Black On Black Moon Roof Cold Ac Clean Interior Rebuilt Heads No Overheating on 2040-cars

Dearborn Heights, Michigan, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:4.6L 281Cu. In. V8 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Cadillac

Model: Eldorado

Trim: ETC Coupe 2-Door

Options: Sunroof, Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 134,000

Sub Model: SPORTS COUPE

Exterior Color: Black

Disability Equipped: No

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Cadillac Eldorado for Sale

1997 cadillac eldorado base coupe 2-door 4.6l(US $1,400.00)

1997 cadillac eldorado base coupe 2-door 4.6l(US $1,400.00) 1973 cadillac eldorado convertiable - good condition(US $6,000.00)

1973 cadillac eldorado convertiable - good condition(US $6,000.00) Cadilac eldorado 2 -door - coup - 1985 - very clean -

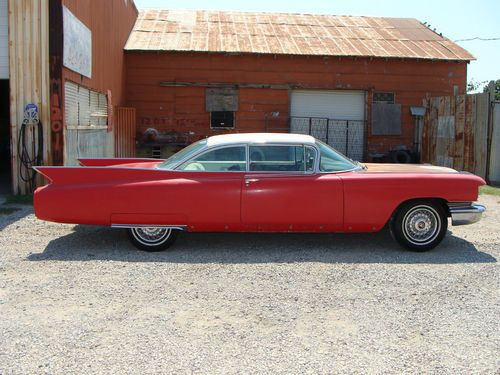

Cadilac eldorado 2 -door - coup - 1985 - very clean - 1960 cadillac eldorado seville project. texas title(US $8,995.00)

1960 cadillac eldorado seville project. texas title(US $8,995.00) 1982 cadillac eldorado baritz edition 5.7 litre diesel powered(US $1,800.00)

1982 cadillac eldorado baritz edition 5.7 litre diesel powered(US $1,800.00) 1976 cadillac eldorado convertible, red/white 17k miles one owner barn find

1976 cadillac eldorado convertible, red/white 17k miles one owner barn find

Auto Services in Michigan

Wilkins Auto Sales Inc ★★★★★

White Jim Honda ★★★★★

Wetland Auto Parts ★★★★★

Vinsetta Garage ★★★★★

Viers Auto Sales ★★★★★

Tom Holzer Ford Inc ★★★★★

Auto blog

Hennessy wastes no time in supercharging the 2015 Cadillac Escalade

Wed, 23 Apr 2014The ink is still drying on the all-new 2015 Cadillac Escalade sales brochures, but that hasn't stopped Texas-based Hennessey Performance (HPE) from leaping out of the gate with its own high-performance variant. In stock form, the big fourth-generation Cadillac flagship arrives with a new small block naturally aspirated 6.2-liter Ecotec3 V8 delivering 420 horsepower and 460 pound-feet of torque. Fresh out of the showroom, the 5,900-pound SUV will sprint to 60 mph in 5.9 seconds.

While that is plenty fast for some owners, others don't want to be shamed by a 550 horsepower Mercedes-Benz GL63 AMG or a 510 horsepower Land Rover Range Rover Sport - both will leave the stock Escalade at a stoplight.

The team at HPE has come to the rescue with its HPE550 supercharger upgrade, which includes a belt-driven supercharger, air-to-water intercooler, recalibrated engine management software and a three-year/36,000 mile powertrain warranty. With 6 psi of boost, the direct-injected 6.2-liter is tuned to deliver an impressive 557 horsepower and 542 pound-feet of torque - gains of 32 percent and 18 percent, respectively, over stock. Although HPE isn't releasing performance figures as of yet, our math says that should be enough power to put the two Europeans in the Cadillac's rearview mirror. The company also offers a set of 20-inch lightweight H10 forged monoblock wheels, to further improve performance.

8 fastest depreciating cars in America

Tue, Feb 27 2018Getting a new car is an amazing experience. The fresh new scent, the barely touched interior, the double digit miles on your odometer, and... the depreciation once it leaves the car dealers lot? Maybe not that last one. To save you from the hurt of a quickly depreciating new car, we collected 8 of the fastest depreciating cars in America. And here's a surprise, one of them is a Toyota. Learn more at Autoblog.com Cadillac Infiniti Jeep Kia Lincoln Toyota Autoblog Minute Videos Original Video jeep compass cadillac xts infiniti q50 camry q50

Next-gen Cadillac Escalade spied with grille uncovered for the first time

Thu, Oct 3 2019The next generation of full-size GM SUVs is coming, and the Cadillac Escalade may the most anticipated reveal of them all. Lincoln has blown up the scene with its excellent Navigator, and Cadillac needs something revolutionary in response. Our latest set of spy photos show us what appears to be a camouflaged Escalade, but it’s missing some of the camo covering the grille. None of our previous Escalade spy photos have given us this detailed of a look at the grille before. The grille design looks like a blown-up version of the XT6 right now. ItÂ’s not the exact same pattern as we see on the Sport or Premium Luxury trims of that car, but the design looks like it comes from a similar mind. ThereÂ’s certainly no mistaking it for anything other than a Cadillac, as the Yukon and Tahoe likely wonÂ’t be sporting such gaudy front pieces — the jury is still out on a potential High Country trim, though. This particular tester looks like it was caught on GMÂ’s proving grounds, as the driver unsuccessfully tries to hide his face from the camera. Just like previous spy shots, these feature the same rectangular exhaust outlets and independent rear suspension down below. We still have no idea what the rest of the SUV is going to look like, but as GM is wont to do these days, a big grille is a certainty now. The camouflage conceals just how far it stretches from one side to the other, but weÂ’ll be interested to see how much of the design language is ripped from smaller SUVs like the XT6 and XT5. We have a feeling Cadillac plans on giving us something new and game-changing with the Escalade; we just donÂ’t know if the styling is up to the task yet.