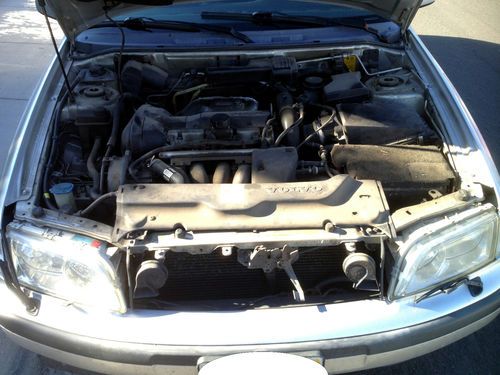

**parts Vehicle** 2000 Volvo V40 Base Wagon 4-door 1.9l on 2040-cars

Gardnerville, Nevada, United States

Body Type:Wagon

Vehicle Title:Clear

Engine:1.9L 1948CC l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 4

Make: Volvo

Model: V40

Trim: Base Wagon 4-Door

Options: Sunroof, Cassette Player, Leather Seats, CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag

Mileage: 217,447

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Silver

Interior Color: Black

For sale is this 2000 Volvo V40 with leather interior, 217,447 miles and a clean title as a parts vehicle. VIN YV1VW2554YF483953 I blew the head gaskets so the motor is toast. It is located in Northern Nevada and will need to be picked up. Please email any questions.

Volvo V40 for Sale

2001 volvo v40 base wagon 4-door 1.9l

2001 volvo v40 base wagon 4-door 1.9l 04 volvo v40- 1 owner! full service history! warranty! 30 mpg (v70 850 s40)(US $7,975.00)

04 volvo v40- 1 owner! full service history! warranty! 30 mpg (v70 850 s40)(US $7,975.00) 2002 02 v40 no reserve non smoker loaded clean leather

2002 02 v40 no reserve non smoker loaded clean leather 2001 volvo v40 base wagon 4-door 1.9l

2001 volvo v40 base wagon 4-door 1.9l Volvo v40 power sunroof dual heated seats cold a/c leather seats no reserve only

Volvo v40 power sunroof dual heated seats cold a/c leather seats no reserve only 2003 v 40 turbo wagon - only 104k! every option! very nice! $99 no reserve!

2003 v 40 turbo wagon - only 104k! every option! very nice! $99 no reserve!

Auto Services in Nevada

Xpress Lube ★★★★★

USA Towing Inc. ★★★★★

Universal Auto ★★★★★

Thomas Automotive ★★★★★

Sunset Collision Center Inc. ★★★★★

Sun Auto Service ★★★★★

Auto blog

Volvo blames EU tariffs as it lowers its 2024 sales forecast

Thu, Jul 18 2024STOCKHOLM — Volvo Cars cut its full-year retail sales forecast on Thursday, blaming European tariffs on EVs made in China that will hit one of the Swedish automaker's key electric models until it shifts production to Belgium. While reporting better than expected second-quarter results that sent its shares up 6% in morning trade, Volvo lowered its forecast for sales growth this year to 12%-15%, down from 15%. "It's really driven by tariffs," CEO Jim Rowan told Reuters. "It's a short-term issue for us, but it is an issue and we're just going to have to deal with that." Rowan said that while Volvo still hoped for 15% growth, it was now providing a range given the uncertainty. "We wanted to put a floor on that for the markets to say we're still going to grow but there are some headwinds," he said. Earlier this month, the EU announced provisional tariffs of up to 37.6% on imports of EVs made in China, saying they benefited from unfair subsidies — an allegation Beijing rejects. Volvo is majority-owned by China's Geely and faces a 19.9% tariff on its Chinese-made fully-electric EX30. Rowan said the Swedish automaker faced a "minimum of six months" of tariffs until it moves EX30 production to Belgium, which is expected to start early next year. Volvo said the main ramp-up of EX30 production at its factory in Ghent was expected during the second half of 2025. Bernstein analysts said in a note that the new sales guidance was "sensible given todayÂ’s macroeconomic situation." Major automakers have seen slowing demand for EVs, driven in part by a lack of affordable models and the slow rollout of charging points. Meanwhile, U.S. and European automakers have reported strong sales of hybrids, and are rolling out more such models to meet demand. Volvo said it saw a "modest decline" in orders for fully electric models in the second quarter, but noted "demand for hybrid cars remains very strong". "We will continue to invest in this line-up and these cars form a solid bridge for our customers not yet ready to move to full electrification," Rowan told analysts in a conference call. Volvo produced 211,900 cars in the second quarter, more than it sold amid the decline in European demand for EVs. Its operating income, which includes its stake in loss-making Polestar, rose to 8 billion crowns ($758 million) from 5 billion crowns a year earlier. That topped the 6.7 billion crowns expected by analysts, LSEG data showed.

Scratch that new crossover, Volvo teases ad campaign for XC60

Sun, 26 May 2013If we were to paraphrase the opening lines of Kenneth Graeme's Wind in the Willows for our own purposes, we'd write, "Have you heard about Volvo? They never planned a new crossover at all. It was all a horrid low trick of theirs...." To be fair, though, we can't blame them for our own presumption. When the Swedish car company created a site called LeaveTheWorldBehind.com and teased a couple of videos for some kind of collaboration with Swedish House Mafia, we thought the crossover in one of the teasers pointed to a new vehicle on the way.

Turns out that's not the case. It really is 'just' a collaboration with the band on a music video for Swedish artist Lune's cover of their 2009 song, Leave the World Behind.

But there are Volvos in it, and you can watch it below and hear original song alongside. We've also included the press release with more details on why it all came together, and a behind-the-scenes video on the collabo. To paraphrase Forrest Gump, "That's all we have to say about that."

Verizon buys Telogis in connected vehicle market push

Wed, Jun 22 2016(Note/disclaimer: We are owned by Verizon, by way of AOL. This gives us no inside track whatsoever when it comes to news.) With a lot of tech companies and automakers staking their claims in the connected car space, now there are signs that others are looking to move in, too. Today, telecoms giant Verizon announced that it is acquiring Telogis, a California-based company that develops cloud-based solutions for mobile workforces, and specifically telematics, compliance and navigation software used by Ford, Volvo, GM and other car companies, as well as Apple and AT&T. Financial terms of the deal have not been disclosed, although we'll try to find out. Considering that Verizon in 2015 reported full-year revenues of $131.6 billion, the price would have to be very high to be considered "material" and may not be made public for some time, if ever. Telogis in its time as a startup raised a substantial amount of money, just over $126 million in all, including $93 million in 2013, supposedly ahead of an IPO, all from Kleiner Perkins Caufield & Byers. Back in 2013 when KPCB made its investment (which was the first from a VC firm in the company), Telogis told TechCrunch it was profitable and forecasting revenues of $100 million annually for the year. It's not clear what size those revenues are now, but if it was on the same growth trajectory as before the funding, sales would be around $150 million annually, with profitability, at the moment. Other investors include some very notable strategics: the investment arm of General Motors, and Fontinalis Partners, which also invests in Lyft and was co-founded by Bill Ford, the executive chairman of the Ford Motor Company. Before the acquisition, Verizon actually had a business in fleet management and telematics; in fact, the two companies competed against each other for business from the trucking and other industries. Verizon Telematics, as the business is called, is active in 40 countries. But in a way, Verizon buying Telogis is a sign that the latter may have proved to be the more superior, and the one with the key customer deals.