1968 Chevrolet Camaro Rs on 2040-cars

Spring, Texas, United States

Body Type:Coupe

Engine:327

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Camaro

Trim: RS

Drive Type: 4 SPEED

Mileage: 99,999

Exterior Color: Blue

Disability Equipped: No

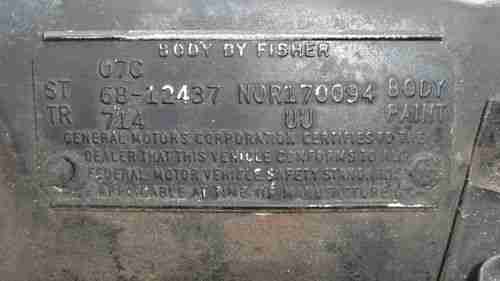

1968 CHEVROLET CAMARO RS L30/M20 NUMBER MATCHING PROJECT CAR.

Chevrolet Camaro for Sale

1968 6 cylinder automatic chevrolet camaro

1968 6 cylinder automatic chevrolet camaro 1999 chevrolet camaro convertible(US $12,000.00)

1999 chevrolet camaro convertible(US $12,000.00) 2011 used 6.2l v8 16v automatic rwd coupe onstar premium(US $29,981.00)

2011 used 6.2l v8 16v automatic rwd coupe onstar premium(US $29,981.00) 1986 chevrolet camaro z28 coupe 2-door 5.0l 373 posi rearend

1986 chevrolet camaro z28 coupe 2-door 5.0l 373 posi rearend 2ss leather, rs package, automatic, sunroof, boston acoustics sound, bluetooth,

2ss leather, rs package, automatic, sunroof, boston acoustics sound, bluetooth, 2002 chevrolet camaro ss convertible 2-door

2002 chevrolet camaro ss convertible 2-door

Auto Services in Texas

Zoil Lube ★★★★★

Young Chevrolet ★★★★★

Yhs Automotive Service Center ★★★★★

Woodlake Motors ★★★★★

Winwood Motor Co ★★★★★

Wayne`s Car Care Inc ★★★★★

Auto blog

Dodge vs. Chevy tug-of-war taken to the extreme

Mon, 17 Dec 2012They say "idle hands are the devil's playground," but said playgrounds grow to Disney-sized proportions when a pair of jacked-up trucks, two egos, a chain and an empty mall parking lot are involved. Proof of this is the video below, which shows a Cummins-powered Dodge Ram circa 2006 to 2008 chained tail-to-tail with what looks to be a gasoline-powered Chevrolet Silverado from the late 1990s or early 2000s.

We don't necessarily have to tell you who wins this battle, but we'll let you see for yourself the lengths the "winning" driver goes to prove his point. There's plenty of foul language in the video below, so beware that this might be Not Safe For Work, and not that we should have to tell you, but please, do not try this at home.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM CEO Barra says 'we are selling every truck we can build'

Tue, Jun 14 2022DETROIT — General Motors Chief Executive Mary Barra said on Monday the automaker is "selling every truck we can build" and expanding North American truck-building capacity, even as U.S. gasoline prices hit record highs. Barra made her comments during the automaker's annual shareholder meeting. GM is pursuing a two-track strategy: Investing heavily in electric vehicles for North America, China and other markets, and funding those investments by trying to maximize profits from its North American combustion pickup truck and large SUV lineups. Barra said GM is planning higher-priced versions of its Silverado large pickup and its large SUV models. GM and its Detroit rivals Ford Motor Co and Stellantis NV rely heavily on sales of large pickup trucks and SUVs for global profits. High U.S. gasoline prices in the past have undermined consumer demand for relatively inefficient models. Nominal pump prices hit an average of above $5 a gallon for the first time ever last week, the federal government said Friday. GM is ramping up production of EVs. Barra said the Cadillac Lyriq electric sport utility is sold out through 2023. In response to shareholder questions, Barra said the "clear priority" for using cash generated by its operations is to "accelerate our EV plans." She did not rule out share buybacks or other approaches to returning cash to shareholders. GM still expects to increase production this year by 25-30%, despite continuing pressure on semiconductor supplies globally. Barra said GM is working to redesign vehicles to reduce the number of processors required by 95%. Barra serves as GM's board chair and CEO. GM shareholders overwhelmingly rejected a proposal to separate those roles.