2010 Chrysler 300c Hemi on 2040-cars

1755 W Elm St, Lebanon, Missouri, United States

Engine:5.7L V8 16V MPFI OHV

Transmission:5-Speed Automatic

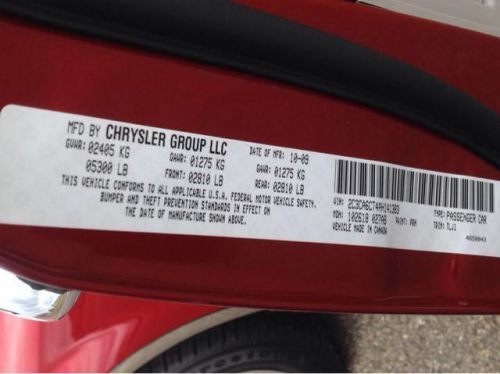

VIN (Vehicle Identification Number): 2C3CA6CT4AH141383

Stock Num: 141383

Make: Chrysler

Model: 300C Hemi

Year: 2010

Exterior Color: Inferno Red Crystal Pearlcoat

Interior Color: Dark Khaki / Light Graystone

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 59578

A Chrysler Certified Pre-Owned Vehicle,This 2010 Chrysler 300C is a beautiful,well maintained car, we have all the service records. Drives like new, come and test drive for yourself. At Graven Chrysler Dodge Jeep Ram, we offer Chrysler, Dodge and Jeep vehicles, along with used cars, trucks and SUVs. Our sales team will guide you along the way as you search for your dream car at our Lebanon, MO lot. We also offer a variety of additional services that include financial assistance, vehicle repair and a well-stocked inventory of OEM auto parts. We hope to hear from you soon!

Chrysler 300 Series for Sale

2014 chrysler 300 base(US $35,035.00)

2014 chrysler 300 base(US $35,035.00) 2008 chrysler 300 touring(US $10,865.00)

2008 chrysler 300 touring(US $10,865.00) 2013 chrysler 300 base(US $22,652.00)

2013 chrysler 300 base(US $22,652.00) 2011 chrysler 300 limited(US $22,663.00)

2011 chrysler 300 limited(US $22,663.00) 2009 chrysler 300 touring(US $20,300.00)

2009 chrysler 300 touring(US $20,300.00) 2012 chrysler 300c 300c(US $25,200.00)

2012 chrysler 300c 300c(US $25,200.00)

Auto Services in Missouri

West County Auto Body Repair ★★★★★

Villars Automotive Center ★★★★★

Tuff Toy Sales ★★★★★

T & K Automotive ★★★★★

Stock`s Underhood Specialist ★★★★★

Schorr`s Transmission, Auto & Truck Service ★★★★★

Auto blog

Chrysler Pacifica adds sixth trim level: Touring Plus

Thu, Apr 27 2017While some of us might not want to admit our fondness for the homely minivan, there's something about the Chrysler Pacifica that gets unlikely drivers giving it the up-and-down on the sly (speaking from experience, here). A year into its life, the kinda-cool people hauler is getting a sixth trim level, called Touring Plus, that falls about in the middle of the lineup. Slotting in above the Touring trim ($32,090), the $33,455 Touring Plus offers a number of visual and convenience upgrades, but retains the cloth seats (for leather, you'll still have to move up to the Touring L level, at $36,090). On the outside, it gets the mesh lower fascia and foglights shared with the higher trim levels, plus projector headlights and LED taillights. For comfort and convenience, it offers three-zone climate control, power liftgate, a universal garage door opener, and second- and third-row sunshades to give your kids the limo treatment. As an added bonus for Touring Plus customers who opt for the 18-inch wheels and the 8.4-inch Uconnect infotainment center, Chrysler will throw in the single overhead DVD player for free. If you were waiting for the "just right" Pacifica to become available, and this higher-content, cloth-seat version suits you just right, there's no need to wait. The Pacifica Touring Plus is available now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Related Gallery 2017 Chrysler Pacifica: First Drive View 35 Photos News Source: FCA Auto News Chrysler Minivan/Van chrysler pacifica

Junkyard Gem: 1979 Chrysler Cordoba

Thu, Oct 20 2016The original Cordoba personal luxury coupe, which debuted for the 1975 model year, was a big hit for Chrysler. Through the 1979 model year, it was based on the successful Chrysler B-Body platform, making it a sibling to the Dukes of Hazzard Charger and Governor Moonbeam's Plymouth Satellite sedan. I see a surprising number of Cordobas showing up in the self-service wrecking yards I frequent in California and Colorado, and this two-tone '79 showed up in a San Francisco Bay Area yard a while back. You could get the 1979 Cordoba with typical 1970s fuzzy-velour seats, but this one has the iconic Corinthian Leather of Ricardo Montalban fame. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Yes, soft Corinthian Leather! This one has just about every possible option, if we are to go by the information in the brochure. The vinyl landau roof and two-tone paint were for serious buyers only. This V8 is either a 318 or a 360, and we won't discuss the depressing power figures that you get with engines of the late 1970s. Worth restoring? Not in this kind of condition. Source of parts for other, more valuable B-bodies? Yes. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery Junked 1979 Chrysler Cordoba View 17 Photos Auto News Chrysler

You can own Don Draper's 1964 Imperial Crown Convertible

Tue, May 24 2016In AMC's Mad Men Jon Hamm's character may have been a jerk, but Don Draper's 1964 Imperial Crown Convertible is fantastic. One of just 922 droptop Imperials built for 1964, Draper's land yacht is up for auction as part of a broader sale of Mad Men props. Alongside stuff like Roger Sterling's Ray-Bans or Draper's copy of Dante Alighieri's Inferno, the big Imperial is the undisputed star of the show. According to the auction page, fewer than 200 exist today, meaning that even without its Hollywood provenance, this is an exceedingly rare vehicle. Under hood, there's a 413-cubic-inch V8 wedge mated up to a push-button, three-speed TorqueFlite automatic transmission. Typical of a big, 1960s luxury vehicle, the Imperial gets power steering, power brakes, and power windows. Even the roof is electric. Cosmetically, the auction site claims Draper's convertible was repainted once, 20 years ago, going from a "drab" Roman Dark Red to today's California Red. In the interior, the only change are new carpets. This isn't the first time Draper's Imperial has crossed the auction block. It sold at a Palm Springs auction in February 2015 for just $23,625, before a St. Louis dealership listed it on eBay for $39,900 less than a month later. That online listing has long since disappeared, so there's no telling if it actually sold or not before being listed as part of this latest auction. Regardless, with fewer than 1,000 made, fewer than 200 in existence, a credit on a critically acclaimed TV show, and a history of reasonable sale prices, this is one big, 1960s land yacht worth considering. The auction starts on June 1 and runs through June 15. Related Video: