2006 Buick Lucerne Cx Sedan 4-door 3.8l on 2040-cars

Holbrook, New York, United States

|

THIS CAR IS BEING SOLD AS/IS THEIR IS NO WARRENTY EXPRESSED OR IMPLIED. YOU ARE WELCOMED TO HAVE THE CAR CHECK BY A 3RD PARTY

|

Buick Lucerne for Sale

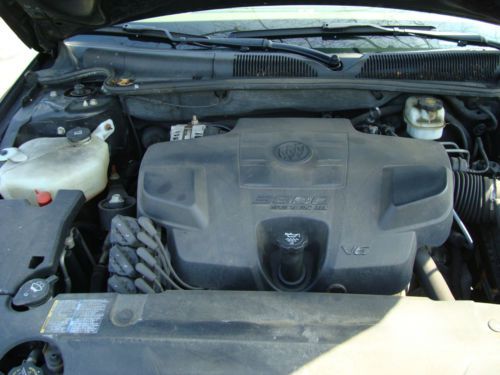

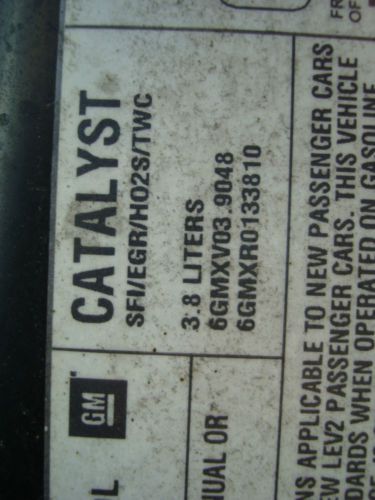

Cxl 3.9l engine 3.9l v6 sfi flexfuel chrome grille fascia fog lamps glass tires

Cxl 3.9l engine 3.9l v6 sfi flexfuel chrome grille fascia fog lamps glass tires 2007 buick lucerne cxl sedan 4-door 3.8l

2007 buick lucerne cxl sedan 4-door 3.8l 2008 buick lucerne cxl climate leather alloy wheels 73k texas direct auto(US $13,780.00)

2008 buick lucerne cxl climate leather alloy wheels 73k texas direct auto(US $13,780.00) 2008 tan leather reverse sensing v6 lifetime warranty we finance 49k miles

2008 tan leather reverse sensing v6 lifetime warranty we finance 49k miles Buick lucerne cxs 4 dr sedan automatic gasoline 4.6l v8 sfi white

Buick lucerne cxs 4 dr sedan automatic gasoline 4.6l v8 sfi white 2007 buick lucerne 4dr sdn v6 cx leather clean carfax carfax buyback guarantee

2007 buick lucerne 4dr sdn v6 cx leather clean carfax carfax buyback guarantee

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Junkyard Gem: 1986 Buick Riviera

Sat, Nov 25 2023The Buick Riviera personal luxury coupe attained monstrous proportions by the middle 1970s, scaling in at well over 4,500 pounds by 1976. After spending 1977 and 1978 as sibling to the Chevy Caprice, the Riviera then moved to the front-wheel-drive platform used by the Cadillac Eldorado and Oldsmobile Toronado, staying there through the 1985 model year. The Riviera world became a lot more interesting for the 1986 model year, when a smaller and more sophisticated generation hit showrooms with curvier lines and electronic gadgetry straight out of science fiction. Today's Junkyard Gem is one of those cars, found in a self-service boneyard in Phoenix, Arizona. What makes this car such a fascinating bit of automotive history is this dash-mounted touchscreen interface, known as the Graphic Control Center. The 1986 Riviera was the first GM vehicle to get the GCC, which means it was the first production car in history with a factory-installed touchscreen display. This system became available in the Buick Reatta and the Oldsmobile Toronado a few years later. The GCC used a cathode-ray tube screen sourced from an ATM manufacturer, which ran on 120VAC power and required an inverter and dangerous high-voltage wiring inside the dash. It was used to operate the HVAC, the radio and the trip computer, as well as to display operating and diagnostic information. The system used numerous bulky components in addition to the dash screen; I've extracted a couple of complete sets of GCC components over the years and plan to build them into a junkyard-parts boombox. As it turned out, the senior-citizen-heavy demographic of Buick shoppers didn't feel great enthusiasm for the GCC and there wasn't a huge sales payoff for this revolutionary technology. That didn't stop GM from introducing the first mass-produced cars with head-up displays a couple of years later. The running gear wasn't quite as sophisticated as the GCC. The 1986-1993 Rivieras got old-fashioned 3.8-liter Buick V6s under their hoods; the one in this car was rated at 140 horsepower and 200 pound-feet. If you wanted a manual transmission in your '86 Rivvie, you were out of luck. A four-speed automatic was mandatory equipment. Note the unusual face-loading cassette deck in front of the shifter; the AM/FM radio was a remote-controlled unit living inside the center console. The MSRP for this car was $19,831, or about $55,691 in 2023 dollars.

Reuss says Cadillac CT6-based Buick could happen

Wed, Apr 15 2015Could the upcoming Cadillac CT6 and its Omega platform spawn a Buick variant? According to General Motors' product chief Mark Reuss, it could potentially be in the cards, but "not yet." "We're working on that," Reuss told Automotive News at the 2015 New York Auto Show. While there hasn't been a large, rear-drive Buick on dealerships since the Roadmaster in 1996, the company gave a big hint that it could head in that direction with the Avenir Concept, shown earlier this year at the Detroit Auto Show. As Automotive News explains, a rear-drive Omega-platform Buick could be a real hit in China, where consumers buy 13 Buicks for every one Cadillac. That move would be a big help to GM's bottom line, too, as it'd significantly increase the Omega platform's economy of scale. If a large Buick based on the CT6 were to head to China, though, it likely wouldn't be a simple case of badge engineering (thank God). Reuss hinted to Automotive News that while the mixed-material construction of the CT6 platform "is very flexible," doing an "identical version of that platform or not is a different conversation." What are your thoughts? Should Buick adopt the Omega platform for an Avenir-based sedan? Should that vehicle be sold here in the US, or should it be a China-only offering? Have your say in Comments. Related Video:

GM claims it's first to sell million 30+ mpg vehicles

Fri, 04 Jan 2013As we continue to put together all the data for the year-end edition of By The Numbers, General Motors has announced that it sold more than a million vehicles in the US last year that achieved at least 30 miles per gallon on the highway. More impressively, GM managed this feat using multiple strategies including small vehicle size, turbocharged engines and hybrid or plug-in technologies across four brands (Buick, Cadillac, Chevrolet and GMC) accounting for 13 separate models. This number will grow even more in 2013 thanks to cars like the all-electric Spark, the diesel Cruze, the range-extended Cadillac ELR and the Buick Encore compact CUV.

GM's small car sales were up 39 percent last year helping to attain this million-sales mark for 30-mpg models, and almost 40 percent of all GM sales consisted of cars with fuel-efficient I4 engines. In regards to more advanced means of improving fuel economy, GM says that it plans on having 500,000 vehicles with "some form of electrification" on the road by 2017.

Scroll down for the full list of GM's million 30+ mpg cars as well as an informative press release.