2011 Cadillac Cts Factory Warranty Panoramic Roof Bose Leather Save Today $24995 on 2040-cars

Cleveland, Ohio, United States

Engine:3.0L 182Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Transmission:Automatic

Fuel Type:GAS

Make: Cadillac

Options: Sunroof, Compact Disc

Model: CTS

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Trim: Base Sedan 4-Door

Power Options: Air Conditioning, Cruise Control, Power Windows

Drive Type: RWD

Doors: 4 doors

Mileage: 15,902

Engine Description: 3.0L V6 DIR DOHC 24V

Sub Model: PANORAMIC ROOF LEATHER BOSE FACTORY WRNTY $24,995

Number of Doors: 4

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Warranty: Vehicle has an existing warranty

Cadillac CTS for Sale

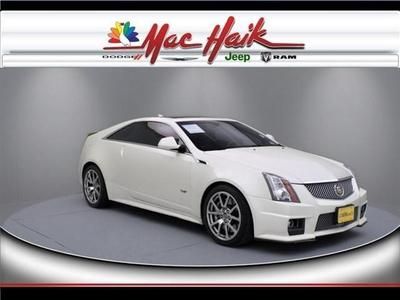

6.2l v8 supercharged engine gps nav one owner leather sunroof clean warranty

6.2l v8 supercharged engine gps nav one owner leather sunroof clean warranty 6.2 v8 supercharged xenon luxury leather 556 hp finance cts coupe rwd

6.2 v8 supercharged xenon luxury leather 556 hp finance cts coupe rwd Cts-v cts v 556 hp navigation rearcam tilt roof auto htd seats 2011 cadillac 6k(US $52,400.00)

Cts-v cts v 556 hp navigation rearcam tilt roof auto htd seats 2011 cadillac 6k(US $52,400.00) 2006 cadillac cts base sedan 4-door 3.6l(US $7,695.00)

2006 cadillac cts base sedan 4-door 3.6l(US $7,695.00) 2008 cadillac cts 1sb,we finance,white,awd(US $20,150.00)

2008 cadillac cts 1sb,we finance,white,awd(US $20,150.00) 2011 cadillac cts-v ctsv sedan no reserve 556hp 6.2 v8 auto nav no reserve

2011 cadillac cts-v ctsv sedan no reserve 556hp 6.2 v8 auto nav no reserve

Auto Services in Ohio

Westerville Automotive ★★★★★

West Chester Autobody ★★★★★

Unique Auto Painting ★★★★★

Thrifty Mufflers ★★★★★

The Right Place Automotive ★★★★★

Superior Automotive & Truck Repair ★★★★★

Auto blog

GM recalling Cadillac ATS, XTS, Chevy Impala over faulty brake lamps

Thu, 06 Jun 2013General Motors has issued a recall covering 1,627 sedans over faulty brake lamps. Both the 2013 Cadillac ATS and XTS are affected by this problem, as is the 2014 Chevrolet Impala.

According to an official National Highway Traffic Safety Administration report, "the brake lamps may intermittently flash without the brakes being applied and the cruise control may disengage" on these vehicles. The report does not state that the brakes themselves are faulty, but rather that "if the brake lamps flash when the vehicle is not slowing, a following driver may not adjust vehicle speed when the vehicle is in fact braking."

This marks the first recall for the 2013 Cadillac ATS, as well as the recently introduced 2014 Chevy Impala. In late 2012, over 12,000 Cadillac XTS models were recalled due to a head restraint issue.

Best car infotainment systems: From UConnect to MBUX, these are our favorites

Sun, Jan 7 2024Declaring one infotainment system the best over any other is an inherently subjective matter. You can look at quantitative testing for things like input response time and various screen load times, but ask a room full of people that have tried all car infotainment systems what their favorite is, and youíre likely to get a lot of different responses. For the most part, the various infotainment systems available all share a similar purpose. They aim to help the driver get where they're going with navigation, play their favorite tunes via all sorts of media playback options and allow folks to stay connected with others via phone connectivity. Of course, most go way beyond the basics these days and offer features like streaming services, in-car performance data and much more. Unique features are aplenty when you start diving through menus, but how they go about their most important tasks vary widely. Some of our editors prefer systems that are exclusively touch-based and chock full of boundary-pushing features. Others may prefer a back-to-basics non-touch system that is navigable via a scroll wheel. You can compare it to the phone operating system wars. Just like some prefer Android phones over iPhones, we all have our own opinions for what makes up the best infotainment interface. All that said, our combined experience tells us that a number of infotainment systems are at least better than the rest. We¬íve narrowed it down to five total systems in their own subcategories that stand out to us. Read on below to see our picks, and feel free to make your own arguments in the comments. Best infotainment overall: UConnect 5, various Stellantis products Ram 1500 Uconnect Infotainment System Review If there¬ís one infotainment system that all of us agree is excellent, it¬ís UConnect. It has numerous qualities that make it great, but above all else, UConnect is simple and straightforward to use. Ease of operation is one of the most (if not the single most) vital parts of any infotainment system interface. If you¬íre expected to be able to tap away on a touchscreen while driving and still pay attention to the road, a complex infotainment system is going to remove your attention from the number one task at hand: driving. UConnect uses a simple interface that puts all of your key functions in a clearly-represented row on the bottom of the screen. Tap any of them, and it instantly pulls up that menu.

Cadillac CTS-V spotted with big exhaust, new grille?

Thu, 20 Feb 2014If you thought Cadillac was content to leave its twin-turbocharged Vsport as the range-topping CTS, think again. Behold, our first good glimpse at the next-generation Cadillac CTS-V sedan, sporting more aggressive styling (somewhere under there), meaty quad-exhaust pipes, and what very well could be a new face for the V-badged Caddies.

Creating an all-new grille design seems like an awful lot of work just for a prototype, so it's very possible that the vertical-bar treatment you see here could make its way into production. Our spy photographers have pointed out that they've seen this same sort of grille treatment on prototypes for the smaller ATS-V sedan, and we've heard V-series models may soon have greater differentiation from the standard vehicles that sired them - that seems especially necessary if Cadillac insists on expanding this whole Vsport range.

Regardless of how its front end looks, the CTS-V ought to be a real monster. Industry sources say we can expect to see a supercharged version of General Motors' 6.2-liter V8 under the Caddy's hood, and considering the current car already makes 556 horsepower and 551 pound-feet of torque, we wouldn't be surprised to see a decent increase in both of those numbers. After all, one of the CTS-V's main competitors, the Mercedes-Benz E63 AMG, is currently putting out 550 hp and 590 lb-ft of torque. Could this mean a 600-hp Cadillac is on the horizon?