2003 Chevrolet Astro Cargo Van-one Owner- Top Score Autocheck.com on 2040-cars

Garland, Texas, United States

|

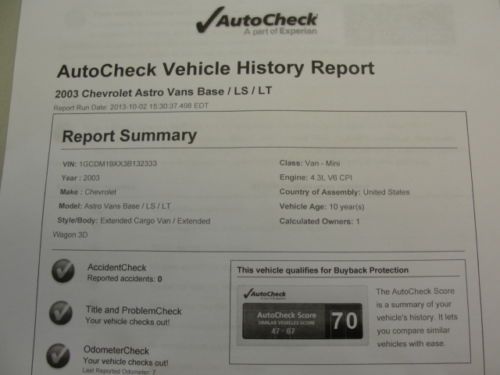

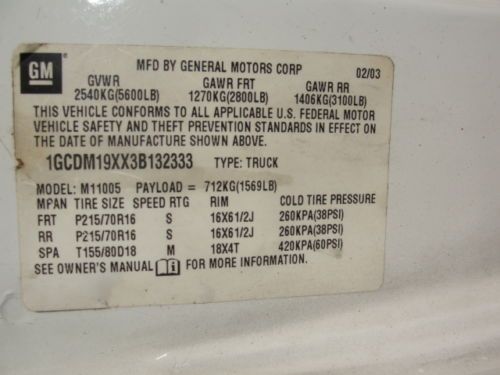

2003 Chevrolet Astro Cargo Van with white color and gray cloth interior, vinyl flooring, Powerful and Gas saver 4.3L V6 engine and Automatic Transmission, Power windows and locks, Tilt steering, great tires, Cold A/C and Hot heater, New Battery, well maintained, New inspection sticker, Texas Blue title with One Owner, Non smoker, and No accident from AutoCheck.com(see picture of printed report)

Thank you and have a great day |

Chevrolet Astro for Sale

Chevrolet astro cargo work van 4.3l auto storage bins compartments bidadoo

Chevrolet astro cargo work van 4.3l auto storage bins compartments bidadoo 2002 chevrolet astro base extended cargo van 3-door 4.3l

2002 chevrolet astro base extended cargo van 3-door 4.3l 1999 chevy astro (cargo) van - one owner

1999 chevy astro (cargo) van - one owner 2003 chevrolet astro van--only 84k miles--runs great!

2003 chevrolet astro van--only 84k miles--runs great! Chevy astro van(US $3,000.00)

Chevy astro van(US $3,000.00) 1999 chevrolet astro base extended cargo van 3-door 4.3l(US $1,850.00)

1999 chevrolet astro base extended cargo van 3-door 4.3l(US $1,850.00)

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

Watch how Corvette Racing's new collision-avoidance radar system works

Fri, 22 Mar 2013When it comes to technology used in racecars, we generally expect it to trickle down to production cars, not the other way around. Well, Pratt & Miller has developed a new rear-facing radar that operates in a similar fashion to what we're used to in modern blind spot detection systems, only it is also capable of tracking cars as they approach and relaying vital information to the driver via a large display screen.

The innovative radar system debuted at last weekend's 12 Hours of Sebring for Corvette Racing, and this system makes perfect sense for endurance races like this since the cars sometimes have to drive through the night and in poor weather conditions.

The radar can detect cars even with poor visibility, and uses easy-to-distinguish symbols for the driver to identify.

Watch NASCAR racer Jeff Gordon put one over on a used car dealer... sorta

Wed, 13 Mar 2013Full Disclosure: in my younger days, I loved nothing more than tormenting passengers with my behind-the-wheel hijinks. Once, after a particularly artful handbrake turn on a two-lane at around 50 miles per hour, I left one backseat occupant crying in their own lap. This isn't necessarily something to be proud of, but it gives you a glimpse into why it is that I find this ad from Pepsi so damn disappointing. The premise is beautiful. Take NASCAR legend Jeff Gordon, give him a disguise and set him loose upon some unsuspecting used car dealer. Hilarity ensues.

Except that this Pepsi Max commercial is so obviously staged, it can't help but feel like some ham-fisted marketing fail. From the strategically placed aftermarket cupholder mounted mid-dash for the hidden camera to the fact that the supposed dealer Camaro is displayed as a 2009 model (Hint: Chevrolet didn't make any), this clip is about as organic as a Twinkie. Still, we would never turn down a chance to watch Gordon thrash on a rental-spec coupe - only problem is, he probably didn't even do the driving himself. Check it out below.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.