1998 Chevrolet Blazer Ls Sport Utility 4-door 4.3l on 2040-cars

Cincinnati, Ohio, United States

Engine:4.3L 262Cu. In. V6 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Transmission:Automatic

For Sale By:Private Seller

Body Type:Sport Utility

Make: Chevrolet

Mileage: 125,043

Model: Blazer

Exterior Color: Black

Trim: LS Sport Utility 4-Door

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 4WD

Number of Cylinders: 6

Disability Equipped: No

Chevrolet Blazer for Sale

1984 chevrolet s10 blazer tahoe sport utility 2-door 2.8l(US $4,900.00)

1984 chevrolet s10 blazer tahoe sport utility 2-door 2.8l(US $4,900.00) 1983 chevrolet chevy k5 blazer diesel 4x4 auto very rare good shape daily driver

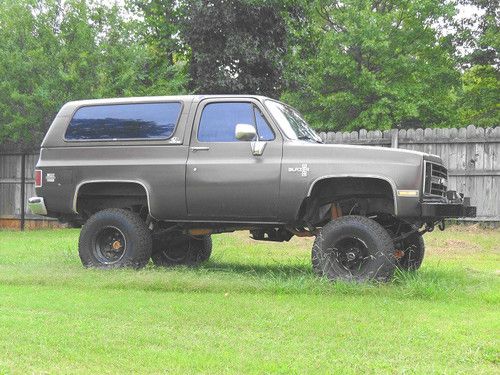

1983 chevrolet chevy k5 blazer diesel 4x4 auto very rare good shape daily driver 1986 chevy, k10,k5, blazer, brown, 350, 4x4, suburban,(US $3,000.00)

1986 chevy, k10,k5, blazer, brown, 350, 4x4, suburban,(US $3,000.00)

2002 chevy blazer 4 door only 24k! like brand new!(US $7,995.00)

2002 chevy blazer 4 door only 24k! like brand new!(US $7,995.00) 2005 chevy blazer zr2 off road 54k miles ***no reserve***

2005 chevy blazer zr2 off road 54k miles ***no reserve***

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Officially Official: Chevrolet replaces Daewoo name in Korea

Thu, 20 Jan 2011

Chevrolet Camaro in Korea - Click above for high-resolution image

There once was a time when Daewoo was one of the biggest companies in South Korea. It was larger than both LG and Samsung, and second only to Hyundai. But these days the name is all but gone.

Chevy's Android Auto update will reach cars in March

Fri, Sep 25 2015Buying a new Chevy with the hopes of using Android Auto during your daily commute? You'll have to sit tight for a while before that dream becomes reality. The carmaker announced that an Android Auto software update will only reach its 2016 model-year vehicles next March, starting with those that have 8-inch MyLink touchscreen systems. That's going to be a long half-year wait if you're eager to get Google Maps directions through the center stack. The good news? Chevy is promising that all vehicles with 7- and 8-inch MyLink displays (ranging from the Spark to the Corvette) will eventually have Android Auto, so you won't have to drive one of the brand's swankier machines to get a smartphone-powered infotainment deck. This article by Jon Fingas originally ran on Engadget, the definitive guide to this connected life. Related Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.