|

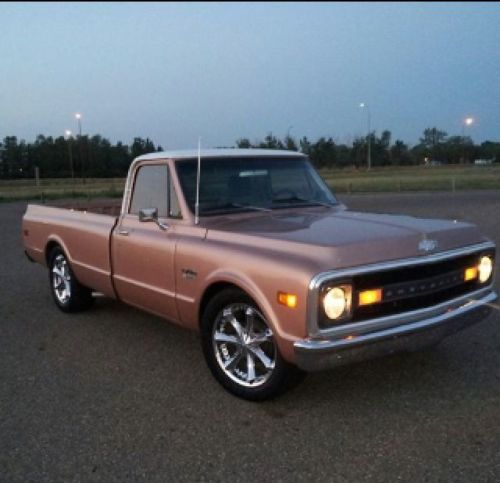

Up for auction is a 68 chevy truck 350 engine in running condition th400 transmission, transmission has problems it will only go reverse no forward. Paint in good condition BUYER IS RESPONSIBLE FOR PICK UP IF YOU DONT HAVE THE FUNDS TO PAY FOR IT PLEASE DONT BID!!

Truck is located in N. Long beach Deposit of $500.00 is require within 48 hours after auction ends On Jan-22-14 at 08:32:10 PST, seller added the following information:truck is a long bed and tires are 275/55 R20 with about 40% life left. |

Chevrolet C-10 for Sale

** patina ** shop truck ** c10 **(US $13,950.00)

** patina ** shop truck ** c10 **(US $13,950.00) Great running c-10, 307ci motor, a/c, newer chevy bed, front discs(US $19,995.00)

Great running c-10, 307ci motor, a/c, newer chevy bed, front discs(US $19,995.00) C-10 c10 chevy truck pro touring regular cab long box

C-10 c10 chevy truck pro touring regular cab long box 1967 chevrolet c-10 custom/10 ..one of the best you will find . my show truck ..

1967 chevrolet c-10 custom/10 ..one of the best you will find . my show truck .. 1968 chevy c/10 truck - numbers matching

1968 chevy c/10 truck - numbers matching 1965 chevy c10 pickup truck original

1965 chevy c10 pickup truck original

Auto blog

Chevy Camaro is a good sport, wishes Ford Mustang Happy 50th

Tue, 15 Apr 2014It was 1966 when Chevrolet launched its challenger to the wildly successful Ford Mustang, the Camaro. While the competition between the two brands was already healthy, the arrival of the Camaro set off one of the most intense, model-to-model rivalries in the industry.

That competitive spirit hasn't stopped Chevy and the Camaro from wishing Ford's iconic muscle car a Happy 50th Birthday as the Ford's April 17 anniversary rolls around. These two cars have been linked over the years, and while the rivalry took a break for a few years in the 2000s, today's competition between the Camaro and Mustang is as fierce as it's ever been.

You might recall that this friendliness when it comes to major milestones isn't too rare. Ford put on quite a display for General Motors' hundredth anniversary back in 2008. As the Camaro's fiftieth birthday approaches in 2016, we wouldn't be surprised to see the Mustang sending its best wishes to its Bowtie rival.

2016 Chevrolet Colorado Diesel First Drive [w/video]

Tue, Oct 6 2015The first thing you notice inside the diesel Chevy Colorado is that it's quiet. Almost too quiet. A lot has been done to quell noise and vibration with this new powertrain, and it shows – or rather, doesn't. There's some characteristic diesel clatter at idle, but even then it's distant and practically disappears as you start moving down the road. At full throttle, when the engine is at its noisiest, the sound isn't particularly diesel-like, just a pleasant intake breath. The accompanying smoothness is almost eerie. When we ask where all the noise went, Chevy's engineers, marketing guys, and PR reps all explain that this refinement is what Americans want. We're still not sure. This is a truck, after all, and the diesel pickup customer is different from the guy buying a diesel Cruze for his highway commute. Chevy contends that they're also not the same as the buyer of a Silverado HD. Although this 2.8-liter Duramax four-cylinder has been in service elsewhere around the globe, its first US application is in the Colorado and its GMC Canyon twin. The engine puts out 181 horsepower and 369 pound-feet of torque, and it does so unobtrusively as a result of a lot of modifications for our market. To keep normal diesel sensations out of the cabin, the intake and oil pan both get acoustic treatments. A new, thicker material is used for firewall sound deadening. Redesigned balance shafts have tighter tolerances to increase smoothness. The diesel powertrain is smoother than the Colorado's gasoline V6. One of the more interesting and certainly unexpected vibration-reduction changes is a special torque converter from German supplier LuK equipped with a centrifugal pendulum absorber. This pendulum spreads from the center of the torque converter as engine speed increases and is tuned to absorb the four-cylinder's second-order vibrations, not just those in a narrow frequency band. It does an admirable job, especially considering the engine's biggish, 0.7-liter cylinders, which lead to bigger vibrations. The result is a powertrain that's smoother than GM's (not particularly smooth) corporate V6, which is available in the standard Colorado. It's quieter than a Cruze diesel and even out-softens some gas direct-injection engines on the market. Paradoxically, it may be the most refined of all of the Colorados. No vibration comes through the steering wheel, pedals, floorboards, or even the rearview mirror. But you can tell it's a diesel when you hit the throttle.

GM executive chief EV engineer says reducing cost of plug-in vehicles is 'huge priority'

Mon, Mar 17 2014As we know, another major automaker investing heavily in electrified vehicles is General Motors, and it's doing things much differently than rivals BMW, Ford or Nissan. The Chevrolet Volt extended-range EV is a modest seller at its $35,000 sticker price but a huge hit with owners. The Chevy Spark BEV, still in limited availability, puts smiley faces on its owners and drivers. The just-introduced Cadillac ELR, a sharp-looking, fun-driving $76,000 luxocoupe take on the Volt's EREV mechanicals, has admittedly low sales expectations. With this interesting trio in showrooms and much more in the works, the third vehicle electrification leader I collared for an interview at Detroit's North American International Auto Show (see #1 and #2) was Pam Fletcher, GM's executive chief engineer, Electrified Vehicles. ABG: Why do your EREVs need four-cylinder power to extend their range when BMW's i3 makes do with an optional 650 cc two-banger? "We designed [the Volt and the ELR] to go anywhere, any time" - Pam Fletcher PF: I get that question all the time: why not something smaller? You don't really need that much. You use the electric to its ability, then you just need to limp. But we designed those cars to go anywhere, any time, and we don't want their performance to be compromised. If you're driving through the mountains, we don't want you to be crawling up grades, or to be limited on any terrain. So it's optimized to be able to travel literally the biggest grades and mountain roads around the globe at posted speeds. Because what if you can't? Another good reason: when the engine is on, you have to run it wide open throttle, max speed, most of the time. And while we can do a lot with acoustics, and the ELR has active noise cancelation, a small-displacement, low cylinder-count engine at high speed, high load all the time isn't something you want to live with. That's how we came up with the balance we did among the key factors of performance, NVH [noise, vibration and harshness] and range. ABG: Where you go from here? Is the range-extender engine due for an update? PF: We know and love the current Volt, and there is still a lot of acclaim about it, so we think it's a good recipe. But we are heavily in the midst of engineering the next-generation car, which I think everyone will love and be excited about.