1974 Volkswagen Karmann Ghia Project on 2040-cars

Fillmore, Utah, United States

Fuel Type:Gasoline

Engine:4 cyl

For Sale By:Private Seller

Drive Type: 2 wheel rear wheel

Make: Volkswagen

Mileage: 92,800

Model: Karmann Ghia

Trim: base

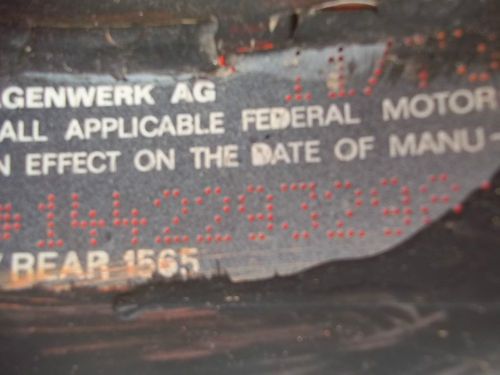

1974 Volkswagen Karmann Ghia Project Engine is out and Parts have been taken off Original color was Orange Low Rust would make a great starter Project We are located 150 mile south of Salt Lake Be sure and email questions. 92800 on the Odometer Item as is where is. Can assist in Loading

Volkswagen Karmann Ghia for Sale

1964 volkswagen karmann ghia coupe

1964 volkswagen karmann ghia coupe 1970 karmann ghia convertible * stunning resoration * ready to go

1970 karmann ghia convertible * stunning resoration * ready to go 1968 karmann ghia convertible beautiful turn key car must see!!!(US $23,750.00)

1968 karmann ghia convertible beautiful turn key car must see!!!(US $23,750.00) 1964 volkswagen karmann ghia, slammed low rider

1964 volkswagen karmann ghia, slammed low rider 1967 volkswagen karmann ghia base 1.5l

1967 volkswagen karmann ghia base 1.5l 1972 restored black vw karman ghia+custom interior+1641cc motor+rebuilt 90%(US $5,999.99)

1972 restored black vw karman ghia+custom interior+1641cc motor+rebuilt 90%(US $5,999.99)

Auto Services in Utah

Young Chevrolet ★★★★★

Utah Auto Wrecking of St George ★★★★★

Tunex ★★★★★

The Junk Car Buyer ★★★★★

Sherms Store Inc ★★★★★

Shane`s Automotive ★★★★★

Auto blog

Workers at Mississippi auto supplier protesting low wages

Tue, Feb 24 2015Workers at an automotive seat factory in Mississippi are protesting what they say are low wages and poor working conditions as they attempt to unionize in what could become a new front for the United Auto Workers in the state. A group of workers and supporters at the Faurecia SA seating plant in Cleveland plans a Tuesday march. "We work an auto job and we're getting paid like Wal-Mart wages," said Jamarqus Reed, a 32-year-old Pace resident who has worked at the plant for almost 10 years. "We're trying to better ourselves." Nationally, the UAW has staked its future on unionizing Southern auto factories, with limited success so far. The union has been trying to organize Nissan Motor Co.'s Canton, MS, plant for years, and lost a 2008 worker vote at a Johnson Controls plant in nearby Madison that French-based Faurecia bought in 2011. The UAW narrowly lost a unionization vote at the Volkswagen AG plant in Chattanooga, TN, last year, but the union has since qualified for a new labor policy at the plant that grants access to meeting space and to regular discussions with management. The policy stops short of collective bargaining rights. The union is also trying to organize Nissan's assembly plant in Smyrna, TN, and Daimler AG's Mercedes-Benz plant in Tuscaloosa, AL. Protesters say Faurecia employees make a top wage of $11.64 per hour, while contract workers make $7.73 an hour. Company spokesman Tony Sapienza said that with overtime, the typical Faurecia employee makes more than the $27,000 a year that is the median wage around Cleveland. Wages are often low in the heavily impoverished Delta. "We are very confident that we are offering a very competitive wage," Sapienza said. Organizers criticize use of lower-paid contract workers Shannon Greenidge, a 44-year-old Cleveland resident, said she worked for a labor agency for more than two years before being hired directly by Faurecia. Greenidge said she makes $9.29 an hour, and can't save for retirement or to send her 11-year-old daughter to college. "That's not going to help me down the line in life," she said. Union supporters say as many as half the workers at the plant work for a contract-labor agency. Sapienza said that while the number varies, the company expects 15 percent of its workforce will be temporary employees this year. The UAW has organized some Southern auto parts plants in recent years, including Faurecia plants in Cottondale, Alabama, in 2012 and Louisville, Kentucky in 2013.

Crash test videos show how rust compromises safety

Fri, Apr 13 2018These recently released Swedish videos serve as a reminder that rust isn't just a cosmetic flaw, when it comes to cars. The insurance company Folksam and the homeowner organization Villaagarnas Riksforbund gathered examples of two relatively popular, but by now rusty cars, and then performed crash tests with them at the Thatcham Research facility in Britain. The results are sobering. The rustier cars chosen for the tests were first-generation Mazda6s, cars that have a reputation for early-onset rust in salty surroundings, such as the Nordic countries in Europe or the Salt Belt in the U.S. The cars in the other end of the spectrum were fifth-generation Volkswagen Golfs, which thanks to their body treatment only really start to show rust at over ten years old. But rust isn't just on the surface, it goes bone deep. While the Mazda did decently well in Euro NCAP testing as a new car, there's now a 20 percent higher risk of death in the 2003-2008 Mazda due to the degradation of its bodyshell. In the rusty car, the chassis rail separates from the floor, the footwell ruptures, the sill gives way, the seat mountings move and the dummy's head hits the B-pillar; all important failures, despite Thatcham saying the cars actually performed better in the crashes than they expected with all the rust. But still, the corroded structure isn't able to transmit loads in the way it was originally designed to do. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. The Golf does significantly better — despite rust flakes flying when the Golf hits the wall — as the years have only caused it to lose a single point. An important thing to remember is that the cars aren't tested in comparison to corresponding new, 2018 cars: the tests are in reference to the crashworthiness standards in place when they were new. The cars' airbags inflate like they were supposed to, but on the Mazda the dummy's head bottoms out the airbag due to the car's structure failing, meaning the airbag cannot perform as designed. Driven cautiously, an older car is still mostly fine for driving around. But tests like these remind us that it's not enough that a car runs and drives, if the body has turned into Swedish knackebrod. And if you repair the visible rust and the structure underneath remains as compromised as ever, there's an ugly truth under all the bondo. Perhaps it isn't such a bad idea to have yearly roadworthiness inspections.

Don't buy that crossover! Buy a cladded wagon instead!

Fri, Nov 10 2017If you're looking to buy a car soon, and you're like most Americans, there's a strong chance you're considering buying a crossover SUV. That's what people want nowadays. People like the tough, tall exterior that suggests adventure and preparedness, they like the high seating position, they like the all wheel drive many have and they like the practicality. Because of this, crossovers have rapidly supplanted typical cars such as sedans, wagons, and more as the most popular vehicles in the country. But they're compromised, too. They're often heavy, thirsty, and expensive compared with more conventional cars. The good news is, there's an alternative, a happy medium between the straight crossover and the traditional car. They're lifted wagons, and they're the best crossover SUVs around. And for those who may not know what we're talking about, we're talking about cars and wagons that have been given a suspension lift for more ground clearance and a higher ride height, and often have all wheel drive standard or optional. They also usually have chunky plastic body cladding to make them look tough and durable. Examples include the Subaru Crosstrek, Audi A4 Allroad, Buick Regal TourX, and Volkswagen Golf Alltrack, among others. Because of the suspension and body modifications, these vehicles fit the trendy crossover mold quite well. And in the case of long-running nameplates such as the Subaru Outback and Volvo Cross Country models, they even have some heritage as outdoorsy machines. They also provide the higher driving position that crossover buyers love. And in some cases, such as with the Golf Alltrack, we've learned they offer better ride quality than their road-oriented siblings. View 9 Photos So these tall wagons offer the key things crossover buyers want, but what makes them better than traditional crossovers is that they have the advantages of the cars they're based on. For instance, the aforementioned Golf Alltrack still drives mostly like a Golf, which is to say, it's nimble, feels peppy, and is easy to maneuver because of its relatively small size. We can't really say the same for the Tiguan, which feels generally more sluggish and uninteresting than the Alltrack. And we mention Volkswagen's compact crossover because it starts at nearly the same price as the Alltrack. Some of the difference in giddy-up can be explained by weight. Normal crossovers can be fairly portly, while these lifted wagons are notably lighter.