1970 Chevrolet El Camino Ss Hot Rod At Bigboyztoyz69.com on 2040-cars

Magnolia, Ohio, United States

Chevrolet El Camino for Sale

Nice black cherry paint, 350ci small block, a/c, very clean el camino(US $21,995.00)

Nice black cherry paint, 350ci small block, a/c, very clean el camino(US $21,995.00) 1970 chevrolet el camino 350 v-8 with blower!(US $18,000.00)

1970 chevrolet el camino 350 v-8 with blower!(US $18,000.00) 1970 70 chevy el camino ss pro touring resto mod beautifully done well over 60k(US $46,900.00)

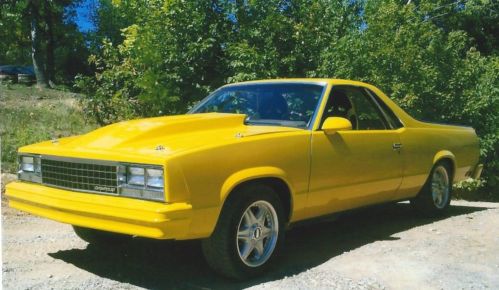

1970 70 chevy el camino ss pro touring resto mod beautifully done well over 60k(US $46,900.00) 1986 el camino hot rod

1986 el camino hot rod 1970 chevrolet el camino 2-door 7.4l

1970 chevrolet el camino 2-door 7.4l 1959 el camino this is a driver

1959 el camino this is a driver

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Chevy's Android Auto update will reach cars in March

Fri, Sep 25 2015Buying a new Chevy with the hopes of using Android Auto during your daily commute? You'll have to sit tight for a while before that dream becomes reality. The carmaker announced that an Android Auto software update will only reach its 2016 model-year vehicles next March, starting with those that have 8-inch MyLink touchscreen systems. That's going to be a long half-year wait if you're eager to get Google Maps directions through the center stack. The good news? Chevy is promising that all vehicles with 7- and 8-inch MyLink displays (ranging from the Spark to the Corvette) will eventually have Android Auto, so you won't have to drive one of the brand's swankier machines to get a smartphone-powered infotainment deck. This article by Jon Fingas originally ran on Engadget, the definitive guide to this connected life. Related Video:

Ford Mustang chief engineer, mid-engine Corvette | Autoblog Podcast #488

Fri, Sep 16 2016Note: There were some technical difficulties that prevented some of you from downloading this week's podcast. The player and link below should be working now, and the file has reached iTunes and other feeds as well. Thanks to everyone who wrote in to let us know of the issues! On the podcast this week, we have some questions for Ford Chief Engineer Carl Widman. Plus, Associate Editor Reese Counts joins Mike Austin to talk about the latest news, most notably the spy photos of the upcoming mid-engine Corvette. We also chat about the Jaguar F-Type Coupe, the Nissan Armada, and why 0-60 mph is a stupid performance figure. And, of course, we get into some Spend My Money advice, telling strangers what car to buy. And new this week is a cost-no-object what-cars-would-you-buy game. The rundown is below. And don't forget to send us your questions, money-spend or otherwise, to podcast at autoblog dot com. Autoblog Podcast #488 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Mid-engine Chevrolet Corvette spied Chevy Bolt EV comes with 238 miles of range Ford will sell self-driving cars by 2025 Jaguar F-Type Coupe 2017 Nissan Armada (yes, Mike knows it's not a Patrol) Ford Mustang Chief Engineer Carl Widman interview Spend My Money - we give purchase advice Why 0–60 mph is a stupid performance test Rundown Intro - 00:00 The news - 03:30 What we've been driving - 16:20 Carl Widman - 26:44 Spend my money - 37:03 New fun game - 51:48 0–60 mph is overrated - 56:50 Total Duration: 1:04:57 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Chevrolet Ford Jaguar Nissan Car Buying nissan armada mid-engine corvette jaguar f-type coupe

GM's Oshawa plant may close after Camaro production moves

Sat, Feb 7 2015Most of the time, when vehicle production is moved from one assembly plant to another, it spells bad news for the former. While General Motors won't go so far as to say its Oshawa, Ontario factory, which is losing the Chevrolet Camaro to the Lansing Grand River plant, is in trouble, analysts seem to think the factory's days are numbered. Forecasts for the facility are far from positive. The loss of the Camaro this year, combined with GM's targeted shutdown of a single-shift assembly line responsible for the fleet-only Chevy Impala Limited and the Equinox crossover is a bad enough omen. But with AutoForecast Solutions CEO Joe McCabe telling The Detroit News that the plant's other two products, the Cadillac XTS and Buick Regal, aren't likely to stick around beyond 2017, things look decidedly grim at Oshawa. "There is a fairly strong chance that the plant could close," Jeff Schuster, senior VP of forecasting for LMC Automotive, told The Detroit News. That doesn't mean that Unifor, Canada's auto union, and the Canadian government are going to let the factory die without a fight. And with the latter chipping in $10 billion as part of GM's 2009 bailout, you might think it has a degree of leverage in the situation. A meeting between the government and the Detroit Three at the 2015 North American International Auto Show revealed that Oshawa is already a topic of conversation. "We made it very clear that we would like to see an indication on the future of Oshawa sooner, in particular because the timing is very challenging for our supply chain to be able to adjust to potentially future orders or changes, but also to know that there are going to be future opportunities at Oshawa," Ontario's Minister of Economic, Development, Employment and Infrastructure Brad Duguid told The Detroit News. "Bottom line: It's time they made a longer-term commitment here," Unifor President Jerry Dias said, echoing Duguid's statements. It's unclear if this sort of strong talk will be enough to save 3,300-plus employees, although based on the analysts' forecasts, we doubt it.