2014 Chrysler Other on 2040-cars

Gilman City, Missouri, United States

If you have any questions please email at: sarazin76@zoho.com .

Beautiful personal 2014 Chrysler 300 Limousine, 70"

33,900 miles

Elegant pearl white exterior

Rich tan and black interior

Mini bar with beautiful led mood lighting

Privacy divider with tv

DVD/CD player

Garaged

Chauffer driven

Serviced

New tires

Chrysler 300 Series for Sale

2015 chrysler 300 awd s-edition(US $13,000.00)

2015 chrysler 300 awd s-edition(US $13,000.00) 2006 chrysler 300 series(US $2,900.00)

2006 chrysler 300 series(US $2,900.00) 1958 chrysler 300 series(US $20,300.00)

1958 chrysler 300 series(US $20,300.00) 2015 chrysler 300 s(US $11,000.00)

2015 chrysler 300 s(US $11,000.00) 2014 chrysler 300 series limousine(US $26,100.00)

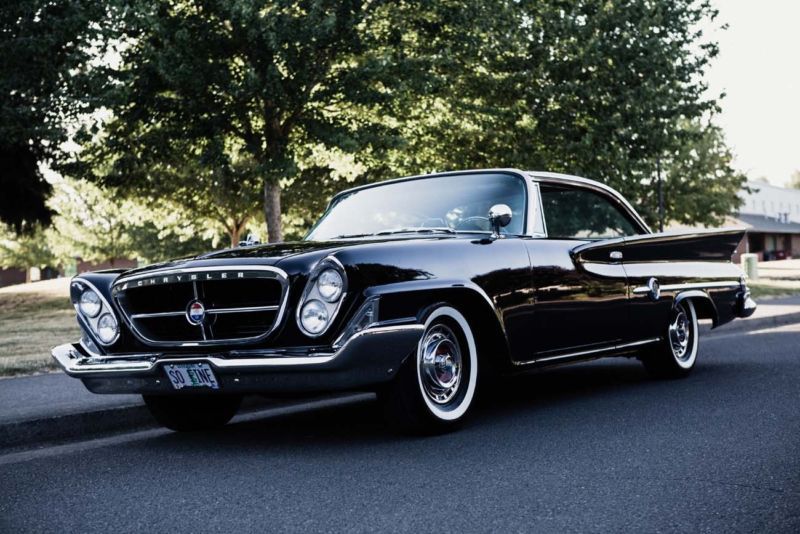

2014 chrysler 300 series limousine(US $26,100.00) 1961 chrysler 300 series 300g(US $19,175.00)

1961 chrysler 300 series 300g(US $19,175.00)

Auto Services in Missouri

Westport Service Center ★★★★★

Sterling Ave Auto Service ★★★★★

Santa Fe Glass Co Inc ★★★★★

Osage Auto Body ★★★★★

North West Auto Body & Service ★★★★★

Napa Auto Parts - Horn`S Auto Supply ★★★★★

Auto blog

Moon landing anniversary: How Detroit automakers won the space race

Fri, Jul 19 2019America's industrial might ó automakers included ¬ó determined the outcome of the 20th century¬ís biggest events. The ¬ďArsenal of Democracy¬Ē won World War II, and then the Cold War. And our factories flew us to the moon. Apollo was a Cold War program. You can draw a direct line from Nazi V-2 rockets to ICBMs to the Saturn V. The space race was a proxy war ¬ó which beats a real war. It was a healthy outlet for technology and testosterone that would otherwise be used for darker purposes. (People protested, and still do, that money for space should go to problems here on Earth, but more likely the military-industrial complex would've just bought more bombs with it.) As long as we and the Soviet Union were launching rockets into space, we were not lobbing them at each other. JFK¬ís challenge to ¬ďgo to the moon in this decade and do the other things, not because they are easy, but because they are hard,¬Ē put American industry back on a war footing. We were galvanized to beat the Russians, to demonstrate technological dominance. (A lack of similar unifying purpose is why we haven¬ít been to the moon since, or Mars.) NASA says more than 400,000 Americans, from scientists to seamstresses, toiled on the moon program, working for government or for 20,000 contractors. Antagonism was diverted into something inspirational. The Big Three automakers were some of the biggest companies in the moon program, which might surprise a lot of people today. Note to a new generation who marveled when SpaceX launched a Tesla Roadster out into the solar system: Sure, that was neat, but just know that Detroit beat Elon Musk to space by more than half a century. This high point in human history was brought to you by Ford It¬ís hard to imagine in this era of Sony-LG-Samsung, but Ford used to make TVs. And other consumer appliances. Or rather Philco, the radio, TV and transistor pioneer that Ford bought in 1961 ¬ó the year Gagarin and Alan Shepard flew in space. Ted Ryan, Ford¬ís archives and heritage brand manager, just wrote a Medium article on the central role Philco-Ford played in manned spaceflight. And nothing¬ís more central than Mission Control in Houston, the famous console-filled room we all know from TV and movies. What we didn't know was, that was Ford. Ford built that. In 1953, Ryan notes, Philco invented a transistor that was key to the development of (what were then regarded as) high-speed computers, so naturally Philco became a contractor for NASA and the military.

25,000 Jeep Grand Cherokee, Dodge Durango SUVs recalled over brake feel

Mon, 10 Mar 2014Chrysler has announced that it is recalling over 25,000 Jeep Grand Cherokee and Dodge Durango SUVs from several markets over concerns about brake feel under hard braking. The affected models are from the 2012 and 2013 model years, although the actual dates of production aren't available. 18,700 are in the US, while 825 are in Canada, 530 are in Mexico and a further 5,200 outside of North America.

According to a statement, Chrysler was informed of the issue by a component supplier for the Ready Alert Braking system, which primes the brakes in anticipation of an emergency stop. A component in the system was restricting the flow of brake fluid too much.

As Chrysler is quick to point out, the way the brakes functioned was in compliance with regulations and there are no reported cases of drivers losing braking power. Instead, the issue rests with what Chrysler calls a pedal feel that "was not consistent with customer expectations." So it would seem Chrysler is being proactive and fixing a problem not because there's a legal issue at work, but simply because it doesn't feel the way the manufacturer wants it to. Well done.

Italy reportedly guarantees $7.1 billion loan to Fiat Chrysler

Wed, Jun 24 2020ROME ó Italy has approved a decree offering state guarantees for a 6.3-billion euro ($7.1 billion) loan to Fiat Chrysler's (FCA)¬† Italian unit, a source said, paving the way for the largest crisis loan to a European carmaker. The source said Italy's audit court had signed off on the decree, in a final step of what had been a lengthy and contested process to get the loan approved. The court's approval follows an earlier endorsement by the economy ministry. "The audit court authorized the decree," said a source close to the matter, asking not to be named because of its sensitivity. FCA's Italian division has tapped Rome's COVID-19 emergency financing schemes to secure a state-backed, three-year facility to help the group's operations in the country, as well as Italy's car sector in which about 10,000 businesses operate, weather the crisis triggered by the coronavirus emergency. The loan will be disbursed by Italy's biggest retail bank Intesa Sanpaolo, which has already authorized it pending the approval of guarantees the government will provide on 80% of the sum through export credit agency SACE. The request for state support has sparked controversy because FCA is working to merge with French rival PSA and the holding for the Italian-American carmaker is registered in the Netherlands. FCA's global brands include Fiat, Jeep, Dodge and Maserati. It was not immediately clear what conditions, if any, Italy has set as part of the guarantees and whether they would affect FCA's planned 5.5 billion euro ($6.2 billion) extraordinary dividend, which is a key element in the merger with PSA. FCA, whose shares were down 0.5% by 0908 GMT, had no immediate comment. ¬† Earnings/Financials Chrysler Fiat Peugeot Italy