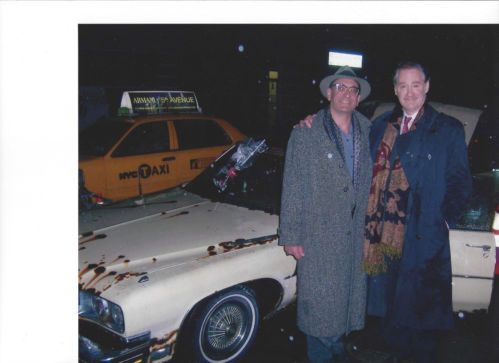

1969 Buick Electra 225 Custom Convertible 2-door 7.0l on 2040-cars

Riverton, New Jersey, United States

|

1969 BUICK ELECTRA 225 CONVERTIBLE, POWER WINDOWS,POWER LOCKS,POWER STEERING, CLEAN RIMS AND TIRES GREAT PROJECT CAR. I wanted keep wife wants it out, Body is perfect needs motor,seats,headlight and bumpers,exhaust and fresh paint and the shows are calling you!!!!

|

Buick Electra for Sale

1977 buick electra 455 custom resto mod 700 hp 350 turbo flowmaster immaculate

1977 buick electra 455 custom resto mod 700 hp 350 turbo flowmaster immaculate Exterior is silver-grey,interior is red 2dr perfect condition interior(US $2,500.00)

Exterior is silver-grey,interior is red 2dr perfect condition interior(US $2,500.00) 401 nailhead 4bbl. cold factory ac. unbelievable survivor.(US $17,500.00)

401 nailhead 4bbl. cold factory ac. unbelievable survivor.(US $17,500.00) 1968 buick electra 225 convertible barn fresh gs, gsx

1968 buick electra 225 convertible barn fresh gs, gsx 1973 buick electra 225 limited hardtop 2-door 7.5l no reserve!

1973 buick electra 225 limited hardtop 2-door 7.5l no reserve! 1975 buick electra limited, all original, with 101 k miles.

1975 buick electra limited, all original, with 101 k miles.

Auto Services in New Jersey

Woodland Auto Body ★★★★★

Westchester Subaru ★★★★★

Wayne Auto Mall Hyundai ★★★★★

Two Guys Autoplex 2 ★★★★★

Toyota Universe ★★★★★

Total Automotive, Inc. ★★★★★

Auto blog

Junkyard Gem: 1956 Buick Special 4-Door Sedan

Sun, Aug 6 2023Buick was flying high in the middle 1950s, with an all-time sales record of nearly 800,000 cars sold for the 1955 model year alone. Buick stood proud in third place for new-car sales in the United States for 1955 and 1956, behind only Chevrolet and Ford. At this time, both Oldsmobile and Buick built cars on the GM B Platform, with the Buick being the swankier and more prestigious of the two. Here's one of those Buicks, found in a Denver self-service boneyard recently. The list price of this car was $2,416, or about $27,505 in 2023 dollars. Located one step down on the GM Ladder of Success, the 1956 Olds 88 sedan started at $2,226 ($25,342 now). The Oldsmobile had a 324-cubic-inch (5.3-liter) Rocket V8 rated at 230 horsepower, which was serious stuff for 1956. This 322-cubic-inch Buick Nailhead V8 made ten fewer horses for 1956, but it would be bored and stroked out to 364 cubes for 1957 (and was all about land-yacht torque, in any case). A three-on-the-tree manual transmission was standard equipment on the 1956 Buick Special, but this one has the $204 Dynaflow automatic transmission ($2,332 in today's money). The Dynaflow usually gets called a two-speed, but it drove like more of a very inefficient (yet smooth) CVT that had two manually-selected ranges. This car spent too many decades outdoors to have any chance of a restoration. As often happens with cars stored in fields in rural Colorado, someone used this Buick for target practice. The bullet holes look like little VentiPorts. Does the '56 Buick go? Va-va-va-voom!

Buick Cascada will start at $33,990

Fri, Sep 25 2015The Buick Cascada goes on sale early next year, bringing open-air motoring to the brand in the US for the first time in 25 years, and you'll need $33,990 to buy the standard model. Notice there's no asterisk after that price in the headline, because $33,990 includes the destination charge. Buick compares this convertible with the $37,525 Audi A3 droptop, noting that the 200-horsepower Cascada has 30 more hp, navigation and heated front seats as standard, eight-way power seats instead of four-way, 20-inch wheels instead of 17-inchers, and a heated steering wheel. The Cascada in Premium trim will run $36,990 and add forward collision alert and lane departure warning, auto headlights, park assist front and back, rain-sensing wipers, and two air deflectors. Quite a few of you have commented that it would be great if Buick could price the Cascada where the defunct Chrysler 200 Convertible used to live, and it's in the neighborhood. The 2014 200 S convertible was the top of the line in the model's last year, came with a 283-hp, 3.6-liter V6, and started at $33,445 before destination. It lacked the features, refinement, and looks of the Cascada, and that thirsty V6 got you gas mileage of 14 highway, 21 city. The soon-to-depart Volkswagen Eos, which also comes up frequently in Comments, starts at $32,860 after destination. If Buick kept the suspension tuning engaging, this could be really good. There's a press release below with more info. Your browser does not support iframes. Buick Cascada Priced at $33,990 Well-equipped convertible offers high levels of standard content, technology DETROIT, 2015-09-23 – The top-down driving experience of the 2016 Cascada – Buick's first convertible offered in the United States in 25 years – is priced at $33,990. When it goes on sale early next year, the Cascada will offer more standard content, a more powerful standard engine and a lower starting price than the Audi A3 Cabriolet. "Cascada expands Buick's lineup with a uniquely fun and personal driving experience," said Duncan Aldred, vice president of Buick. "With a lower price than key competitors, it also promises to shake up the segment – and look good doing it." The 2016 Cascada – designed from the ground up as a convertible – comes well-equipped in a 2+2 configuration, with room for four adults.

The last Buick Cascada unceremoniously rolls off the assembly line

Mon, Oct 7 2019Motorists in the market for a new Buick Cascada need to act fast. Peugeot-owned Opel has built the last example of the drop-top model in its Gliwice, Poland, factory, and there's no replacement in sight. Buick announced the Cascada's demise in early 2019, and GM Authority learned the model went out unceremoniously. There's no indication that the final example received a commemorative plaque on its dashboard, or is headed to a private collection; photos of it aren't even available. The dealership who ordered it might not know it's about to receive the last specimen of the breed. As a non-luxury, front-wheel-drive convertible, the Cascada was marooned on an island that Buick's rivals abandoned halfway through the 2010s. The Chrysler 200 Convertible and the Volkswagen Eos were discontinued after the 2014 and 2015 model years, respectively. Landing in a class of one likely raised more than a few eyebrows in Buick's product planning division, but it was a semi-enviable position that helped the firm sell about 17,000 units of the Cascada between the 2016 and 2019 model years. It proudly pointed out about 60 percent of buyers were new to General Motors. Left-hand-drive examples of the Cascada were sold under the Buick and Opel banners. Right-hand-drive models joined the Vauxhall range in the United Kingdom, and they wore a Holden emblem in Australia. The four flavors were identical with the exception of some brand-specific trim pieces and powertrains. None will get a successor; the aforementioned carmakers are no longer operating under the same roof, and the global convertible segment is steadily shrinking. The Cascada's multinational provenance made more sense before General Motors sold its Opel and Vauxhall divisions to PSA Groupe, the Paris-based carmaker that owns Peugeot, Citroen and DS. The French firm pledged to keep producing cars for Buick for as long as necessary, but the former sister companies tacitly agreed to stop co-developing vehicles. The sedan and station wagon variants of the Regal are now the only Opel-designed, PSA-built model left in the the Buick portfolio.