2013 Volvo C70 T5 Premier Plus 2dr Convertible on 2040-cars

Houston, Texas, United States

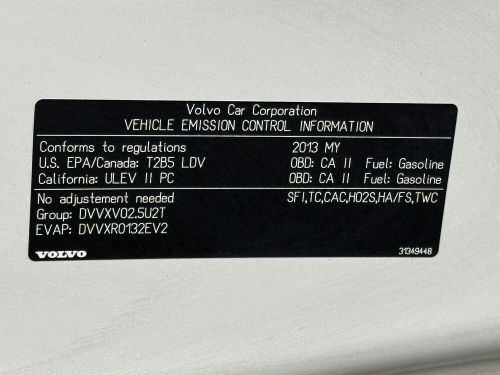

Engine:2.5L I5 Turbocharger

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): YV1672MC1DJ143989

Mileage: 53961

Make: Volvo

Trim: T5 Premier Plus 2dr Convertible

Drive Type: --

Number of Cylinders: 2.5L I5

Features: --

Power Options: --

Exterior Color: White

Interior Color: Tan

Warranty: Unspecified

Model: C70

Volvo C70 for Sale

2011 volvo c70 t5(US $7,900.00)

2011 volvo c70 t5(US $7,900.00) 2013 volvo c70 t5(US $8,950.00)

2013 volvo c70 t5(US $8,950.00) 2013 volvo c70 t5 convertible 2d(US $15,995.00)

2013 volvo c70 t5 convertible 2d(US $15,995.00) 2002 volvo c70 ht(US $14,695.00)

2002 volvo c70 ht(US $14,695.00) 2004 volvo c70(US $7,980.00)

2004 volvo c70(US $7,980.00) 2008 volvo c70 t5(US $8,500.00)

2008 volvo c70 t5(US $8,500.00)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Volvo to stop funding Polestar, sees stock rise dramatically

Thu, Feb 1 2024STOCKHOLM — Volvo Cars said on Thursday it would stop funding Polestar Automotive Holding and was handing responsibility for the struggling luxury car brand over to Volvo's top shareholder China's Geely Holding. The announcement sent the Swedish automaker's stock up more than 30% at market open. The heavy involvement by Swedish-listed Volvo Cars in Polestar, where it owns around 48% of the shares, has been criticised by analysts who see the stake as a drag on Volvo's resources. Like other new EV brands and startups, Polestar has struggled to make headway, particularly since Tesla started a price war last year. The automaker said earlier this month that it had missed its already-reduced delivery targets for 2023. Polestar's shares are down just over 83% since it went public in June 2022 via a merger with a special purpose acquisition company, or SPAC. Volvo Cars said it has considered handing Polestar shares over to Volvo's shareholders, which would make Geely a big direct owner in the brand. Shares in Volvo were up 20% at 0814 GMT, after they soared 32% at market open. Geely in a separate statement welcomed Volvo's decision to focus its resources on its own development. "Geely Holding will continue to provide full operational and financial support to the independent exclusive (Polestar) brand going forward," the Chinese group said. "This support will not require a reduction of Geely Holding shareholding in Volvo Cars," it added. However, the broker Bernstein said it saw a distinct possibility that the Geely ecosystem could sell down its shares in Volvo. Polestar last week said it planned to cut around 450 jobs globally, or about 15% of its workforce, amid "challenging market conditions". It also said in November that it would try to reduce its reliance on external help, publishing a revised business plan, which included getting additional loans from Volvo and Geely. The news could raise questions about the viability of Polestar, which aims to become cash flow break-even in 2025. Some analysts have said it could make more sense to fold Polestar company into Geely. Volvo Cars meanwhile reported a bigger than expected rise in fourth-quarter operating earnings on Thursday, with operating income excluding joint ventures and associates rising to 6.7 billion Swedish crowns ($643.83 million) from a year-earlier 3.9 billion. Analysts polled by LSEG had expected adjusted earnings before tax and interest (EBIT) of 6.5 billion.

Russian auto boomtown grinds to halt over Ukraine sanctions

Tue, Apr 5 2022Thousands of auto workers have been furloughed and food prices are soaring as Western sanctions pummel the small Russian city of Kaluga and its flagship foreign carmakers, with more sanctions likely to come. The Kaluga region, 190 kilometers (120 miles) southwest of Moscow, says it has attracted more than 1.3 trillion roubles ($15 billion) in investment, mostly foreign, since 2006. But Western sanctions imposed in recent weeks after Russia sent tens of thousands of troops into Ukraine have exacerbated lingering component shortages and halted production at two flagship car plants, Germany's Volkswagen and Sweden's Volvo. A third, the PSMA Rus plant that is a joint venture between Stellantis and Mitsubishi and employs 2,000, may halt production soon due to a lack of parts, Stellantis' chief executive said last Thursday. "It is not clear what will happen. They don't give us any concrete information," said Pavel Terpugov, a welder at the PSMA Rus plant. Terpugov said he needs twice as much money to buy groceries than before the sanctions. Analysts have forecast Russian inflation could soar to 24% this year, while the economy may shrink to 2009 levels. The United States and Europe are weighing more sanctions against Russia after Ukraine accused Russian forces of civilian killings in northern Ukraine, where a mass grave was found in Bucha, outside Kyiv. Russia calls its actions in Ukraine a "special operation" and the Kremlin categorically denied any accusations related to the murder of civilians, including in Bucha. One source of hope for some in Kaluga, with its 325,000 residents, is the West may be reluctant to hurt its own companies. "Does it make sense to impose sanctions on its own plant and lose money?" said Valery Uglov, an auto mechanic at the Volkswagen plant. "Does it make sense to lose the Russian market?" "We hope to return to work as soon as possible and everyone will have confidence in the future again," Uglov said. Volkswagen, whose factory employs 4,200 people, in early March suspended operations. A spokeswoman said production remained frozen. Volvo Group, which employs over 600 people to build trucks, also suspended production. Even before the sanctions, Russian car sales had contracted from 2.8 million units from when the Volkswagen factory opened in 2007 to 1.67 million units last year, damaged by both sanctions after the 2014 annexation of Crimea and the COVID-19 pandemic.

Automakers suspend some business in Russia following invasion

Mon, Feb 28 2022These Russian GAZ Tigr infantry mobility vehicles were destroyed by Ukrainian fighters in Kharkiv on Monday. (Getty Images) Â Global auto and truck makers, including Sweden's Volvo Cars and Germany's Daimler Truck, on Monday suspended some business in Russia following that country's invasion of Ukraine. Russian forces invaded Ukraine last week, marking the biggest attack by one state against another in Europe since World War II. Many firms have idled operations in Russia following Western sanctions against Russia. Energy giant BP Plc, Russia's biggest foreign investor, abruptly announced over the weekend it was abandoning its 20% stake in state-controlled Rosneft at a cost of up to $25 billion. On Monday, Swedish automaker Volvo Cars said it would suspend car shipments to the Russian market until further notice, becoming the first international automaker to do so as sanctions over the invasion continue to bite. In a statement, the company said it had made the decision because of "potential risks associated with trading material with Russia, including the sanctions imposed by the EU and US." "Volvo Cars will not deliver any cars to the Russian market until further notice," it said. A Volvo spokesman said the carmaker exports vehicles to Russia from plants in Sweden, China and the United States. This came as Russia warned Sweden and Finland not to join NATO or risk facing “serious military-political consequences." Volvo sold around 9,000 cars in Russia in 2021, based on industry data. Earlier on Monday, RIA news agency reported Volkswagen had temporarily suspended deliveries of cars already in Russia to local dealerships, citing a company statement. VW had no immediate comment when contacted by Reuters. VW previously said it would halt production for a few days this week at two German factories after a delay in getting parts made in Ukraine. Daimler Truck said on Monday it would freeze its business activities in Russia with immediate effect, including its cooperation with Russian truck maker Kamaz. Mercedes-Benz Group is also looking into legal options to divest its 15% stake in Kamaz as quickly as possible, the Handelsblatt newspaper reported. A Mercedes spokesperson told Reuters business activities would have to be re-evaluated in light of the current events. Mercedes-Benz Group, formerly Daimler AG, was the parent company of Daimler Truck before the truck maker was spun off.