Wheel Chair Van One Owner!! on 2040-cars

Woodburn, Oregon, United States

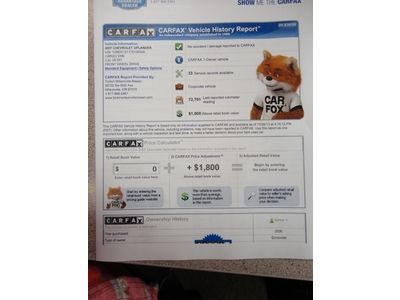

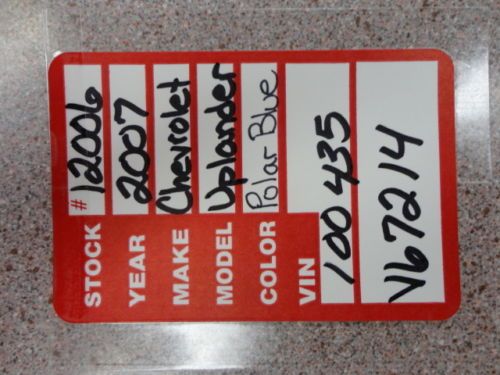

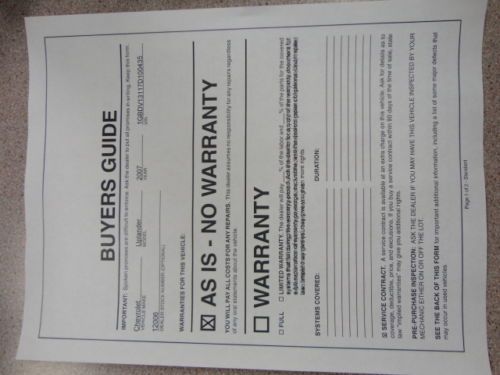

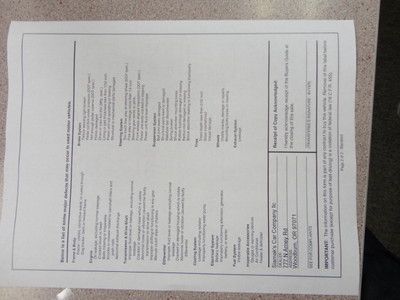

Chevrolet Uplander for Sale

2008 chevrolet uplander cargo very good condition with a lot of extra staff(US $7,000.00)

2008 chevrolet uplander cargo very good condition with a lot of extra staff(US $7,000.00) 2007 chevy uplander cargo van with shelves

2007 chevy uplander cargo van with shelves 2006 chevy uplander cargo van with shelves

2006 chevy uplander cargo van with shelves 2006 chevy uplander cargo van with shelves

2006 chevy uplander cargo van with shelves 2006 chevrolet uplander cargo mini van 3.5l 116.437mi(US $1,499.00)

2006 chevrolet uplander cargo mini van 3.5l 116.437mi(US $1,499.00) 2008 chevrolet uplander base mini cargo van 4-door 3.9l

2008 chevrolet uplander base mini cargo van 4-door 3.9l

Auto Services in Oregon

Zilkoski Auto Electric ★★★★★

Trifer Auto Glass & Window Tint ★★★★★

Stephenson Automotive ★★★★★

Salem Transmission Service ★★★★★

Ricks Quality Import Service ★★★★★

Richmond`s Service ★★★★★

Auto blog

GM profits threatened by glut of pickups

Wed, 05 Dec 2012Automotive News reports that General Motors may slash production or ramp up discounts in order to deal with an oversupply of pickup trucks. GM currently has more than double the standard supply of pickups, and the vehicles are threatening to dampen the automaker's profits for 2013. Typically, automakers try to sustain a 60- to 75-day supply of vehicles, but GM is currently loaded with a 139-day supply, as of last month. At the end of November, the automaker was sitting on 245,853 units.

The manufacturer says that it will adjust production accordingly before laying any incentives on the profitable pickups. Even so, there's some concern that the inventory swell could hurt the roll-out of the next-generation Chevrolet Silverado and GMC Sierra. GM actually began slowly stepping back production in August, but it's clear the company will take further action as it heads toward the end of the year and into the next. Analysts predict the automaker could reduce pickup manufacturing by nearly half in the first quarter of 2013.

That still may not be enough to keep GM from laying extra cash on the Silverado and GMC Sierra. While the company's incentive spending was down in November compared to the same month in 2011, both the Ram 1500 and Ford F-150 saw double-digit percentage increases in sales last month while the Silverado and Sierra numbers slid compared to a year prior. Incentive spending could help move more trucks and add some balance to the GM inventory surge.

Chevy monitors drivers' biometrics while experiencing new Corvette Stingray

Fri, 25 Oct 2013We tell you about what a car is like to drive every day, remarking on throttle response, steering weight and feedback, squat, dive, brake fade and a dozen or more other factors of performance. What we can't tell you, though, is what the car does to us - how its performance impacts us, physically. That's what makes this video series from Chevrolet so darn cool.

The Bow-Tie brand rented out Spring Mountain Motorsports Ranch, got several (very) different individuals together, strapped a bunch of sensors to their bodies to record biometric data ranging from heart rate to respiration to brain activity, and then handed them keys to the new Chevrolet Corvette Stingray. The results are explained in a series of videos, devoted to each driver, showing how different people react to the Corvette's performance.

If, like your author, you're a nerd for medical science, this is going to be a fascinating set of videos. If not, it's still pretty cool to see how the body of someone with racing experience, like Gran Turismo creator Kazunori Yamauchi, reacts to tracking a car like the Corvette Stingray compared to the owner of legendary Detroit barbecue joint, Slows BBQ. Take a look below for all six videos from the series, or hop over to the Corvette Vimeo channel for the interactive experience, where you can see all the different metrics.

GM, Ford, Toyota, Stellantis CEOs want EV tax credit cap lifted

Mon, Jun 13 2022For just over a decade now, the U.S. has had a federal tax credit worth up to $7,500 for buyers of electric cars and plug-in hybrids. The catch has been that, once 200,000 of them were claimed for a manufacturer, that credit would be phased out. Now, automakers are asking for this cap to be lifted across the board, specifically General Motors, Ford, Toyota and Stellantis. The request comes in the form of a joint letter to Congress (which you can read here), signed by the CEOs of each company. And the ask really is as simple as that. The automakers would like the cap lifted for all EV manufacturers, and instead have a sunset date for the tax credit put in place. Broadly speaking, they want it lifted because of concerns about rising costs from materials and supply chain issues, which can lead to higher prices and could discourage buyers from getting an EV. It would also put automakers back on an even playing field. GM reached its tax credit cap a few years ago, meaning that none of its EVs are eligible for the tax credit. So while it reaped the benefits early on, it now has something of a disadvantage to competitors with credits remaining, such as those that signed on to this letter. GM wouldn't be the only beneficiary. Tesla ran out of credits years ago, too. Nissan still has credits, but likely not for much longer, as InsideEVs reports around 190,000 Leafs have been sold in the U.S. as of April. So it will probably face a phase-out soon, just as the anticipated, and more expensive, Ariya is heading to market. Making this change would also seem like a good choice for continuing to stimulate EV sales, if that's what the government is looking to do. While EVs are now reaching parity in practicality and performance with gas-powered cars, having an additional financial incentive will surely keep them looking more attractive. And automakers can push EVs without fear of running out of credits early. Certainly some sorts of changes to the EV tax credit are likely. There are bills in the works focusing on cap changes as well as the amount of money available, and which vehicles are eligible. Credits up to $12,500 have been proposed, plus possible credits for used EV sales and restricting some credits to vehicles of certain price brackets. Of course, any changes will require some cooperation in a deeply divided Congress. Related Video: Government/Legal Green Chevrolet Chrysler Ford Toyota Electric EV tax credit