1969 Camaro Z28 Real X77 302 Dz Cross Ram 4 Speed Jl8 on 2040-cars

Milford, Connecticut, United States

Body Type:Coupe

Engine:8

Vehicle Title:Clear

Interior Color: Other

Make: Chevrolet

Model: Camaro

Warranty: Vehicle does NOT have an existing warranty

Mileage: 67,090

Sub Model: Z28

Number of doors: 2

Exterior Color: Other

Inspection: Vehicle has been inspected (include details in your description)

Chevrolet Camaro for Sale

Auto Services in Connecticut

West Springfield Auto Parts ★★★★★

Monro Muffler Brake & Service ★★★★★

M K Auto Body Inc ★★★★★

Lia Volkswagen of Enfield ★★★★★

Jensen Tire & Automotive ★★★★★

Goodyear Tire & Service Network ★★★★★

Auto blog

Stop-start standard in four-cylinder 2015 Chevrolet Impala

Fri, May 23 2014Chevrolet has announced that it will include stop-start technology as standard in the entry level 2015 Impala. The result is a nearly five-percent improvement in city fuel economy, also known as one mile per gallon, up to 25 mpg, combined. The 3.6-liter V-6 Impala will not feature stop-start. The 2015 Impala comes equipped with Chevrolet's 2.5-liter Ecotec four-cylinder engine, which will also offer 22 mpg in the city, and 31 on the highway. The 3.6-liter V-6 Impala will not feature stop-start and the mild-hybrid eAssist model from the 2014 MY, which got 29/25/35 combined/city/highway mpg, has been discontinued. Chevrolet spokesman Chad Lyons told Green Car Reports that not even one percent of the 2014 Impalas purchased were the Eco model. So Chevy is trying something different. With a seamless driving experience in mind, the new Impala's stop-start tech features software that governs under what conditions the feature will activate. The engine won't shut off if the car has not reached a speed of six miles per hour, so the start-stop won't be cycling during traffic jams. It can also fire the starter even if the engine has not come to a full stop, which quickens reaction time, particularly in instances of what Chevrolet calls "change-of-mind events." The stop-start function uses information about cabin temperature and humidity as well as battery charge to help determine whether or not to shut off the engine. The 2015 Impala has been engineered to reduce NVH, which will also help create a smoother stop-start experience for occupants, Chevy says. Motor mounts have been updated, and a burlier starter motor will help restart the engine after a stop. The Impala follows the 2014 Malibu as Chevrolet's second vehicle to feature stop-start tech. The four-cylinder model currently makes up over 30 percent of Impala sales. The 2015 Impala will be available beginning this summer, with a base MSRP of $27,735 (including destination charges). And while one MPG isn't a huge difference, neither is the price increase of just $50 for a bit of eco-minded innovation. Read on for more details in the press release below. Chevrolet Makes Stop/Start Standard in 2015 Impala Technology improves city fuel economy by 5 percent 2014-05-22 DETROIT – Stop/start technology will be standard on the 2015 Impala base 2.5-liter ECOTEC® engine, an addition that improves the vehicle's city fuel economy by nearly 5 percent, or one mile per gallon.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2016 Chevrolet Malibu Hybrid: 48 mpg for $28,645

Thu, Dec 10 2015With the 2016 Chevrolet Malibu Hybrid, General Motors wants to show it's as serious about mainstream hybrids as it is about mainstream midsize sedans. Keeping with the theme, Chevy announced the Malibu Hybrid will have a serious price tag of $28,645. Chevy said Thursday the 2016 Malibu Hybrid will go on sale in the spring, with that price also including an $875 destination charge. That's about $3,000 more than where the Ford Fusion Hybrid kicks off, and about $2,000 more than a Toyota Camry Hybrid LE. The big news being pushed with the Malibu Hybrid, however, is the fuel economy. GM says it's capable of 48 miles per gallon city and 45 highway, for a combined rating of 47 mpg. That's better than any other 2016 midsize hybrid sedan. Power comes from a 1.8-liter gasoline engine and an electric motor with a 1.5-kWh lithium-ion battery, producing 182 combined horsepower. That's competitive with both the Camry and Fusion. Chevy also likes to say it's roughly the same system as the one installed in the 2016 Volt – although with a smaller battery, larger gas engine, and without the plug – so the Malibu Hybrid has that halo effect going for it. With both this Malibu and 2016 Toyota Prius, there's a lot of activity around gas-electric hybrids amid lowering fuel prices and a raft of plug-ins and full-electrics. The gas-only 2016 Malibu was found to be, "at least good again," so the 2016 Malibu Hybrid should be able to attract those who want a competent midsize sedan with excellent fuel economy that awaits EPA verification. We'll go with that thought until we get to drive it. Related Video: NEXT-GEN CHEVROLET MALIBU HYBRID LT STARTS AT $28,645 Projected to offer 48 MPG city using technologies borrowed from Volt DETROIT – The 2016 Chevrolet Malibu Hybrid LT, which achieves a General Motors'-estimated 48 mpg city, will be available this spring with a starting price of $28,645. "The Malibu leverages knowledge and technology directly from the second-generation Chevrolet Volt," said Steve Majoros, marketing director of Chevrolet Cars and Crossovers. "By leveraging technology, we are broadening our level of expertise and lessons learned to bring consumers a world-class hybrid." With an all-new, hybrid powertrain that uses a slightly modified drive unit and electric motors used in the 2016 Chevrolet Volt, the Malibu Hybrid offers a GM-estimated 48 mpg city, 45 mpg highway – and 47 mpg combined, unsurpassed in the midsize car segment. Official EPA estimates are pending.

2000 chevy camaro ss. slp performance. loaded. six speed. low miles.clean!

2000 chevy camaro ss. slp performance. loaded. six speed. low miles.clean! 1972 chevrolet camaro

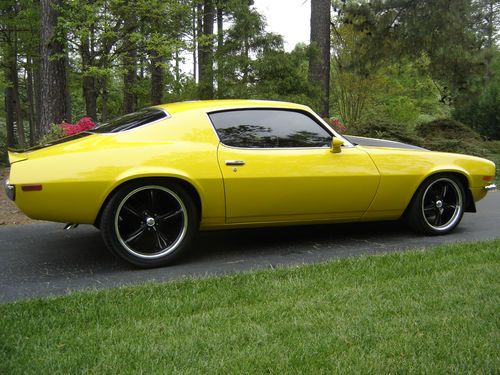

1972 chevrolet camaro 1970 camaro

1970 camaro 1990 camaro rs convertible loaded

1990 camaro rs convertible loaded 1969 chevy camaro rs/ss

1969 chevy camaro rs/ss 1977 z-28

1977 z-28