Manual 5.3l Straight 8 37,433 Original Miles on 2040-cars

San Francisco, California, United States

Chrysler New Yorker for Sale

1951 chrysler new yorker good condition no motor

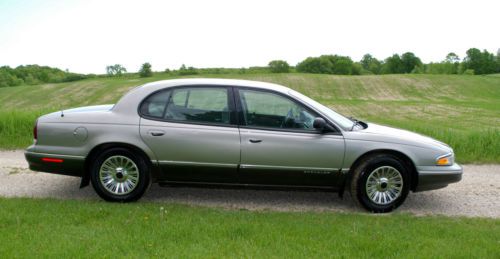

1951 chrysler new yorker good condition no motor 1995 chrysler new yorker lh sedan 4-door 3.5 108,200 miles silver grey(US $1,800.00)

1995 chrysler new yorker lh sedan 4-door 3.5 108,200 miles silver grey(US $1,800.00) 68 new yorker, chrysler, classic, antique(US $9,000.00)

68 new yorker, chrysler, classic, antique(US $9,000.00) 1955 chrysler new yorker deluxe - 331 hemi ***mopar classic***

1955 chrysler new yorker deluxe - 331 hemi ***mopar classic*** 1974 chrysler new yorker base hardtop 4-door 7.2l - very clean

1974 chrysler new yorker base hardtop 4-door 7.2l - very clean 1989 chrysler new yorker, no reserve

1989 chrysler new yorker, no reserve

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Junkyard Gem: 1975 Plymouth Fury Sedan

Sun, Dec 27 2020The Plymouth Fury was once among the most commonplace vehicles on American roads, with the 1970s being the most Furious decade of all. If you've watched a lot of Malaise Era cop shows, you've seen endless examples of the 1975-1978 B-Body Fury sedan; today's Junkyard Gem in Colorado is a civilian version with a very unusual combination of features and options. Though the 1975-1978 Fury is sibling to many much more famous B Platform Chryslers, including the Dukes of Hazzard General Lee and a lot of other highly revered Mopars of the late 1960s and early 1970s, it doesn't get the recognition it deserves today. Would the world be the same if Debbie Harry had posed in her Anya Phillips dress on the bumper of, say, a Ford LTD instead of the iconic '76 Fury on the cover of Plastic Letters? I've got this album cover hanging on my garage wall, right next to Sir Mix-a-Lot's My Hooptie and its '69 Buick Electra. This sun-baked '75 left the assembly line with some nice luxury options for an affordable midsize sedan of its time, including a padded vinyl roof. Factory air conditioning was a $437 option on the Fury in 1975, a price tag that comes to an attention-grabbing $2,185 in 2020 dollars. The MSRP on a Fury sedan that year started at just $3,571 ($17,840 today), so A/C jacked up the cost by close to 15%. The base engine was a 225-cubic-inch (3.7-liter) Slant-6, but this car took the next step up on the Fury engine hierarchy for 1975: a 318-cubic-inch (5.2-liter) V8 making 145 horsepower. Here's where things get a bit weird. That shift lever on the steering column controls a three-speed manual; this rig is commonly known as a three-on-the-tree. The most popular transmission setup on Detroit cars of the 1940s through the early 1960s, the good ol' three-on-the-tree survived here all the way through the 1979 model year in new cars and 1987 in new trucks. By 1975, most lower-priced American mid- and full-sized cars had the three-on-the-tree as base equipment, but by that time nearly every new-car shopper here opted for an automatic transmission or — occasionally — a floor-shifted three- or four-speed manual. The total number of 1975 Fury buyers who sprang for the V8 engine, air conditioning, and a vinyl roof yet still kept the old-fashioned three-on-the-tree transmission setup probably can be counted in the low hundreds, if even that many.

Automakers are putting pancakes in your car, when all you want is a parking spot

Sat, Jul 6 2019The Dashboard Act was introduced June 24 in Congress by Sens. Mark Warner, D-Va., and Josh Hawley, R-Mo. Its name notwithstanding, it isn’t about cars. Rather, “Dashboard” is an acronym for “Designing Accounting Safeguards to Help Broader Oversight and Regulations on Data.” The purpose of the act is to make sure that companies disclose to consumers how their data is being used by companies like Facebook and Google — how their data is being monetized. Oddly enough, the Dashboard Act does have something to do with automotive companies, too. Why? Because OEMs have determined that people have plenty of time on their hands when driving — much of which is just sitting in traffic (according to the 2018 INRIX Global Traffic Scorecard, U.S. drivers sit for an average of 97 hours last year). So what better thing to do than shop? And presumably, like credit-card companies, theyÂ’re benefiting from facilitating commerce. Coincidentally, also on June 24 FCA announced it is launching Uconnect Market, an in-vehicle commerce platform. Explained Alan DÂ’Agostini, FCA's global head of connected services, “Our customers live busy lives, and our goal with the Uconnect platform is to provide an advanced portfolio of services to make their daily drive more convenient, productive and enjoyable. “This is why we are launching Uconnect Market, as we continue to ramp-up our connectivity efforts around the world with the goal of having all new FCA vehicles connected by 2022.” Uconnect Market, which will begin rolling out this year, allows people to buy things like DominoÂ’s Pizza and Shell gasoline and make reservations through Yelp via the touchscreen in the vehicle. This is similar to GMÂ’s Marketplace, which it introduced at the end of 2017. This allows you to order from ApplebeeÂ’s, Starbucks, TGI Fridays, ExxonMobil, Wingstop, and even book travel on Priceline.com. And in keeping with the third company in the Detroit Three, Ford offers the Amazon Alexa App, which provides a variety of functions from controlling smart devices in oneÂ’s home to, for Amazon Prime members (of which there are estimated to be more than 100 million in the U.S.), ordering organic kale from Whole Foods. All through your dashboard. Earlier this year at the Mobile World Congress in Barcelona, BMW Group introduced “BMW Natural Interaction,” a system that combines voice, gestures and even gaze to interact with the vehicle.

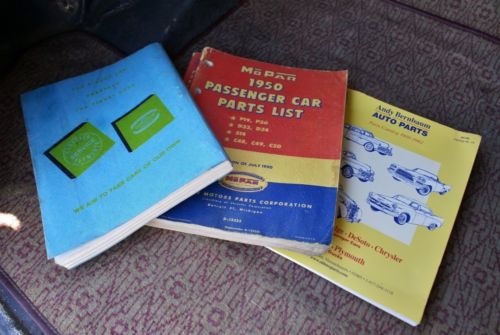

Mopar boss promoted at FCA, still runs Mopar

Thu, May 21 2015Fiat Chrysler Automobiles is appointing Pietro Gorlier as its new chief operating officer for components. The change in title is effective June 30 and means that he reports directly to Sergio Marchionne. He already runs Mopar globally. Gorlier is replacing Eugenio Razelli, who is leaving the automaker. Even with the new position, Gorlier continues to be the boss at Mopar and retains his seat on FCA's global executive council, which is the company's top decision-making group. This is essentially one more step up the ladder for the Turin-born executive. Gorlier became CEO of Mopar service, parts, and customer care for FCA US in 2009 and took over that role worldwide in 2011. FCA announces new appointment Fiat Chrysler Automobiles N.V. (NYSE: FCAU / MI: FCA) announced today that effective June 30, 2015, Pietro Gorlier is appointed Chief Operating Officer Components reporting directly to the Chief Executive Officer Sergio Marchionne. Mr. Gorlier will also retain his current responsibilities as Head of Parts & Service (MOPAR) and member of the Group Executive Council. Mr. Gorlier will succeed Eugenio Razelli, who elected to leave the Group after several years of dedicated service. "We extend our sincere appreciation to Eugenio for his leadership and contribution to the organization" said Sergio Marchionne. Pietro Gorlier is Head of Parts & Service (MOPAR) and a member of the Group Executive Council (GEC) since September 1, 2011. He joined the Group in 1989 in Iveco and held various positions in Logistics, After Sales, and Customer Care before joining the automobile business in 2006 in Network Development. He holds a Master of Economics from the University of Turin. London, 18 May 2015 Related Video: News Source: FCA Hirings/Firings/Layoffs Chrysler Fiat FCA fiat chrysler automobiles fca us