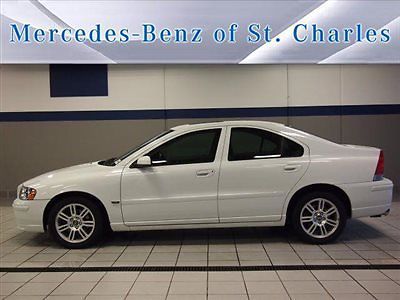

2012 Volvo S60, T5, Exceptional, 18,000 Miles, Original Owner on 2040-cars

Canoga Park, California, United States

|

Very clean. Kept in garage. Original owner. Heated seats, leather, navigation, folding rear seats. 18,000 miles. In excellent condition. Always maintained. Never smoked in. Still under factory warranty.

|

Volvo S60 for Sale

Auto Services in California

Yes Auto Glass ★★★★★

Yarbrough Brothers Towing ★★★★★

Xtreme Liners Spray-on Bedliners ★★★★★

Wolf`s Foreign Car Service Inc ★★★★★

White Oaks Auto Repair ★★★★★

Warner Transmissions ★★★★★

Auto blog

Driving the Ford Explorer ST and Volvo V60 Cross Country | Autoblog Podcast #613

Fri, Feb 7 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick. First they talk about driving the Volvo V60 Cross Country and Ford Explorer ST, with some thoughts about the Subaru Outback and Super Bowl commercials as well. Then they dive into the mailbag, answering questions and following up on the outcomes of previous "Spend My Money" segments. Finally they wrap things off with a new "Spend My Money," in which they help a listener pick a new car that will accommodate a new, tiny family member without sucking all the fun out of driving. Autoblog Podcast #613 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars We're Driving: 2020 Volvo V60 Cross Country 2020 Ford Explorer ST 2020 Subaru Outback Super Bowl ads Mail bag Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Volvo Cars leaps 22% in IPO stock debut — a big endorsement for EVs

Fri, Oct 29 2021Volvo Cars CEO Hakan Samuelsson at the automakers' stock market opening bell on Friday in Stockholm. (Getty Images)  STOCKHOLM — Volvo Cars shares surged 22% on their Stockholm market debut on Friday after wrapping up Europe's biggest IPO of the year so far, in a boost for new issues markets and carmakers' vision of an electric future. The Gothenburg-based company cut the size of its listing and priced it at the bottom of a previously-announced range UPDATE 3-Volvo Cars gives itself $18 bln price tag as cuts IPO size - Reuters News on Monday, valuing it at just over $18 billion and making it Sweden's second largest listing yet. But the successful deal and strong market reaction — which propels the valuation to about $22 billion — is a lift for a European automotive industry that has embarked on a challenging transition towards electric vehicles (EVs). It also shows that while the euphoria over initial public offerings (IPO) in the first half of 2021 is over, the market is open for new listings of big companies with a story to tell. Volvo Cars Chief Executive Hakan Samuelsson said the listing showed a recognition of its transition plans, adding it would be key for Volvo to demonstrate it is on track to be the "fastest transformer." "There's a much bigger interest in the market to invest in electric car makers than in the conventional ones. So we better do what we said we would," he told Reuters in an interview. Shares in the carmaker, which is majority owned by China's Geely Holding, were trading at 64.70 Swedish crowns ($7.59) at 1057 GMT, after being priced at 53 crowns in the IPO. Polestar Apart from Volvo's commitment to becoming a purely electric carmaker by 2030, it also has a 49% stake in EV venture Polestar, which said in September it would go public through a $20 billion deal. Samuelsson said Polestar had a "good valuation." "They are already electric... showing in a way what the potential would be for Volvo if this (the transformation) is done in the right way." A source familiar with Volvo's transaction said the outcome of this week's IPO was good, even though investors had pushed back and forced Volvo to price at the bottom of the announced range. "The company had to compromise on size and the governance structure. They were hoping for a read across on Polestar, but they were clearly not getting that," the source said, requesting anonymity because they were not authorised to speak to the press.

Volvo credits China, Europe for first-half profitability

Fri, 22 Aug 2014If everything goes to plan, Volvo might be showing the first signs of a turnaround after several years coping with old products and a staid image. The Swedish brand is imminently launching its next-gen XC90 SUV on a completely revised, modular platform and using a cutting-edge family of engines, and it has even more products to take advantage of the fresh components on the drawing board. "We are excited about the launch of the all-new XC90, which marks the beginning of the re-launch of the Volvo brand," said CEO Håkan Samuelsson in the company's announcement. In the meantime, the business is moving back to profitability and is even forecasting growth through the rest of 2014.

In Volvo's recently released financial and sales results for the first six months of the year, volume was up 9.5 percent to 299,013 cars. On top of that, operating income reached 1.21 billion Swedish krona ($175 million) after posting a loss in the same period in 2013. Net income was also improved to 535 million Swedish krona ($77.4 million), which was also a reversal from a negative last year.

With these great results, Volvo is now forecasting 10 percent sales growth worldwide by the end of the year, and the key to it is a booming market in some regions. China, home to parent company Geely, was up 34.4 percent first half of the year. It's now Volvo's biggest market in the world and helped by exclusive models like the S60L (pictured above) and S80L. "We are growing our presence in China and we expect to sell at least 80,000 cars there this year," said Samuelsson in the company's forecast.

2004 volvo s60 2.5t sedan 4-door 2.5l

2004 volvo s60 2.5t sedan 4-door 2.5l 2003 volvo s60 2.4t sedan 4-door 2.4l

2003 volvo s60 2.4t sedan 4-door 2.4l 2006 volvo s60

2006 volvo s60 2013 volvo s60 t5 turbocharged, white, only 6miles

2013 volvo s60 t5 turbocharged, white, only 6miles 2006 volvo s60 2.5t; clean; nice car!!

2006 volvo s60 2.5t; clean; nice car!! 2006 volvo s60 2.5t sedan 4-door 2.5l

2006 volvo s60 2.5t sedan 4-door 2.5l