1983 Vw Rabbit Mk1 65k Original Miles! Automatic! on 2040-cars

Arvada, Colorado, United States

|

Up for Auction is a 83 Rabbit MK1 with 65k original miles. It has brand new tires less then 1000 miles on them. I'm the third owner the first was a grandpa that owned it until a couple of years ago. The second owner was a older man that lowered the car professionally. He only put 2k miles on in 3 years.

I bought it with my wife's and daughters permission but they do not like riding in it. Since its lower it's a little bouncy. It's on coilovers.

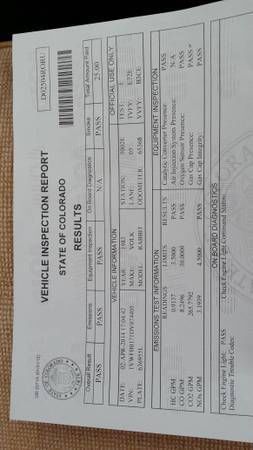

It really only has 65k original miles. I drive it daily so this will be increasing at a slow pace. As you can see by the emissions test she passed with flying colors. If you have any questions just let me know.

The starter has been spinning once a week so that will have to be changed in the near future. But everything is operational and in great shape for a 31 year old VW Mk1. There is minimal scratches with no body damage. This VW is in great shape. I wish I could keep it. It turns heads!!!!

The buyer will be responsible for pick up/ delivery. Sold in Arvada, CO 80003

|

Volkswagen Rabbit for Sale

Black, rabbit, used(US $8,900.00)

Black, rabbit, used(US $8,900.00) 2007 volkswagen rabbit 2.5 hatchback 4-door 2.5l(US $6,500.00)

2007 volkswagen rabbit 2.5 hatchback 4-door 2.5l(US $6,500.00) No reserve vw rabbit s manual 2dr hatchback 2.5l 4cyl fwd alloys warranty

No reserve vw rabbit s manual 2dr hatchback 2.5l 4cyl fwd alloys warranty 2008 vw rabbit damaged wrecked rebuildable salvage repairable project e z fix(US $3,995.00)

2008 vw rabbit damaged wrecked rebuildable salvage repairable project e z fix(US $3,995.00) 1984 volkswagen rabbit l hatchback 2-door 1.6l

1984 volkswagen rabbit l hatchback 2-door 1.6l 1982 volkswagen rabbit convertible base convertible 2-door 1.7l

1982 volkswagen rabbit convertible base convertible 2-door 1.7l

Auto Services in Colorado

We are West Vail Shell ★★★★★

Vanatta Auto Electric ★★★★★

Tim`s Transmission & Auto Repair ★★★★★

South Colorado Springs Nissan ★★★★★

Santos Muffler Auto ★★★★★

RV Four Seasons ★★★★★

Auto blog

2024 CES Mega Photo Gallery: Honda concepts, a VinFast truck and flying cars galore

Thu, Jan 11 2024The 2024 rendition of CES is coming to a close, and per usual, it was full of all the funky, futuristic tech the show is long known for. It’s also full of cars and legitimately forward-thinking tech related to cars, and we were on the ground to see it all and bring photos to you in this Mega Gallery. A boatload of manufacturers attended and made big reveals, from the Star Wars-like Honda concept cars to a pickup truck from VinFast, the sort of debuts we got to see ran the gamut. Of course, there were plenty of reveals and vehicles on the floor that were even more outlandish than concepts from traditional OEMs like Honda and Mercedes. Check out this flying Xpeng car as an example. Or perhaps the flying Mansory car. Apparently, flying cars were a theme. Anyway, make sure you scroll down to check out the various reveals and photos of the cars and technologies revealed at the 2024 CES in our barrage of galleries. Honda 0 Series Honda 0 Series saloon 1 View 26 Photos VinFast Wild pickup VinFast Wild 10 View 10 Photos VinFast VF3 VinFast VF3 1 View 4 Photos VW GTI Prototype with AI-enhanced infotainment CES 2024: New Volkswagen GTI with AI-Enhanced Infotainment View 17 Photos Kia PBV Concept Kia PBV Concept platform View 28 Photos Sony Honda Mobility Afeela concept Afeela by Sony Honda Mobility View 5 Photos Hyundai Mobion Concept Hyundai Mobion Concept CES 2024 View 6 Photos Mullen Five RS Mullen 2 View 14 Photos Mansory Empower concept Mansory Empower concept View 14 Photos Hyundai Supernal S-A2 eVTOL Hyundai Supernal S-A2 View 13 Photos XPeng Aeroht eVTOL Flying Car XPeng Aeroht eVTOL?Flying Car View 6 Photos Verge TS Ultra verge-ts-ultra-ces-2024-electric-motorcycle-01 View 17 Photos Horwin Senmenti Maxi Scooter Range Horwin Senmenti 0 View 12 Photos BMW Teleoperated Valet BMW iX controlled with Remote Valet View 15 Photos Mercedes-Benz MB.OS infotainment Mercedes-Benz MB.OS infotainment system View 9 Photos Lamborghini Telemetry X Lamborghini Telemetry X View 5 Photos Related video: Green Motorsports CES BMW Ford Honda Hyundai Kia Lamborghini Mercedes-Benz Volkswagen Volvo Green Automakers Green Culture Technology Infotainment Smartphone Autonomous Vehicles Commercial Vehicles Concept Cars Polestar Infrastructure

There might be a second VW software cheat

Fri, Oct 16 2015The initial flurry of news about Volkswagen's diesel scandal is just beginning to settle down, but the company is months away from actually having any of the affected vehicles fixed. A stop sale is still in effect on new examples in the US, as well. The remedy process now faces yet another hurdle because the Environmental Protection Agency is requesting more info about other previously undisclosed emissions software on the engines, Bloomberg reports. Separate from the defeat device that evades tests, this new bit of code reportedly helps warm up the engine. However, automakers are supposed to disclose to the EPA any software that can affect emissions. The tech isn't necessarily against the law, but the regulatory agency needs to know about it during evaluations. The company didn't reveal this system until applying for certification on the latest TDIs. "VW did very recently provide EPA with very preliminary information on an auxiliary emissions control device that VW said was included in one or more model years," EPA spokesperson Nick Conger told Bloomberg. In response to the disclosure, VW took back its application for the diesels until it provided more details to the EPA on the previously undisclosed code. So far, there's no evidence that this code is actually another defeat device, though. Regulators are preparing an onslaught of tests on the revised engine to make sure the German automaker isn't gaming the system again. VW has until November 20 to outline a fix for the diesels to the California Air Resources Board. In response to the scandal, the company is preparing for severe cutbacks to have enough money to pay for all of the expected fines and repairs. It also recently announced plans for a serious electrification push in the near future.

The super-sized Atlas isn't the three-row VW should build

Fri, Dec 2 2016In the late '50s and early '60s the Volkswagen Beetle wasn't ubiquitous in my hometown of Lincoln, Nebraska, but it came pretty damn close. Fords and Chevys dominated, but beyond the occasional MG, Triumph, or Renault the import scene was essentially a VW scene. When my folks finally pulled the trigger on a second car they bought a Beetle, and that shopping process was my first exposure to a Volkswagen showroom. For our family VW love wasn't a cult, but our '66 model spoke – as did all Volkswagens and most imports at the time – of a return to common sense in your transportation choice. As VW's own marketing so wonderfully communicated, you didn't need big fins or annual model changes to go grab that carton of milk. Or, for that matter, to grab a week's worth of family holiday. In the wretched excess that was most of Motown at the time, the Beetle, Combi, Squareback, and even Karmann Ghia spoke to a minimal – but never plain – take on transportation as personal expression. Fifty years after that initial Beetle exposure, and as a fan of imports for what I believe to be all of the right reasons, the introduction of Volkswagen's Atlas to the world market is akin to a sociological gut punch. How is it that a brand whose modus operandi was to be the anti-Detroit could find itself warmly embracing Detroit and the excess it has historically embodied? Don't tell me it's because VW's Americanization of the Passat is going so well. To be fair, the domestic do-over of import brands didn't begin with the new Atlas crossover. Imports have been growing fat almost as long as Americans have, and it's a global trend. An early 911 is a veritable wisp when compared to its current counterpart, which constitutes – coincidentally – a 50-year gestation. In comparing today's BMW 3 Series to its' '77 predecessor, I see a 5 Series footprint. And how did four adults go to lunch in the early 3 Series? It is so much smaller than what we've become accustomed to today; the current 2 Series is more substantial. My empty-nester-view of three-row crossovers is true for most shoppers: If you need three rows of passenger capacity no more than two or three times a year – and most don't – rent it forgawdsake. If you do need the space more often, consider a minivan, which goes about its three-row mission with far more utility (and humility) than any SUV.