1968 Buick Skylark Custom on 2040-cars

Gill, Colorado, United States

|

Restore under way, all original. Car was a daily driver when I purchased and tore down. I was going to clone a GS, installed a GS hood scoop. Was originally a 2 barrel (which is included). Correct year intake and 4 barrel carb installed.

Drive train: Buick 350, 4 barrel with rebuilt heads and new complete gasket kit, wires, fuel pump, water pump, starter etc etc, fresh paint on motor, factory AC, original power glide transmission has been tanked and professionally rebuilt, new torque converter, new dual exhaust, new brakes (drum) all around. Car has not been started since reassembled. Interior: Car is factory floor shift with bucket seats.Console is in VGC for a 68 and has a new console lid. Dash is complete painted and restored. Dash pad has no cracks. New window seal kit included, still in boxes. Interior is complete, but removed, needs redone. Body: no rust in floors, very small spot in trunk. I have brand new 1/2 quarter panels, uninstalled. I have multiple complete sets of chrome and SS trim for this car in VGC. Please note I have a near perfect 68 grill which is almost impossible to find. Front head light buckets are near perfect. Front bumper is near perfect and a VGC driver. Core support is solid and painted. New door hinges installed. Car comes with two hoods and rear deck lids. Like new marker lights and tail lights. Fenders are nice and straight with very little rust. Has a nice set of rollers on it and includes set of 5- 14" rallies in VGC. Car needs: Paint and body, interior and a rear bumper (I have two bent rears that can be cut in half and welded to make a good one). Car has been stored in shop for about five years now. Includes tons of extra parts. Originally from New Mexico. Clean Colorado title. Too many other projects. |

Buick Skylark for Sale

Auto Services in Colorado

Tight Curves LTD ★★★★★

TheDingGuy.com ★★★★★

Select Auto Brokers ★★★★★

Ramsey Auto Body Inc ★★★★★

Precision Auto Glass ★★★★★

Northglenn Auto Body ★★★★★

Auto blog

GM and Ford quarterly sales continue to slump in China

Fri, Jul 5 2019BEIJING ó General Motors and Ford announced their quarterly sales in China fell, albeit at a slower pace sequentially, as the U.S. automakers were hit by a slowing economy amid the Sino-U.S. trade war. GM's vehicle sales in China for the quarter ended June 30 dropped 12.2%, while Ford's sales slumped by 21.7%. While GM also suffered from heightened competition in its key mid-priced SUV segment, Ford was hurt by the limited new models for customers to choose from. For the first quarter of this year, Ford's sales in China tumbled 35.8 percent while GM's skid 17.5 percent. Still, the numbers from GM, the second biggest international¬†automaker in China by sales, and Ford portend more uncertainty for the industry which is trying to rebound from a downward spiral that led to its first annual sales decline last year in more than two decades. GM delivered 1.57 million vehicles in China in the January-June period this year, while Ford delivered 290,321 vehicles. China's factory activity shrank more than expected in June, highlighting the need for more economic stimulus amid higher U.S. tariffs and weaker domestic demand. Annual car sales in China fell last year for the first time since the 1990s, and they are expected to fall this year too. Sales tumbled 16.4% in May from the same month a year prior, the China Association of¬†Automobile Manufacturers (CAAM) said. That marked the 11th consecutive month of decline and followed falls of 14.6% in April and 5.2% in March. U.S. car companies' share of total China passenger vehicles sales fell to 9.6% in the first five months of this year from 10.9% in the year-ago period, according to CAAM. Over the same period, German car makers' share has risen to 23.3% from 20.9% and Japanese¬†auto¬†makers' to 21.3% from 17.3%. CAAM is set to announce June sales next week, which industry analysts forecast will be negative. ¬† New models In China, GM has a joint venture with SAIC Motor Corp, in which the Buick, Chevrolet and Cadillac are made. It also has another venture, with SAIC and GuangxiAutomobile Group, in which they make no-frills minivans and have started to make higher-end cars. Sales of GM's affordable brand Baojun dropped 31.8% for the latest quarter. But luxury brand Cadillac's sales jumped 36.6%. GM sold 3.64 million units in China last year, down from 4.04 units in 2017. Ford makes cars in China through its joint venture with Chongqing Changan Automobile Co and Jiangling Motors Corp (JMC).

2018 Buick LaCrosse Avenir gets dash of flash

Wed, Nov 8 2017The 2018 Buick LaCrosse Avenir continues the rollout of the top-trim Avenir line, joining the Enclave. They use the same strategy: package some extra features as standard and give the vehicles more design flair. On the outside, the LaCrosse Avenir gets shiny chrome mesh grilles and Avenir badging, just like the Enclave. Two types of wheels are available on the LaCrosse, either 19-inch pieces finished in "Pearl Nickel" or 20-inch versions finished in "Midnight Silver." Inside, there is exclusive chestnut brown leather interior. The Avenir logo is stitched into the headrests of the seats and is displayed on the door sill plates. Aside from the visual tweaks, the Avenir trim adds a bunch of standard features. Among the convenience items are navigation, a sunroof and a Bose sound system. It also features the nine-speed automatic transmission hooked up to the 310-horsepower V6. But items such as the trick all-wheel-drive system and continuously adjustable suspension are still options. Pricing hasn't been announced yet, but expect it to be more than the $42,090 of the next highest-trim LaCrosse Premium with the V6. And Buick expects it will sell plenty of these cars, since it also revealed that 90 percent of LaCrosse buyers choose the top two trims out of the four available. The car goes on sale early next year. Related Video: Featured Gallery 2018 Buick LaCrosse Avenir View 10 Photos Image Credit: Buick Buick Luxury Sedan buick avenir

Best and worst car brands of 2022 according to Consumer Reports

Thu, Feb 17 2022It's that time again, Consumer Reports this morning lifting the curtain on its 2022 Annual Car Brand rankings and its 10 Top Picks in the car, crossover, and truck category. Drumroll, please: This year, Subaru climbs two spots to claim the winner's circle, having come third the last two years. Last year, Mazda climbed three spots from 2020 to take the crown. This year, Mazda slipped to second, BMW taking the last spot on the podium, also a one-spot drop from 2021. Six automakers in the top 10 hailed from Japan, which is one more than last year, and five luxury makers occupied the top 10, which is two more than last year. And South Korean representation didn't crack the top this year, after Hyundai managed tenth last year. The seven makes after BMW are: Honda, Lexus, Audi, Porsche, Mini, Toyota, and Infiniti.¬† The magazine and testing concern says its Brand Report Card "[reveals] which automakers are producing the most well-performing, safe, and reliable vehicles based on CRís independent testing and member surveys," and that "Brands that rise to the top tend to have the most consistent performance across their model lineups." The domestics also took steps back among the 32 OEMs ranked on the 2022 card. Chrysler and Buick were the domestic carmakers who made last year's top 10 in eighth and ninth, respectively. This year, Buick dropped to eleventh, Chrysler to thirteenth. Dodge went from fourteenth to sixteenth. CR continues to ding Tesla's yoke steerer, the not-exactly-natural handhold responsible for the electric carmaker going from sixteenth last year to twenty-third this year.

1964 buick skylark base hardtop 2-door 4.9l

1964 buick skylark base hardtop 2-door 4.9l 1972 buick skylark convertible must sell no reserve

1972 buick skylark convertible must sell no reserve 1971 buick skylark 455 base coupe 2-door 7.5l

1971 buick skylark 455 base coupe 2-door 7.5l 1971 buick skylark convertible project car

1971 buick skylark convertible project car 1972 buick gs 455 stage 1

1972 buick gs 455 stage 1 1970 buick skylark convertible

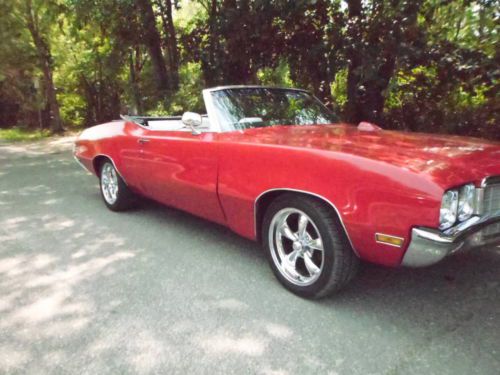

1970 buick skylark convertible