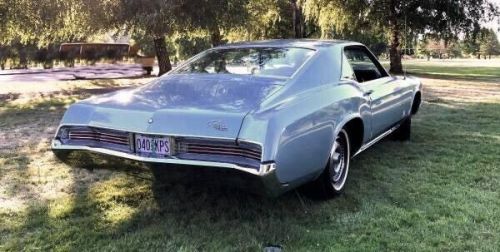

1971 Buick Riviera Deluxe on 2040-cars

Lockport, Illinois, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:455ci V8

Year: 1971

Mileage: 89500

Interior Color: Tan

Previously Registered Overseas: No

Trim: Deluxe

Number of Cylinders: 8

Make: Buick

Drive Type: RWD

Independent Vehicle Inspection: No

Engine Size: 455

Exterior Color: Red

Model: Riviera

Car Type: Classic Cars

Number of Doors: 2

Features: --

Country/Region of Manufacture: United States

Buick Riviera for Sale

1963 buick riviera(US $31,500.00)

1963 buick riviera(US $31,500.00) 1965 buick riviera deluxe interior(US $47,500.00)

1965 buick riviera deluxe interior(US $47,500.00) 1958 buick riviera(US $10,000.00)

1958 buick riviera(US $10,000.00) 1985 buick riviera(US $5,000.00)

1985 buick riviera(US $5,000.00) 1967 buick riviera(US $35,000.00)

1967 buick riviera(US $35,000.00) 1968 buick riviera 2dr coupe(US $7,700.00)

1968 buick riviera 2dr coupe(US $7,700.00)

Auto Services in Illinois

World Class Motor Cars ★★★★★

Wilkins Hyundai-Mazda ★★★★★

Unibody ★★★★★

Turpin Chevrolet Inc ★★★★★

Tuffy Auto Service Centers ★★★★★

Triple T Car Wash Lube & Detail Center ★★★★★

Auto blog

Why Buick's future lies in China

Mon, Apr 10 2017Back in the last half of 2008 and into 2009, when General Motors was looking at too much capacity for too few customers, when it was running out of money and needing to go to the governments of the US and Canada and to the UAW for financial support, its management team was pretty much instructed by the feds to focus resources on what would create the best likelihood for a return on the investments and guarantees that it was getting. Things needed to be cut, and not just the corporate air fleet. This led to the elimination of Saturn, Hummer and Pontiac and the sale of Saab to Spyker. What remained of GM's North American brand portfolio was Chevrolet, Buick, Cadillac, and GMC. (Oldsmobile had been shuttered in 2004.) There were a variety of opinions regarding which brands GM should keep/lose during the midst of the Great Recession. Some thought GMC should be axed, but then it was pointed out that GMC essentially produced high-content Chevys, which resulted in fantastic transaction costs. Lots of money in the back of those pickups. Others thought Buick should be eliminated. The rationale was: Chevy was the mass-market brand, Cadillac was the luxury brand, and GMC helped leverage the company's investment in trucks. (Yes, even back then the F-Series was winning the pickup sales race, so it was always a matter of adding Silverado and Sierra sales to show that GM was solidly in the game.) So what was Buick? Better than Chevy but not as good as a Cadillac? Somehow that doesn't seem to be a particularly aspirational position to hold. But Buick's identity didn't need to be worked out in 2008-09 because there was a single compelling reason to keep it: China. According to official GM history, Pu Yi, the last emperor of China, Dr. Sun Yat-sen, the first provisional president of China, and Zhou Enlai, a Chinese premier, "Either owned, drove or were driven in Buick automobiles." What's more: "According to statistics from the Shanghai government, in 1930 one out of every six cars on the city's roads was a Buick." Which is to say that Buick got to China early and has a major presence in that market. When the Regal Sportback and Regal TourX were being unveiled at the GM Design Dome the first week of April, Duncan Aldred, vice president of Global Buick, gave a briefing of Buick's place on the automotive landscape.

Neil Young's 1953 Buick Roadmaster Skylark brings $400,000 at auction

Mon, Dec 11 2017Singer-songwriter Neil Young's extensive collection of model trains have fetched nearly $300,000 at auction, along with classic cars and musical equipment owned by the 72-year-old folk-rock icon. Young, a model train enthusiast for decades, offered more than 230 pieces at Julien's Auctions in Los Angeles from his collection of Lionel trains, including a custom-painted Commodore Vanderbilt 4-6-4 locomotive that sold for $10,000. Several cars that Young owns were also sold. A 1953 Buick code 76X Roadmaster Skylark convertible with a steering wheel hub that says, "Customized for Neil Young," went for $400,000, the auction house said on Saturday. Young, best known for his Woodstock-era songs as well as his work with the bands Buffalo Springfield and Crosby, Stills, Nash & Young has said the vast model train layouts at his California ranch helped him connect with his son Ben, who has cerebral palsy. Other items auctioned off on Saturday included some of Young's guitars, amplifiers and microphones. A portion of the proceeds will benefit the Bridge School in California, which Young's ex-wife Pegi Young co-founded in 1986 for children with severe speech and physical impairments.Reporting by Joseph AxRelated Video:

GM throttles back Chevy Malibu, Buick LaCrosse production over swollen inventories

Wed, 06 Feb 2013As inventory of the Chevrolet Malibu and Buick LaCrosse continues to pile up, General Motors will be idling its Fairfax Assembly Plant for two weeks, according to Automotive News. This move comes about a month after the plant was shut down for three weeks in late December and early January for the same reason. As of January 31, the GM had a 94-day supply of Malibu stock while the LaCrosse was a little worse with a 117-day supply.

Just last week, GM announced that it would be investing $600 million in upgrading this plant, but it's unclear what future plans the company has in store for Fairfax considering slow sales of both the plant's models. We do expect a refreshed and more luxurious LaCrosse shortly and an early design update for the Malibu to be announced at some point this year, although we have had no official word as to when either will happen.