 9,000 vehicles annually by 2019. To reach that 30-percent boost, expect to see a new model every year, and some of them might use a new, modular platform that's reportedly under development. Related Video:

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

Chrysler recalling hundreds of thousands of Jeep Grand Cherokee and Commander SUVs

Wed, 23 Jul 2014The public might associated ignition switch recalls with General Motors - and with good cause - but that's not the only automaker calling its vehicles back in to fix that sort of issue.

Last month we reported that the National Highway Traffic Safety Administration was investigating an array of Chrysler Group vehicles for electrical-related safety issues. The administration and Chrysler subsequently issued a recall for 700,000 Dodge Journey crossovers, Dodge Grand Caravan minivans and Chrysler Town & Country minivans. But while the Jeeps that were also under investigation were not covered in that recall, they are being addressed in a separate one now.

Although Chrysler reports that it is only aware of a single accident stemming from this issue, it is "committing now to conduct a recall out of an abundance of caution." The recall affects the 2006-2007 Jeep Commander and 2005-2007 Jeep Grand Cherokee, of which it reports there are 792,300 on the road: 649,900 in the United States, 28,800 in Canada, 12,800 in Mexico and a further 100,800 outside of North America.