No Reserve Nr 2003 Chevy Trailblazer 4x4 Super Clean Runs Great Cold Ac Nice Suv on 2040-cars

Hampton, New Jersey, United States

Chevrolet Trailblazer for Sale

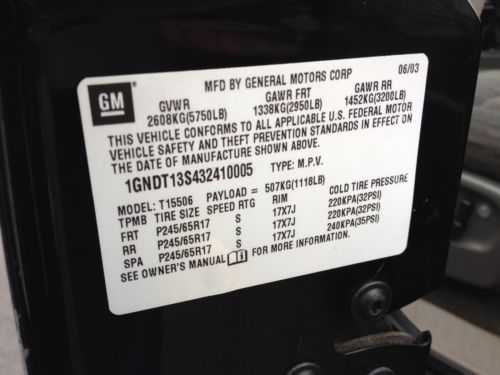

2003 chevrolet trailblazer lt 2wd suv automatic 6 cylinder no reserve

2003 chevrolet trailblazer lt 2wd suv automatic 6 cylinder no reserve 2003 chevy trailblazer ext, no reserve, one owner, no accidents, runs fine

2003 chevy trailblazer ext, no reserve, one owner, no accidents, runs fine Chevrolet trailblazer fleet w/1fl low miles automatic gasoline vortec 4.2l i6 sf

Chevrolet trailblazer fleet w/1fl low miles automatic gasoline vortec 4.2l i6 sf 74k miles clean car fax 6.0l awd(US $21,990.00)

74k miles clean car fax 6.0l awd(US $21,990.00) 2006 procharged supercharged trailblazer ss/lt awd with nitrous(US $27,000.00)

2006 procharged supercharged trailblazer ss/lt awd with nitrous(US $27,000.00) We finance 06 trailblazer ls 4wd 1 owner clean carfax cloth bucket seats 6cd(US $9,500.00)

We finance 06 trailblazer ls 4wd 1 owner clean carfax cloth bucket seats 6cd(US $9,500.00)

Auto Services in New Jersey

Woodland Auto Body ★★★★★

Westchester Subaru ★★★★★

Wayne Auto Mall Hyundai ★★★★★

Two Guys Autoplex 2 ★★★★★

Toyota Universe ★★★★★

Total Automotive, Inc. ★★★★★

Auto blog

'Tomorrowland' movie will advertise Chevy Volt, E-NVs

Fri, Mar 27 2015Before the 2016 Chevrolet Volt arrives at dealerships, it's going to come to a cineplex near you. The next-generation hybrid and the EN-V electric networked vehicle concept will play bit parts in the background of the upcoming Disney movie Tomorrowland starring George Clooney and Britt Robertson. Chevrolet will run digital and television ads around the movie's opening, which is May 22 in the US. The Bowtie and Disney tie-up is another in their years-long collaboration, going back to the revamped Test Track that opened at Epcot Center in 2012, and Chevolet is also the official vehicle of Shanghai Disney. The press release below has more on the movie and the Volt, the movie trailer is above – there's no Volt in it, but there is a late-model Buick. Chevrolet and Disney See Possibilities in 'Tomorrowland' Film to help kick off marketing efforts for next-generation Chevrolet Volt DETROIT, 2015-03-26 – At their core, Disney and Chevrolet are entities of optimism, believing that with a little ingenuity, anything is possible. They will come together in the new Disney film "Tomorrowland" to imagine the possibilities. The all-new 2016 Chevrolet Volt and EN-V concepts appear in the backdrops of the present day and Tomorrowland. The film's U.S. debut is May 22. In Disney's riveting mystery adventure "Tomorrowland," a jaded scientist and an optimistic teen embark on a danger-filled mission to unearth the secrets of an enigmatic place somewhere in time and space. "Tomorrowland is a place where nothing is impossible, which is something that Chevrolet believes can exist in the here and now," said Tim Mahoney, vice president, Global Chevrolet. "The Chevrolet spirit reflects the hopes and possibilities of tomorrow in real instruments of change for today like the next-generation Chevrolet Volt." The first marketing efforts for the 2016 Chevrolet Volt will be tied to Tomorrowland. A television spot and digital advertising will debut in early May. The all-new Volt is an electric car with extended range, showcasing a sleeker, sportier design that offers 50 miles of EV range, greater efficiency and stronger acceleration. The Volt's new, efficient propulsion system will offer an estimated total driving range of more than 400 miles. With regular charging, owners can expect to average more than 1,000 miles between gas fill-ups. Chevrolet and Disney have a long history of collaboration around the globe.

New Chevy Small Block crate engine has 405 hp, endless possibilities

Sat, Oct 3 2015With decades of history, the Chevrolet Small Block V8 has definitely stood the test of time, and the company has kept finding ways to make it better. At this year's SEMA Show in November, Chevy Performance is unveiling the latest upgrade to that legacy with the new ZZ6 350-cubic-inch (5.7-liter) crate engine. Offering 405 horsepower and 405 pound-feet of torque, the mill should add a big dose of power to any project car. For the ZZ6, Chevy is working to improve the Small Block's high-rpm performance. To make that happen, the engine has Fast Burn aluminum cylinder heads and an updated valvetrain inspired by the LS family of powerplants. Large intake runners help with the airflow, and the valve springs use a tapered design that allows for less reciprocating mass. The mill also packs a forged steel crankshaft and high-silicon aluminum pistons inside of a cast iron block. Chevy is offering the engine in two versions depending on what the builder needs. The Base configuration comes with an intake, distributor, water pump, and a few other parts but lacks carburetor and accessories. Conversely, the Turn Key option has everything, including the carb, air cleaner, starter, alternator, and more. More details about their availability will be announced at SEMA. NEW ZZ6 CHEVY SMALL BLOCK ADVANCES CRATE ENGINE LEGACY Revised Fast Burn heads with LS-inspired valvetrain enhance high-rpm performance 2015-10-02 DETROIT – Developed with contemporary technologies, including a high-rpm valvetrain, Chevrolet Performance's new ZZ6 crate engine offers builders a modern twist on the classic Chevy Small Block 350. It uses updated Fast Burn cylinder heads with beehive-style valve springs inspired by the LS engine family – a feature that enhances high-rpm capability, enabling the new high-performance engine to achieve 405 horsepower and 405 lb-ft of torque. That's more power than any factory produced 350 engine ever installed in a Chevrolet production vehicle and it's one of the most powerful 350 Small Block-based crate engines in the nearly 27-year history of the "ZZ" lineup. "The new ZZ6 is the ultimate ZZ 350-based crate engine from Chevrolet Performance," said Jim Campbell, GM U.S. vice president of Performance Vehicles and Motorsports.

GM Ultium tech can scavenge heat from everywhere, even you

Mon, Apr 25 2022GM likes to give us tidbits about its Ultium platform from time to time, and today it’s telling us about the platformÂ’s ability to capture waste heat from the propulsion system. In addition to capturing from the propulsion system, it can also capture humidity from both inside and outside the vehicle and even from passengersÂ’ body heat. Yes, you, your family and/or your friends are a usable heat source as far as GM EVs are concerned. It then deploys the heat in an advantageous way. If at this point, youÂ’re screaming, "Heat pump!" youÂ’d be right. WeÂ’re talking about an elaborate heat pump system that GM is using for its Ultium-based vehicles. Every Ultium-based GM vehicle gets this system that is covered by 11 patents and four publications. The waste heat it collects is used in a number of ways, but its primary use is to heat the cabin quickly and efficiently. GM claims it can heat the cabin of its Ultium-based vehicles quicker than vehicles with traditional internal combustion engines. Plus, when put to use, GM claims that using the heat pump provides its EVs with up to 10% more range than theyÂ’d have without. Beyond heating the cabin, the heat pump is capable of putting waste heat to use by preheating the battery prior to charging so that you can charge quicker. The system can even cool the propulsion system in preparation for Watts to Freedom (WTF) launch control starts. GM says this was vital in helping the Hummer EV achieve its bonkers 0-60 mph time of about 3 seconds. “Having a ground-up EV architecture gives us the freedom to build in standard features like UltiumÂ’s energy recovery capabilities,” said Doug Parks, GM executive VP of global product development, purchasing and supply chain. “This helps us squeeze more efficiency, performance and overall customer benefit out of our EVs.” GM says itÂ’s been developing heat pump technology since the EV1 and its heat pump. This is the modern evolution of that technology, and GM says itÂ’s going to be implemented in every Ultium-based vehicle as a standard feature. Related video: Green Cadillac Chevrolet GM GMC Technology Electric Future Vehicles