on 2040-cars

mississauga, Ontario, Canada

|

Chevrolet Caprice for Sale

1974 caprice classic convertible survivor !! looks,runs and drives excellent !!!

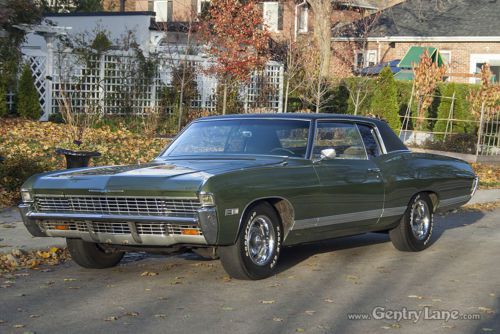

1974 caprice classic convertible survivor !! looks,runs and drives excellent !!! 1969 chevrolet caprice base hardtop 4-door 5.7l

1969 chevrolet caprice base hardtop 4-door 5.7l 1994 chevrolet impala ss wagon custom. lt1 corvette engine florida rust free.(US $12,995.00)

1994 chevrolet impala ss wagon custom. lt1 corvette engine florida rust free.(US $12,995.00) 1996 chevrolet caprice classic only 53k miles white michelins no reserve l@@k

1996 chevrolet caprice classic only 53k miles white michelins no reserve l@@k 1968 chevy caprice restoration project, minimum input for maximum output

1968 chevy caprice restoration project, minimum input for maximum output 1992 chevrolet caprice base sedan 4-door 5.0l(US $2,200.00)

1992 chevrolet caprice base sedan 4-door 5.0l(US $2,200.00)

Auto blog

GM sweetens military discount for Buick, Chevy and GMC

Sun, 06 Oct 2013American servicemen and women interested in a new vehicle from Chevrolet, Buick or GMC now have a bit more incentive to head down to their local dealer, as General Motors has announced plans to improve its military discount program.

The new GM Military Discount Program offers eligible consumers a new Chevy, Buick or GMC at invoice pricing, which in some cases can take very large chunks out of a car's retail price. When factored in with other incentives, most of which are available with the Military Discount, the bargains are thick on the ground for members of the US armed forces.

GM's Retail Sales and Marketing Support general manager, Chuck Thomson, said, "GM has long supported the military and military families, and we hope this simplified and enhanced discount will show our appreciation for their service and help make it easier for them to own one of our great new vehicles." The program is open to all active duty and reserve members in the Army, Navy, Marines, Air Force, National Guard and Coast Guard, as well as veterans that have been out of the service for less than a year. Military retirees and their spouses are also eligible for the discount.

UAW rejects GM contract proposal but makes a counter offer

Tue, Oct 1 2019The United Auto Workers union said a new comprehensive offer made by General Motors Co late Monday to end a two-week-old strike was not acceptable and said it had made a new counterproposal. UAW¬†vice president Terry Dittes said in a letter to members "there are many important issues that remain unresolved." The union is awaiting GM's next proposal. He said GM's offer came up short on many issues.¬† Dittes said GM made a "comprehensive proposal" at 9:40 p.m. Monday. "This proposal that the company provided to us on day 15 of the strike did not satisfy your contract demands or needs. There were many areas that came up short like health care, wages, temporary employees, skilled trades and job security to name a few." Dittes is the union's vice president for GM relations and the UAW's lead negotiator in these contract talks. "We have responded today with a counterproposal and are awaiting GM's next proposal to the union," he wrote. "Regardless of what is publicized in print or social media, etc., there are still many important issues that remain unresolved." The strike, in its third week, has cost GM more than $1 billion, according to J.P. Morgan analyst Ryan Brickman. He said the cost per day in potential profit is $82 million. However, another analysis, by East Lansing-based consultant Anderson Economic Group, put the losses at $25 million a day. And the effects of the strike are expanding. GM said Tuesday the strike has created a parts shortage that forced the automaker to halt production at its pickup and transmission plants in Silao, Mexico, temporarily laying off 6,000 workers. Silao is where GM builds its highly profitable four-door crew cab Chevy Silverado and GMC Sierra pickups. The strike has also forced GM to idle some Canadian workers, and many suppliers have been forced to halt operations. About 48,000¬†UAW¬†members went on strike on Sept. 16 seeking higher pay, greater job security, a bigger share of the leading U.S. automakerís profit and protection of their healthcare.¬†

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT ó General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.