2001 Silver on 2040-cars

Independence, Missouri, United States

Body Type:Coupe

Vehicle Title:Clear

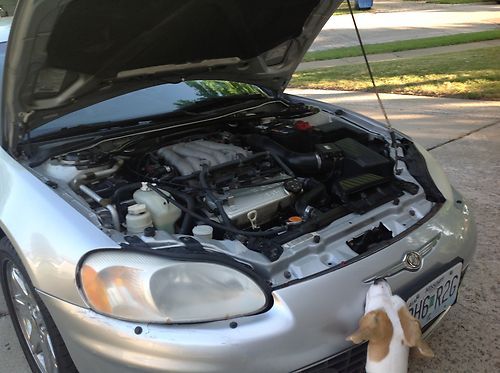

Engine:3 liter V6

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Sebring

Trim: Coup 2 doors

Options: Leather Seats, CD Player

Safety Features: Driver Airbag

Drive Type: Front

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 156,000

Sub Model: LXI

Exterior Color: Silver

Disability Equipped: No

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

Small crack in front bumper, broken latch on glove compartment, tear in driver sit upholstery, needs new headlight covers, new tires, Crome wheels, 3liter v6, good condition, runs well, 150 . 000 miles, 5speed manual.

Chrysler Sebring for Sale

2004 chrysler sebring limited convertable low miles(US $9,000.00)

2004 chrysler sebring limited convertable low miles(US $9,000.00) 2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00)

2008 chrysler sebring touring model,blk & grey/7" dvd player/runs and looks mint(US $5,500.00) We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00)

We finance!! 2011 chrysler 200 limited convertible nav heated leather texas auto(US $22,998.00) 2005 chrysler sebring convertible low miles florida car new top(US $5,900.00)

2005 chrysler sebring convertible low miles florida car new top(US $5,900.00) 2004 chrysler sebring gtc convertible (low miles)(US $3,200.00)

2004 chrysler sebring gtc convertible (low miles)(US $3,200.00) Steel blue . two owners . south florida(US $3,900.00)

Steel blue . two owners . south florida(US $3,900.00)

Auto Services in Missouri

Wrench Tech ★★★★★

Valvoline Instant Oil Change ★★★★★

Tint Crafters Central ★★★★★

Riteway Foreign Car Repair ★★★★★

Pevely Plaza Auto Parts Inc ★★★★★

Performance By Joe ★★★★★

Auto blog

Dodge to resurrect Scat Pack?

Fri, 27 Sep 2013Before social media ever existed, if automotive enthusiasts wanted to be noticed or recognize other fans, they joined a car club. For Dodge muscle car lovers from 1968 through 1971, that group was known as the Scat Pack. Just like the Charger, Challenger and Dart nameplates, it looks like the Scat Pack could be getting a resurrection by Chrysler.

Automotive News is reporting that Chrysler recently renewed its trademark on the Scat Pack name, and while this is in no way a guarantee that the name will return, AN talked to Tim Kuniskis, Dodge President and CEO, who stoked the fire a little more. In the article, Kuniskis said that the name is "a very important part of our history" and added that "we like the whole idea of having a Scat Pack of cars." Scat Pack models were identified by their bumblebee stripes and helmet-wearing bumblebee logo, and the idea of a modern Scat Pack doesn't seem all that outlandish in light of recent vehicles like the Charger SRT Super Bee and the Ram 1500 Rumble Bee Concept.

What do you think, is this a cool idea, or is it just an unwelcome bit of nostalgia? Have you say in Comments.

Man escapes attempted carjacking and catches the incident on his dashcam

Fri, Dec 9 2016(Warning: video contains strong language. Viewer discretion is advised.) A quick-thinking driver avoided a potentially dangerous situation this week in New Mexico when he evaded and attempted car jacking. On the evening of December 6, an unnamed man accompanied a friend to a market near the intersection of Central and San Mateo in Albuquerque. After he saw his friend safely away in her car, he got back into his and pulled out of the parking lot. Almost immediately, as shown in dashcam footage uploaded to Youtube, a red Chrysler 300 began following him. When the driver pulled up to a stop sign around the block from the market, the Chrysler zipped around and pulled in front of him, blocking his forward progress. Figuring he was about to be carjacked, the driver threw the car into reverse and backed quickly away from the Chrysler. The Chrysler followed, and a chase ensured. With the Chrysler close on his tail, the unnamed driver fled through the nearly empty streets. At one point he cut through a gas station when the Chrysler tried to block him at another intersection. As they drove through the city the Chrysler continually tried to stop the fleeing driver, but he successfully evaded every time. The driver called 911 and reported his predicament. Eventually, both vehciles pulled up at a stop light right next to an Albuquerque Police cruiser. The driver laid on the horn to get the cop's attention, then jumped out to tell the cop what was going on. The Chrysler then made a run for it with the cop in hot pursuit. Unfortunately, the red Chrysler evaded the APD and the car's license plate was obscured so the APD was unable to identify the vehicle or its occupants. Thankfully no one was hurt during the chase, and the driver was able to get home safe and sound. Carjacking is a serious crime. The driver in this video did everything right, except maybe delay calling the police a little too long. The crime is so prevalent that the US Department of Justice has tips for avoiding carjacking. They suggest drivers avoiding stopping when signaled by other drivers or assisting during an accident. Calling the authorities should be your first step if you're every followed or harassed while driving. Head to the nearest police station if you can't get a hold of a cop in time. Related Video: News Source: YouTube Auto News Weird Car News Chrysler Police/Emergency police chase carjacking albuquerque

Marchionne on Alfa's US return, Dodge Dart's powertrain weakness and minivan plans

Fri, 18 Jan 2013As a reporter covering an auto show, the one opportunity you never want to miss is going to the Sergio Marchionne press briefing.

"This undertaking to bring Alfa back is a one-shot deal... We are not going to do this twice."

There just aren't that many real characters left in the auto industry. Marchionne, who sits atop both Chrysler and Fiat, is not only one of the smartest execs in the business, but also the most frank. Herein, a sample of the quotable always-sweatered executive: