1968 Chevy Bel Air 2dr Sedan *parts Car* Good Chrome/engine/body Panels! on 2040-cars

Novelty, Ohio, United States

Body Type:2 door sedan

Vehicle Title:Clear

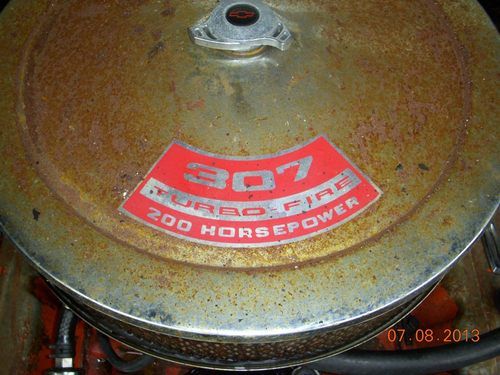

Engine:307 civ 8

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Green

Make: Chevrolet

Model: Bel Air/150/210

Trim: Base

Drive Type: Automatic

Mileage: 49,000

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Green

Chevrolet Bel Air/150/210 for Sale

1957 chevrolet 150 series sedan delivery - original california car

1957 chevrolet 150 series sedan delivery - original california car One bad 1953 chevy barret jackson bought a/c od zz4 lead slead

One bad 1953 chevy barret jackson bought a/c od zz4 lead slead 1961 chevy bel-air 2 door coupe(US $2,500.00)

1961 chevy bel-air 2 door coupe(US $2,500.00) 1956 chevy 150 pro touring 383 stroker(US $42,500.00)

1956 chevy 150 pro touring 383 stroker(US $42,500.00) 1951 chevrolet bel air 2 door hard top(US $2,500.00)

1951 chevrolet bel air 2 door hard top(US $2,500.00) 57 chevy 210 black corvette 350 engine & trans(US $11,000.00)

57 chevy 210 black corvette 350 engine & trans(US $11,000.00)

Auto Services in Ohio

Wired Right ★★★★★

Wheel Medic Inc ★★★★★

Wheatley Auto Service Center ★★★★★

Walt`s Auto Inc ★★★★★

Walton Hills Auto Service ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Callaway debuts its new C7 Stingray at National Corvette Museum

Fri, 02 May 2014Callaway showed off its first tuned version of the 2014 Corvette Stingray at the National Corvette Museum last week, giving the rampant enthusiasts of America's sports car a look at the roughly 620-horsepower, supercharged rocket.

Unlike the Corvette SC610 we showed you back in January, this Stingray packs a fair bit more oomph. Horsepower is only up ten ponies, but torque has jumped from 556 pound-feet to "at least" 600 pound-feet. Neither horsepower nor torque is official quite yet, although Callaway is expecting to know just what its creation can do once testing and validation is completed later this month.

The 6.2-liter, supercharged V8 now boasts a new, three-element intercooler, which Callaway claims only allowed the inlet air temperature to increase by ten degrees Fahrenheit during dyno runs. Previous designs saw a 35-degree-Fahrenheit jump. The exhaust system has also been fettled with, and now is even less restrictive.

GM to make most cars LTE hotspots for 2015

Mon, 25 Feb 2013General Motors isn't the first automaker to deliver in-car Internet access, but a proposed plan announced today could make the technology more widespread than any of its competitors have offered. By the 2015 model year, most Chevrolet, Buick, Cadillac and GMC products in the US and Canada will offer 4G LTE mobile broadband access. Initially, GM will just be pairing with AT&T to deliver this service, but additional carriers will be revealed in the future.

Current in-car Wi-Fi hot spots are limited to 3G, but GM says that 4G LTE is 10 times faster than 3G service and will allow for full Internet access, including streaming video for entertainment as well as services like real-time traffic updates and navigation driving directions. There is also no need for a paired smartphone with this new system, which should make it easier to use, and GM and AT&T will also be working together to develop new apps for customers.

Buyers can expect to start seeing 4G LTE in their cars starting next year, and GM is already planning to expand the service to other global markets as well. All of the information from GM's announcement is posted in a press release below.

New Chevrolet Silverado to be revealed on Facebook on Thursday

Tue, 11 Dec 2012There's not much to see here, but if you're one of those waiting for the reveal of the 2014 Chevrolet Silverado 1500, above is the teaser image that Chevrolet posted on its Facebook page. We've seen the truck in form-fitting camo before, and even less can be made out here beyond those seriously punchy Silverado-esque fenders and the knowledge that the projector-beam headlamps teased previously do indeed work. We'll have to wait until Thursday for a full perusal of the "bold exterior design" and "careful attention given to every detail" we've been promised.

Gathering intel and rumors, magnesium and aluminum contribute to the Silverado's weight loss plan, the purported "High Country" top-tier trim will contribute to luxury pickup truck competition and profit margins and the next-generation small-block V8 will contribute to improved fuel economy. On the engine note, there have been rumors of available V6 engines, and when Facebook user John Jones asked "Where's your answer to that EcoBoost Chevy?", the Bowtie replied "stay tuned on the 13th. We think you'll be pleased...".

Along with the "Raise the Bar" tag, Chevrolet says of the Silverado, "You asked, we delivered." You can watch the reveal live on Chevrolet's Facebook page at 9:30 am EST, this Thursday, December 13. The GMC Sierra 1500 will also be there, and we'll see both in person at the Detroit Auto Show in January.