2006 Chrysler Pt Cruiser Base on 2040-cars

6950 Loop Rd, Centerville, Ohio, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:4-Speed Automatic

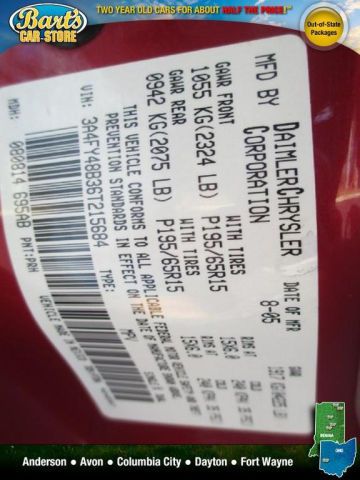

VIN (Vehicle Identification Number): 3A4FY48B36T215684

Stock Num: B313563

Make: Chrysler

Model: PT Cruiser Base

Year: 2006

Exterior Color: Inferno Red Crystal Pearl

Interior Color: Pastel Slate Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 56825

Thank you for visiting another one of Bart's Car Store - Avon's exclusive listings! 100% CARFAX guaranteed! 100% AutoCheck guaranteed! At Bart's Car Store - Avon, we strive to provide you with the best quality vehicles for the lowest possible price, and this PT Cruiser is no exception. "Use your SMARTS and buy at BART'S!!"

Chrysler PT Cruiser for Sale

2004 chrysler pt cruiser gt(US $6,985.00)

2004 chrysler pt cruiser gt(US $6,985.00) 2005 chrysler pt cruiser touring(US $4,995.00)

2005 chrysler pt cruiser touring(US $4,995.00) 2003 chrysler pt cruiser gt(US $5,500.00)

2003 chrysler pt cruiser gt(US $5,500.00) 2002 chrysler pt cruiser limited(US $4,900.00)

2002 chrysler pt cruiser limited(US $4,900.00) 2003 chrysler pt cruiser touring(US $5,995.00)

2003 chrysler pt cruiser touring(US $5,995.00) 2007 chrysler pt cruiser base(US $7,995.00)

2007 chrysler pt cruiser base(US $7,995.00)

Auto Services in Ohio

Zig`s Auto Service ★★★★★

Zeppetella Auto Service ★★★★★

Willis Automobile Service ★★★★★

Voss Collision Centre ★★★★★

Updated Automotive ★★★★★

Tri C Motors ★★★★★

Auto blog

NHTSA closes investigation on 4.7M FCA power modules, no recall

Thu, Jul 30 2015FCA US hasn't had the best time with recalls as of late. Not only did the company recently agree to greater safety oversight and paid $105 million to the government, that came just days after hacking fears prompted a 1.4-million model recall campaign. However, a recent decision to close an investigation by the National Highway Traffic Safety Administration means that the automaker doesn't have to worry about another major recall possibly affecting 4.7 million vehicles, according to the agency's report (as a PDF). Last September, the Center for Auto Safety petitioned NHTSA to investigate an alleged problem with the totally integrated power module (TIPM) on these FCA US models. The group claimed that a fault with the component could cause a variety of maladies, including stalls, not starting, catching fire, unintended acceleration, and airbag non-deployment. At the time, it also submitted 70 cases where this had reportedly happened. According to NHTSA, "no valid evidence was presented in support of claims related to airbag non-deployment, unintended acceleration, or fire resulting from TIPM faults and these claims were found to be wholly without merit based on review of the field data and design of the relevant systems and components." The agency did find signs of an issue with the fuel pump relay in some Jeep Grand Cherokees and Dodge Durangos, but FCA US issued recalls for the problem in September 2014 and February 2015. Without anything else to go on, the Feds don't think it's worth investigating this topic any more.

Renault wants to merge with Nissan, then go after Fiat Chrysler

Wed, Mar 27 2019The late Sergio Marchionne used to say consolidation would be the only way to compete against the biggest global carmakers. The company looks certain to fulfill that goal, but perhaps not in the way he intended. The Financial Times reports that Renault wants to begin merger talks with Nissan in the next 12 months. Assuming a merger gets completed, the plan is for the combined company to then pursue another merger, with Fiat Chrysler a prime target. Renault, Nissan, and Mitsubishi have been busy since cutting ties with ex-alliance boss Carlos Ghosn. They formed a new alliance board with Renault chairman Jean-Dominique Senard at the helm, Renault has shrunk the size of its board while Nissan added more outside directors, and the two agreed to a new governance structure to ease operational decision making. All three automakers have walked away from Ghosn-era goals to sell 14 million cars and find 10 billion euros in savings by 2022. New strategic plans for all three car companies are in the works. With stability in sight, it's said Senard wants to succeed where Ghosn failed — a full-fledged merger between Renault and Nissan with talks to begin "as soon as possible." Ghosn's pursuit of a merger last year in attempt to make the 20-year-old alliance "irreversible" is part of what led to his downfall, with Nissan executives including CEO Hiroto Saikawa against the push. The new effort is presented as larger scale being the only way for the alliance to take on companies like Volkswagen and Toyota. But the Nissan-Renault-Mitsubishi trio sold 10.76 million cars around the world last year, second to Volkswagen with 10.83 million sales, ahead of Toyota with 10.39 million. If Nissan hadn't suffered a 2.8 percent dip in sales, the alliance would have taken the top spot. If a little scale is good that means more is better, right? Pulling Fiat Chrysler into the alliance would add around 5 million annual sales, and would be another move in Ghosn's footsteps. The former honcho is said to have "held talks with FCA" about some kind of union within the past three years. The French government, which has a 15 percent stake in Renault and double voting rights, shut down the initiative. It's not clear if FCA will be an independent company by the time a potential Nissan-Renault merger closed, though.

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.