Ruth I Hurlman on 2040-cars

Montrose, New York, United States

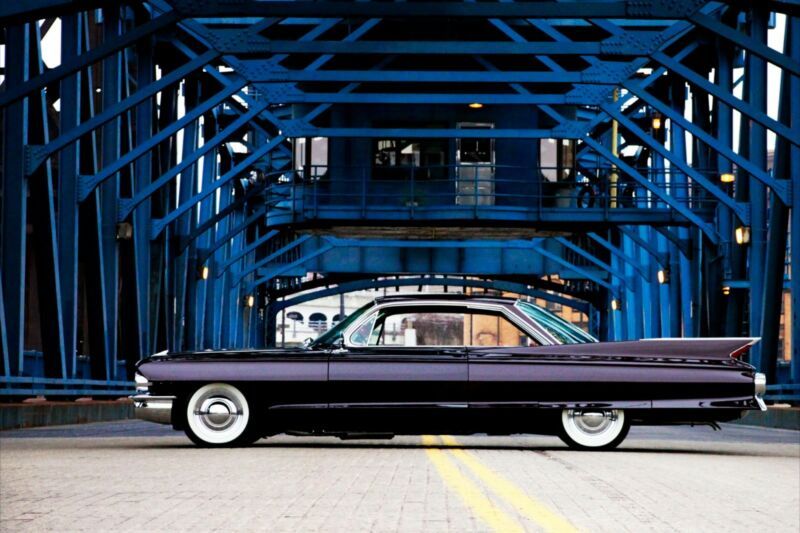

Cadillac DeVille for Sale

1961 cadillac deville(US $19,950.00)

1961 cadillac deville(US $19,950.00) 1960 cadillac deville(US $17,500.00)

1960 cadillac deville(US $17,500.00) 1959 cadillac deville --(US $25,560.00)

1959 cadillac deville --(US $25,560.00) 1960 cadillac deville(US $18,400.00)

1960 cadillac deville(US $18,400.00) 1965 cadillac deville(US $19,840.00)

1965 cadillac deville(US $19,840.00) 1961 cadillac deville(US $17,850.00)

1961 cadillac deville(US $17,850.00)

Auto Services in New York

Zuniga Upholstery ★★★★★

Westbury Nissan ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Value Auto Sales Inc ★★★★★

TM & T Tire ★★★★★

Auto blog

Chinese-made Cadillac CT6 Plug-In starts US sales

Thu, Apr 13 2017General Motors has started US sales of the Cadillac CT6 Plug-In after taking its first domestic deliveries of the China-produced sedan last month. The model is GM's first new plug-in hybrid in the US since the automaker discontinued sales of the ELR extended-range plug-in last year. The arrival and sales, first reported by InsideEVs, were confirmed by Cadillac spokesman Andrew Lipman. Not surprisingly, the sedan isn't cheap, as the CT6 Plug-In is priced at $75,095, or almost $12,000 more than the gas-powered variant, though that figure doesn't include federal and state tax credits for electric vehicles. For that tab, buyers get a 335-horsepower luxury car that can go 31 miles on electricity alone, and 0-60 miles per hour in a little over 5 seconds. The model gives GM three plug-in vehicles to sell to the American public, or the same number US competitor Ford offers. InsideEVs estimates that about 100 of the sedans have been delivered to US dealers, so the car remains a relatively low-volume affair. By comparison, GM's Chevrolet division has sold 5,563 Volt extended-range plug-ins and 3,092 Bolt electric vehicles through March. Cadillac sold 534 units of the ELR in 2016 after moving 1,024 the previous year. GM opted to produce the plug-in hybrid in China because of that country's receptiveness to new models that feature alternative and environmentally friendlier powertrains. Additionally, such production shortens the distance to the CT6's battery maker LG Chem, which is producing the car's battery packs in South Korea. On that note, GM has previously estimated that the Cadillac CT6 Plug-In will move more units in China than in the US. Related Video:

Cadillac XT5 platform to underpin three-row crossover

Wed, Mar 16 2016Cadillac just launched the XT5 crossover to replace the SRX. But that's only the start. Speaking with Automotive News, Caddy president Johan de Nysschen confirmed that a new three-row crossover is also on the way. The seven-seater is based on a stretched version of the flexible platform underpinning the XT5, which we just drove recently. Taking that approach will give the luxury brand a larger crossover to pit against the likes of the Infiniti QX60, Audi Q7, and Volvo XC90 without having to develop one from scratch. It will also give buyers a more car-like alternative to the larger, truck-based Escalade. "It's one of the benefits of having this very flexible architecture. We can expand it, make it longer and wider. That gives us the ability to develop the car very quickly, as opposed to starting from scratch," de Nysschen told AN. "It's not running yet. It is a program request that we initiated with the engineers only last year. They are working at remarkable, record-breaking speed to get us the car." The new model would likely be called the XT7 and offer similar levels of equipment to the existing, smaller XT5. The existing mid-size model packs a 3.6-liter V6 mated to an eight-speed automatic transmission and comes in four trim levels. Related Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.