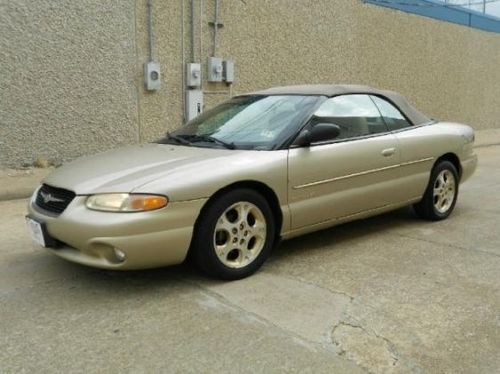

2000 Chrysler Sebring Jxi Convertible 2-door 2.5l on 2040-cars

Triangle, Virginia, United States

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Salvage

Body Type:Convertible

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 137,000

Make: Chrysler

Exterior Color: Gold

Model: Sebring

Interior Color: Tan

Trim: JXi Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Number of Cylinders: 6

Options: Cassette Player, Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Chrysler Sebring for Sale

2010 chrysler sebring touring 39k low miles great shape we finance 1.9% w.a.c(US $12,000.00)

2010 chrysler sebring touring 39k low miles great shape we finance 1.9% w.a.c(US $12,000.00) 2.4l i-4 cyl 4-speed automatic sedan silver 10 cd player automatic keyless entry

2.4l i-4 cyl 4-speed automatic sedan silver 10 cd player automatic keyless entry 2007 used 2.4l i4 16v automatic fwd sedan(US $7,991.00)

2007 used 2.4l i4 16v automatic fwd sedan(US $7,991.00) Lqqk-51,000 mile red pearlcoat 2000 chrysler sebring jxi conv`t-no reserve-wow!!

Lqqk-51,000 mile red pearlcoat 2000 chrysler sebring jxi conv`t-no reserve-wow!! 2005 chrysler sebring limited convertible low miles premium leather/suede cd(US $9,950.00)

2005 chrysler sebring limited convertible low miles premium leather/suede cd(US $9,950.00) 2003 chrysler sebring lxi sedan 4-door 2.7l - complete but has bad motor!

2003 chrysler sebring lxi sedan 4-door 2.7l - complete but has bad motor!

Auto Services in Virginia

Wiygul Automotive Clinic ★★★★★

Valle Auto Service ★★★★★

Trusted Auto Care ★★★★★

Stanton`s Towing ★★★★★

Southside Collision ★★★★★

Silas Suds Mobile Detailing ★★★★★

Auto blog

Fiat to list on New York Stock Exchange?

Mon, 06 Jan 2014Citing the ever-nebulous "two sources close to Fiat," Reuters is reporting that the Italian automaker and owner of the Chrysler brand is likely to list itself on the New York Stock Exchange. The move could reportedly happen as soon as 2015, marking the end, at least in the minds of investors, of Fiat's 115-year base in Turin, Italy.

The Italian government is not likely to react favorably to Fiat's potential move from Italy to the United States, despite initially positive reactions to Fiat's landmark final purchase of Chrysler, the third-largest automaker in the US. Fiat spent $3.65 billion to buy out the 41.46-percent stake in Chrysler that had been owned by the United Auto Workers' VEBA trust fund.

With little sign of a swift European recovery, Fiat has little choice but to focus on markets outside its traditional home, and a listing in New York could potentially be a boon for investors. According to International Strategy and Investment analyst George Galliers, speaking to Reuters, "People [would be] more likely to think of the entity in the same context as they do Ford and GM" if it were listed on the NYSE.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot