1974 Buick Regal Survivor 79,000 Act Miles Cool Donk Cruiser Gs Century A Body on 2040-cars

Center City, Minnesota, United States

|

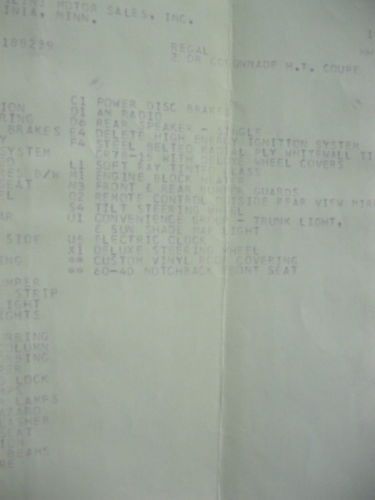

For sale is my 74 Regal two door. The car runs and drives fantastic. New brakes, gas tank, exhaust, water pump and alternator. The car has just under 80,000 miles and I have service records that go back into the 70s. The interior is super nice and the dash is mint. The car has a factory AM/FM radio that works. All lights and wipers and dash components work as they should. The car has great heat and the headliner is perfect. The tires are all matching with no dry rot and good tread. Please ask questions before bidding. Possible trade of a Dodge Ram 4x4. I will store the car for free for as long as it takes because I have had to arrange shipping on a few cars and it can sometimes take a while. Thanks for looking and good luck. Dan 651 274-I09I MN

|

Buick Regal for Sale

2013 buick regal gs(US $28,500.00)

2013 buick regal gs(US $28,500.00) 2013 buick regal turbo sedan 4-door 2.0l

2013 buick regal turbo sedan 4-door 2.0l 1998 buick regal ls sedan 4-door 3.8l(US $4,200.00)

1998 buick regal ls sedan 4-door 3.8l(US $4,200.00) 1996 buick regal 3800 ii sedan 4-door(US $1,700.00)

1996 buick regal 3800 ii sedan 4-door(US $1,700.00) 1987 buick t type no reserve 9sec turbo built regal turbo grand national gnx

1987 buick t type no reserve 9sec turbo built regal turbo grand national gnx 2012 used 2.4l i4 16v automatic fwd sedan onstar(US $18,899.00)

2012 used 2.4l i4 16v automatic fwd sedan onstar(US $18,899.00)

Auto Services in Minnesota

Victory Auto Service & Glass ★★★★★

Victory Auto Service & Glass ★★★★★

Trevis Transmission ★★★★★

T & M Towing & Snow Plowing, Inc. ★★★★★

S & T Auto Repair ★★★★★

Rising Star Auto Sales ★★★★★

Auto blog

Nearly half of Buick dealers choose buyout over investing to sell EVs

Wed, Dec 20 2023In 2022, General Motors gave Buick dealers across the nation a simple choice: invest a significant amount of money to prepare for EVs or opt for a buyout. Over a year later, the brand has reportedly lost nearly half of its dealerships as it prepares to roll out its first electric cars. Trade journal Automotive News reported that the number of Buick dealers in the United States dropped by about 47% during 2023. At the beginning of the year, the network included 1,958 stores; fast-forward to December and that figure stands at approximately 1,000. More dealers could throw in the towel in the coming weeks, as the publication adds that the buyout program remains open and will continue. Dollar figures haven't been released, so we don't know precisely how much money a dealer who opts out can claim from General Motors or how much money a dealer needs to spend to stick with the brand. However, the latter figure falls somewhere between $300,000 and $400,000, Automotive News learned. Dealers notably need to invest in equipment (such as charging stations) and training. Buick doesn't seem fazed by the exodus. "I'm really pleased with where we are. The network, where we are now, is a good size. It's with dealers who are focused on the business, who've shown that they can recover the volume that the dealers who transitioned away were doing," company boss Duncan Aldred said. According to Automotive News, the dealers who chose to stop selling Buick models accounted for about 20% of the brand's sales in the United States. Buick told the publication that around 89% of the American population still lives within 25 miles of one of its dealerships. General Motors extended the same offer to Cadillac dealerships in 2020, and about 150 stores allegedly chose to leave. For context, the dealer network consisted of 880 locations in the United States before executives floated the buyout offer. The dealers who left received between $300,000 to $500,000, the report adds, while preparing to sell electric cars would have set them back by around $200,000. Related video:

GM investing $167m in Spring Hill for new midsize vehicles

Tue, 06 Aug 2013General Motors has announced a large investment in its Spring Hill, Tennessee facility. The former home of Saturn production will be getting a $167 million addition to a previously announced $183 million, to cover a pair of new midsize vehicles. The investment is expected to create 1,800 jobs at the factory.

That $350 million is being divvied up for a pair of programs at Spring Hill. The first will take the bulk of the money ($223 million) and create 1,000 of the 1,800 jobs, while the other will take the remaining $127 million and generate the leftover 800 positions. But GM says the investment will cover "midsize vehicle programs." So what could they be?

The leading candidate in our minds is a new crossover for Buick, called the Anthem, that will slot between the Encore and Enclave, but will be slightly smaller than the Equinox and Terrain. As we've explained, the new model will likely be the first product to sport GM's new D2UX platform, which will eventually replace both the Delta and Theta platforms. Spring Hill is already building the Equinox, so there could be some credence to this theory.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.