1966 Chevy Nova, Big Small Block, Pro Street Or Drag on 2040-cars

Redwood City, California, United States

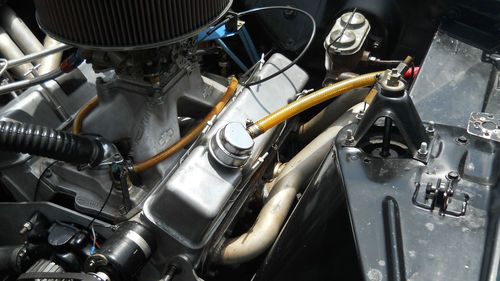

Engine:406 Big Small block

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Year: 1966

Interior Color: Blue

Model: Nova

Number of Cylinders: 8

Trim: Pro Street or Drag

Drive Type: Quick

Mileage: 1,000

Exterior Color: Blue

Chevrolet Nova for Sale

1966 chevy nova ss turbo muscle car hot rod(US $44,600.00)

1966 chevy nova ss turbo muscle car hot rod(US $44,600.00) Real ss, frame-off concourse restored matching numbers factory 4spd, pristine!(US $55,000.00)

Real ss, frame-off concourse restored matching numbers factory 4spd, pristine!(US $55,000.00) 1963 chevy nova, big small block, pro street or drag

1963 chevy nova, big small block, pro street or drag 1966 drag race pro street tube chassis tubbed fiberglass front clip 1700lbs l@@k

1966 drag race pro street tube chassis tubbed fiberglass front clip 1700lbs l@@k 1977 chevrolet nova rally coupe 2-door 5.0l(US $6,500.00)

1977 chevrolet nova rally coupe 2-door 5.0l(US $6,500.00) 1969 chevy nova project car

1969 chevy nova project car

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

Bring back the Bronco! Trademarks we hope are actually (someday) future car names

Tue, Mar 17 2015Trademark filings are the tea leaves of the auto industry. Read them carefully – and interpret them correctly – and you might be previewing an automaker's future product plans. Yes, they're routinely filed to maintain the rights to an iconic name. And sometimes they're only for toys and clothing. But not always. Sometimes, the truth is right in front of us. The trademark is required because a company actually wants to use the name on a new car. With that in mind, here's a list of intriguing trademark filings we want to see go from paperwork to production reality. Trademark: Bronco Company: Ford Previous Use: The Bronco was a long-running SUV that lived from 1966-1996. It's one of America's original SUVs and was responsible for the increased popularity of the segment. Still, it's best known as O.J. Simpson's would-be getaway car. We think: The Bronco was an icon. Everyone seems to want a Wrangler-fighter – Ford used to have a good one. Enough time has passed that the O.J. police chase isn't the immediate image conjured by the Bronco anymore. Even if we're doing a wish list in no particular order, the Bronco still finds its way to the top. For now (unfortunately), it's just federal paperwork. Rumors on this one can get especially heated. The official word from a Ford spokesman is: "Companies renew trademark filings to maintain ownership and control of the mark, even if it is not currently used. Ford values the iconic Bronco name and history." Trademarks: Aviator, AV8R Company: Ford Previous Use: The Aviator was one of the shortest-run Lincolns ever, lasting for the 2003-2005 model years. It never found the sales success of the Ford Explorer, with which it shared a platform. We Think: The Aviator name no longer fits with Lincoln's naming nomenclature. Too bad, it's better than any other name Lincoln currently uses, save for its former big brother, the Navigator. Perhaps we're barking up the wrong tree, though. Ford has made several customized, aviation themed-Mustangs in the past, including one called the Mustang AV8R in 2008, which had cues from the US Air Force's F-22 Raptor fighter jet. It sold for $500,000 at auction, and the glass roof – which is reminiscent of a fighter jet cockpit – helped Ford popularize the feature. Trademark: EcoBeast Company: Ford Previous Use: None by major carmakers.

2016 Chevy Equinox brings its revised face to Chicago

Thu, Feb 12 2015It's vital these days for automakers to keep up with the Jones' when in the crossover market. The segment is just too popular among buyers to let a vehicle waste away, and Chevrolet is giving the 2016 Equinox a slight refresh at the Chicago Auto Show to hopefully keep people interested. In reality, though, the CUV isn't too much different beyond a tweaked face and some interior improvements. The exterior now boasts a revised front fascia with a chrome-accented grille and projector beam headlights, and at the rear there are new taillights. Top -evel models get LED running lights, as well. Inside, the Equinox features a standard seven-inch touchscreen infotainment system with a backup cam, and for added safety, the CUV is now available with rear cross traffic and blade zone alert on some trims. Beyond these updates, the powertrains carry over entirely from before with the choice between a 2.4-liter four-cylinder and a 3.6-liter V6. These refreshed 2016 models go on sale this fall. Related Video:

GM announces $7 billion Michigan factory investment, most going to EVs

Tue, Jan 25 2022GM announced a $7 billion investment in Michigan manufacturing, much of which is earmarked for EV production. Four sites are included, but the key elements are a new battery cell plant in Lansing and the conversion of GM's existing Orion Township facility to expand production of the forthcoming Chevrolet Silverado EV and its GMC Sierra sibling. GM says it is the largest investment announcement in company history and that it will create 4,000 new jobs. It also says 1,000 jobs will be retained. "We are building on the positive consumer response and reservations for our recent EV launches and debuts, including the GMC Hummer EV, Cadillac Lyriq, Chevrolet Equinox EV and Chevrolet Silverado EV," said GM CEO Mary Barra. GM says the Orion expansion and new battery plant will support an increase in full-size electric truck production capacity to 600,000 units. This is in addition to the Factory ZERO facility in Detroit that will also be constructing the electric Silverado and Sierra. The Orion Township factory current builds the Chevrolet Bolt EV and EUV, and will continue to do so during the plant's conversion. GM did not indicate what will happen with the Bolts once that conversion is complete or whether all will continue to be built at Orion. They do not use the Ultium vehicle architecture. GM will build other EV models at three other factories that are under construction or being converted. They are located in Spring Hill, Tennessee, Ingersoll, Ontario, and Ramos Arizpe, Mexico. GM says that it will have the ability to produce 1 million electric vehicles by 2025. The Ultium Cells Lansing facility is a $2.6 billion joint investment by GM and LG Energy Solution. GM says it alone will create 1,700 jobs once fully operational by late 2024. It will join two other GM Ultium Cells battery factories currently under construction in the United States, one in Ohio and the other in Tennessee. Not all of the $7 billion investment will be for EVs. It also announced $510 million of the total will go toward upgrading the Lansing Delta Township Assembly to produce the next-generation Chevrolet Traverse and Buick Enclave. Money will also go to upgrading Lansing Grand River Assembly.