1985 Cadillac Eldorado With Only 71k. Miles Cold A/c Runs Good >no Reserve< on 2040-cars

Las Vegas, Nevada, United States

Cadillac Eldorado for Sale

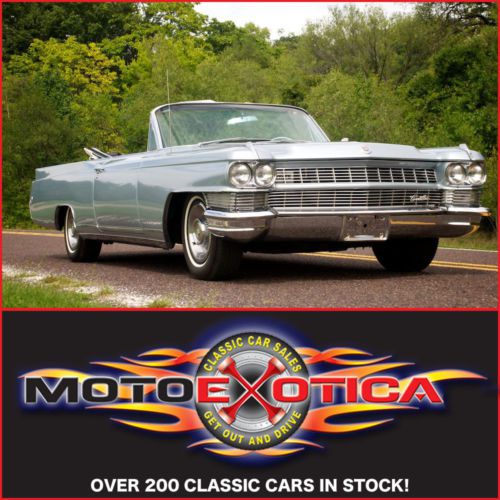

1964 cadillac eldorado convt-429 v8-new interior- a/c- cosmetic resto

1964 cadillac eldorado convt-429 v8-new interior- a/c- cosmetic resto 2000 cadillac eldorado esc clean carfax florida car northstar 4.6l v8 coupe(US $5,495.00)

2000 cadillac eldorado esc clean carfax florida car northstar 4.6l v8 coupe(US $5,495.00) Very clean cadillac eldorado biarritz

Very clean cadillac eldorado biarritz 1995 cadillac eldorado etc coupe 2-door 4.6l

1995 cadillac eldorado etc coupe 2-door 4.6l Cadillac eldorado 1985(US $6,500.00)

Cadillac eldorado 1985(US $6,500.00) 1991 cadillac eldorado base coupe 2-door 4.9l low miles(US $1,800.00)

1991 cadillac eldorado base coupe 2-door 4.9l low miles(US $1,800.00)

Auto Services in Nevada

Yee Bros. Automotive ★★★★★

Ultimate Automotive ★★★★★

Transmission Warehouse ★★★★★

Top Dent Repair ★★★★★

Sparks Muffler Service ★★★★★

Sierra Window Tinting ★★★★★

Auto blog

Cadillac mulling CTS Coupe successor after all

Thu, 04 Apr 2013The 2014 Cadillac CTS made a big splash last week at the New York Auto Show, but now that we've seen the sedan, we can start to wonder about whether coupe and wagon versions are in the cards. According to Edmunds, Cadillac is at least considering bringing back the CTS Coupe for a second generation, which seems like an even better chance since the brand's global marketing director, Jim Vurpillat, was quoted as saying that the car was the top-selling luxury coupe in the industry.

Of course, this goes against reports we heard last year that Caddy's coupe and wagon would live on just not under the CTS name, but the interview with Vurpillat has us hopeful for a next-generation CTS Coupe. If it does come to fruition, we would expect the new two-door to have a largely unique exterior design like the current CTS Coupe, to echo that of intended rivals like the Mercedes-Benz E-Class Coupe and even the high-dollar BMW 6 Series.

GM to accelerate its EV strategy Ś Cadillac could be all-electric by 2025

Wed, Nov 18 2020General Motors will roll out details of an expanded and accelerated electric vehicle strategy on Thursday in an effort to convince investors it can be a serious competitor to Tesla, people familiar with the plans said. GM Chief Executive Mary Barra, who is scheduled to speak at a conference hosted by Barclays, is expected to say the automaker is ready to spend more on electric models by 2025 than the $20 billion previously outlined, the sources said. Supplier sources said previous plans to make the Cadillac brand all-electric by 2030 are being sped up, possibly to 2025, and other sources said that acceleration will be repeated in other brands and in segments such as commercial vans. Asked about the Thursday appearance, a GM spokeswoman called talk of increased spending speculative and declined to give details. The Detroit automaker is also expected to discuss a new timeline for many of the EVs to follow those already identified, such as the GMC Hummer EV pickup and Cadillac Lyriq crossover, people familiar with the plans said. Lyriq (shown above) is slated to go into production in late 2022, but GM officials have been stung by criticism the automaker was bringing the vehicle to market too late, one source said. "The pull-ahead in programs is real and the organization is really doubling down on speeding up product development," the source said. Barra and other GM executives have been signaling the automaker's EV acceleration plans. She said earlier this month GM would boost capital spending over the next three years to speed EV development and was talking with other automakers about partnerships to develop more vehicles using GM's battery technology. Last week, a GM executive said the company had pulled forward the rollout of two "major" EV programs, and GM officials have touted the faster 18-month development time for the Hummer truck. Tesla's soaring market capitalization, and growing pressure from regulators to phase out carbon-emitting engines, has put pressure on established automakers to respond to investors who view their internal combustion lineups as outmoded and doomed in the long run. A critical part of GM's pitch to investors has been its new Ultium batteries, which it estimates will offer an electric driving range of 400 miles or more on a single charge. It is building a battery plant with Korean battery maker LG Chem in northeast Ohio.

Consumer Reports explains its disdain for infotainment

Thu, 20 Mar 2014One of the perks of reviewing all manner of cars and trucks is that we're exposed to all the different infotainment systems. Whether Cadillac's CUE, Chrysler's UConnect, BMW's iDrive or MyFord Touch, we sample each and every infotainment system on the market.

Not surprisingly, some are better than others. It seems consumers have come to a similar consensus, with Consumer Reports claiming that Ford and Lincoln, Cadillac and Honda offer the worst user infotainment experiences. Not surprisingly, you won't find much argument among the Autoblog staff.

Take a look below to see just what it is about the latest batch of infotainment systems that grinds CR's gears. After that, scroll down into Comments and let us know if you agree with the mag's views.