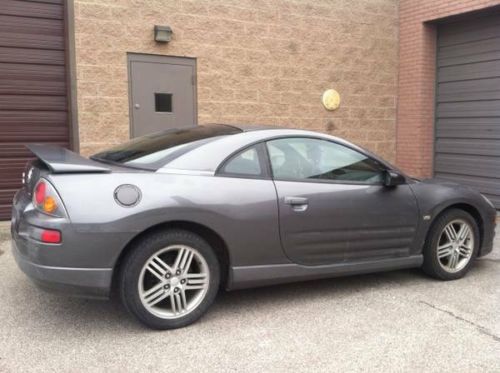

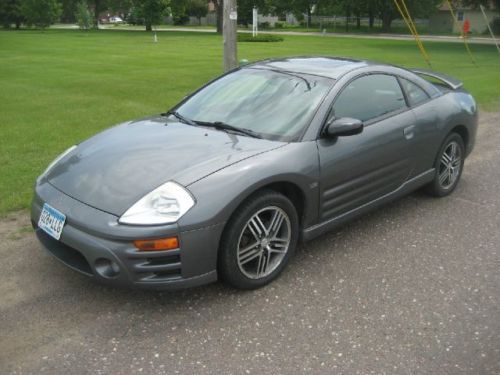

2009 Mitsubishi Eclipse Gt Premium Sport Leather Xenons Heated Seats Sunroof Wow on 2040-cars

Skokie, Illinois, United States

For Sale By:Dealer

Engine:6

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Used

Year: 2009

Make: Mitsubishi

Model: Eclipse

Disability Equipped: No

Doors: 2

Mileage: 55,020

Drivetrain: Front Wheel Drive

Sub Model: GT 3dr Coupe

Trim: GT Coupe 2-Door

Exterior Color: White

Drive Type: FWD

Interior Color: Black

Number of Cylinders: 6

Mitsubishi Eclipse for Sale

2000 mitsubishi eclipse gt hatchback automatic 6 cylinder no reserve

2000 mitsubishi eclipse gt hatchback automatic 6 cylinder no reserve 1994 mitsubishi eclipse 2.4l turbo dsm 1g 6 bolt gst must see(US $6,750.00)

1994 mitsubishi eclipse 2.4l turbo dsm 1g 6 bolt gst must see(US $6,750.00) 2003 mitsubishi eclipse gt coupe 2-door 3.0l

2003 mitsubishi eclipse gt coupe 2-door 3.0l 2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $550.00)

2003 mitsubishi eclipse gs coupe 2-door 2.4l(US $550.00) 2004 mitsubishi eclipse gts, 5-spd manual, 3.0l v-6, loaded

2004 mitsubishi eclipse gts, 5-spd manual, 3.0l v-6, loaded 1997 mitsubishi eclipse 2 dr. gs

1997 mitsubishi eclipse 2 dr. gs

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

Mitsubishi Lancer Evo X Final Edition gets official for Japan only

Thu, Apr 16 2015It'll be the end of an era when Mitsubishi discontinues the Lancer Evolution, putting to rest a dynasty that challenged the Subauru WRX STI for decades. But before it does, the Diamond-Star automaker is sending off its most celebrated model with the Final Edition you see here. Unfortunately, it's nowhere near as cool as the concept. While the showcar pumped the output from its 2.0-liter turbo four to 473 horsepower thanks to a remapped ECU and a fresh HKS turbocharger, the production version is sticking with the stock 296 hp. It's otherwise based on the GSR model, so it's got a five-speed gearbox, but packs a long list of top-shelf equipment: BBS alloys, Bilstein shocks, Eibach springs, Brembo brakes, Recaro seats... the works. Mitsubishi will only offer 1,000 examples of the Evo X Final Edition in Japan, where buyers will be able to choose between five exterior colors and a contrasting roof in black or white. We don't know at this point whether a similar special will be offered Stateside, but if it is, we hope it'll pack at least some of the concept's power upgrades (we can dream, right?).

Mitsubishi denies plans for Toyota/Subaru rival sports coupe

Tue, 23 Oct 2012Forgive us for being wistful, but there was a time when Mitsubishi coupes and sports cars were the downright awesome. The 1990s brought us the all-wheel drive, turbocharged Eclipse GSX and the twin-turbocharged 3000GT VR-4 (seen here). The times, they were good.

Fast-forward to today, and the Lancer Evolution exists as Mitsubishi's sole, true performance offering. Mitsubishi killed off the Eclipse last year, by which time it had lost much the luster of its predecessors. With an affordable Japanese sports car fomenting underway thanks to Scion FR-S and Subaru BRZ, one may think that it's an ideal time for a brand like Mitsubishi to jump back into the performance coupe game. A rear-drive Mitsubishi sports car to take on the Toyobaru twins could be just what the brand needs to gain some mindshare among consumers.

Not so, says Osamu Masuko. The president and executive director of Mitsubishi told reporters at the Sydney Motor Show, "Our engineers are very prominent to investigate new technologies, but to use that technology they are not that good to bring the revenue to make that money." Read: the engineers want to do it, but the company does not find it to be financially responsible.

Even Consumer Reports is savaging the Mitsubishi Mirage

Tue, 24 Jun 2014When we reviewed the 2014 Mitsubishi Mirage a few months ago, we absolutely hated it. Our conclusion was that if you needed a car in this segment to either pay a few hundred dollars more for a Chevy Spark or spend less for an entry-level Nissan Versa. Basically, avoid this Mitsubishi at all costs. It turns out that we weren't the only ones who despised it. Consumer Reports can often find something positive about just about any vehicle, but even the usually gentle publication struggles to find compliments when it comes to the Mirage.

It's most serious gripe concerns the model's handling. CR describes the way that the Mirage wallows around turns with tons of body lean even at low speeds as "scary." A little car with a curb weight of 2,051 pounds just shouldn't corner this poorly.

While Consumer Reports definitely has no love when it comes to the 2014 Mirage, finding something to dislike about practically every aspect of the vehicle from its powertrain to the interior, the reviewers do end up digging out one positive aspect. You'll have to scroll down and watch the video to find out what it is.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.042 s, 7972 u