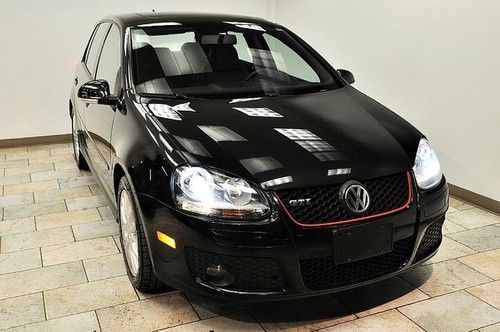

2006 Vw Gti 200hp 2.0l Turbocharged 4 Cylinder, Leather, ** Only 50k Miles ** on 2040-cars

Easton, Pennsylvania, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.0L 1984CC 121Cu. In. l4 GAS DOHC Turbocharged

Body Type:Hatchback

Fuel Type:GAS

Make: Volkswagen

Model: GTI

Trim: Base Hatchback 2-Door

Disability Equipped: No

Doors: 2

Drive Type: FWD

Drivetrain: Front Wheel Drive

Mileage: 50,319

Number of Doors: 2

Sub Model: 2.0L TURBO

Exterior Color: Black

Number of Cylinders: 4

Interior Color: Black

Volkswagen Golf for Sale

2005 vw gti 1.8t (florida car - no reserve!)

2005 vw gti 1.8t (florida car - no reserve!) 10' 10 6 speed manual hatchback 2.0l moonroof turbo alloy wheels no reserve

10' 10 6 speed manual hatchback 2.0l moonroof turbo alloy wheels no reserve 2010 volkswagen golf 2.5l 4-door pzev(US $14,100.00)

2010 volkswagen golf 2.5l 4-door pzev(US $14,100.00) 2010 volkswagen gti base hatchback 2-door 2.0l

2010 volkswagen gti base hatchback 2-door 2.0l 2008 volkswagen gti base hatchback 2-door 2.0l(US $14,000.00)

2008 volkswagen gti base hatchback 2-door 2.0l(US $14,000.00) 2007 volkswagen gti 4door 48k 6speed ext warranty(US $16,999.00)

2007 volkswagen gti 4door 48k 6speed ext warranty(US $16,999.00)

Auto Services in Pennsylvania

YBJ Auto Sales ★★★★★

West View Auto Body ★★★★★

Wengert`s Automotive ★★★★★

University Collision Center ★★★★★

Ultimate Auto Body Inc ★★★★★

Stewart Collision Service ★★★★★

Auto blog

Porsche board members facing another ˆ1.8B lawsuit over VW takeover bid

Mon, 03 Feb 2014Back in 2008, Porsche got the bright idea that it could take over Volkswagen in the midst of the worst economic slump since the Great Depression. Ignoring that this was a catastrophic move for the Stuttgart sports car manufacturer that that eventually resulted in it nearly going bankrupt and eventually being taken over by the same company it sought to control, the aftermath has left Porsche Chairman Wolfgang Porsche and board member Ferdinand Piëch in the crosshairs of seven hedge funds that lost out during the takeover and are now seeking €1.8 billion - $2.43 billion US - in damages from the two execs, according to the BBC.

See, investors bet on Volkswagen's share price going down, partially because Porsche said it wasn't going to attempt a takeover. But Porsche was attempting to take over VW, having bought up nearly 75-percent of VW's publicly traded shares. When word broke that Porsche owned nearly three-quarters of VW (which indicated an imminent takeover attempt), rather than go down like the hedge funds bet it would, VW's share price skyrocketed to over 1,000 euros per share, according to Reuters.

Naturally, when you bet that a company's share price is going to drop and it in turn (temporarily) becomes the world's most valuable company, you lose a lot of money, unless you're able to buy up shares before prices jump too much. This led to a squeeze on the stock, which the hedge funds accuse Porsche and Piëch (who are both members of the Porsche family and supervisory board) of organizing.

Crash test videos show how rust compromises safety

Fri, Apr 13 2018These recently released Swedish videos serve as a reminder that rust isn't just a cosmetic flaw, when it comes to cars. The insurance company Folksam and the homeowner organization Villaagarnas Riksforbund gathered examples of two relatively popular, but by now rusty cars, and then performed crash tests with them at the Thatcham Research facility in Britain. The results are sobering. The rustier cars chosen for the tests were first-generation Mazda6s, cars that have a reputation for early-onset rust in salty surroundings, such as the Nordic countries in Europe or the Salt Belt in the U.S. The cars in the other end of the spectrum were fifth-generation Volkswagen Golfs, which thanks to their body treatment only really start to show rust at over ten years old. But rust isn't just on the surface, it goes bone deep. While the Mazda did decently well in Euro NCAP testing as a new car, there's now a 20 percent higher risk of death in the 2003-2008 Mazda due to the degradation of its bodyshell. In the rusty car, the chassis rail separates from the floor, the footwell ruptures, the sill gives way, the seat mountings move and the dummy's head hits the B-pillar; all important failures, despite Thatcham saying the cars actually performed better in the crashes than they expected with all the rust. But still, the corroded structure isn't able to transmit loads in the way it was originally designed to do. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. The Golf does significantly better — despite rust flakes flying when the Golf hits the wall — as the years have only caused it to lose a single point. An important thing to remember is that the cars aren't tested in comparison to corresponding new, 2018 cars: the tests are in reference to the crashworthiness standards in place when they were new. The cars' airbags inflate like they were supposed to, but on the Mazda the dummy's head bottoms out the airbag due to the car's structure failing, meaning the airbag cannot perform as designed. Driven cautiously, an older car is still mostly fine for driving around. But tests like these remind us that it's not enough that a car runs and drives, if the body has turned into Swedish knackebrod. And if you repair the visible rust and the structure underneath remains as compromised as ever, there's an ugly truth under all the bondo. Perhaps it isn't such a bad idea to have yearly roadworthiness inspections.

VW stock delisted from Dow Jones Sustainability Index

Thu, Oct 1 2015Because of the company's years-long diesel emissions evasions, Volkswagen AG is being removed from the Dow Jones Sustainability Indices effective October 6, according to a joint statement by S&P Dow Jones Indices LLC and RobecoSAM. After looking at reports of the automaker's cheating software, the DJSI has decided that the company shouldn't be part of the index anymore. According to The Detroit News, the DJSI is meant to track the top 10 percent of companies that are considered leaders environmentally and socially in each industry among the 2,500 largest companies in the S&P Global Broad Market Index. This de-listing means that VW is no longer considered an industry leader by this group for its economic, environmental and social performance. As of this writing, VW AG's stock price sits at 97.75 euros ($109.14), and the figure has been largely in freefall since the emissions evasions reports first surfaced. It was considered shocking on September 21 when the shares plunged almost 18 percent to end the day at 132.15 euros ($147.57). According to The Detroit News, the automaker has lost about $30.8 billion in value since the EPA put out its notice of violation on September 18. Related Video: Â Volkswagen AG to be Removed from the Dow Jones Sustainability Indices New York and Zurich, September 29, 2015 Effective October 6, 2015, Volkswagen AG (VW) will be removed from the Dow Jones Sustainability Indices (DJSI). A review of VW's standing in the DJSI was prompted by the recent revelations of manipulated emissions tests. Per the published and publicly available methodology for the DJSI, potential problematic issues relating to any DJSI component company automatically trigger a Media & Stakeholder Analysis (MSA), which examines the extent of the respective company's involvement and how it manages the issue. Following the MSA, the Dow Jones Sustainability Index Committee (DJSIC) reviews the issue and decides whether the company will remain in the index, based on DJSI Guidelines. In VW's case, the DJSIC reviewed the situation and ultimately decided to remove the Company from the DJSI World, the DJSI Europe, and all other DJSI indices. The stock will be removed after the close of trading in Frankfurt on October 5, 2015, thus making the removal effective on October 6, 2015. As a result, VW will no longer be identified as an Industry Group Leader in the "Automobiles & Components" industry group.