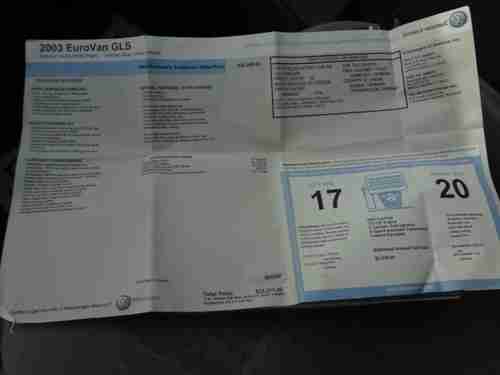

2003 Volkswagen Eurovan Gls! One Owner! No Reserve! on 2040-cars

Plainville, Connecticut, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:2.8L 2792CC V6 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

Make: Volkswagen

Model: EuroVan

Warranty: Vehicle does NOT have an existing warranty

Trim: GLS Standard Passenger Van 3-Door

Options: Sunroof, Cassette Player, CD Player

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 124,616

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: White

Interior Color: Gray

Disability Equipped: No

Number of Cylinders: 6

Volkswagen EuroVan for Sale

2002 volkswagen eurovan mv van 3-door 2.8l no reserve

2002 volkswagen eurovan mv van 3-door 2.8l no reserve Clean 2002 volkswagen eurovan

Clean 2002 volkswagen eurovan Vw eurovan 7 pass

Vw eurovan 7 pass 1999 volkswagen eurovan gls standard passenger van 3-door 2.8l(US $1,250.00)

1999 volkswagen eurovan gls standard passenger van 3-door 2.8l(US $1,250.00) 1995 vw camper euro van,cold ac,stove,frig,automatic gasoline 2.5l,runs great(US $18,900.00)

1995 vw camper euro van,cold ac,stove,frig,automatic gasoline 2.5l,runs great(US $18,900.00) 2002 volkswagen eurovan mv pop top weekender 3-door 2.8l

2002 volkswagen eurovan mv pop top weekender 3-door 2.8l

Auto Services in Connecticut

Tender Car Care ★★★★★

Supreme Auto Collision Inc ★★★★★

Sunoco Ultra Service Center ★★★★★

Pete`s Tire & Oil ★★★★★

Napa Auto Parts - Fair Auto Supply Inc ★★★★★

Moran`s Service Ctr ★★★★★

Auto blog

My year in EVs: 8 electrics that are changing the car industry

Wed, Dec 1 2021The year 2021 will go down as an inflection point in the auto industryís transition to electric vehicles. It's when many much-anticipated models became reality. No longer sketches or sketchy prototypes, electric vehicles appeared from all corners with everything from the Lucid Air to Ford Mustang Mach-E changing how we think about transportation. I managed to drive a lot of them, and as I went through my notes, I realized I¬íve got a mini memoir of the seminal EVs of 2021. Here¬ís my take on eight of them. Hummer EV Easily the most over-the-top EV I tested this year. The 1,000-hp super truck lived up to the hype with its domineering presence, stupendous power and simply being a reincarnated Hummer. I took it for a short spin on- and off-road at the General Motors Proving Grounds in Milford, Mich., and was impressed with the airy cabin, removable sky panels and expansive touchscreens. Yes, I crab walked, which felt like steering a pontoon boat, though I can see why it would be useful. Lucid Air Dream Performance The most beautiful sedan I tested all year, EV or otherwise. Unlike the futuristic Mercedes EQS ¬ó which is quite attractive ¬ó Lucid¬ís car is a blend of mid-century modern interior aesthetics and classic European exterior styling. When I walked up for my test drive, someone who I¬ím pretty sure was comedian Jon Lovitz was sitting inside and taking it all in. As it sat in the valet of a hotel in a wealthy suburban enclave north of Detroit, the Lucid drew more attention than any of the Mercedes, Cadillacs or Lexus models passing by. The driving experience was enveloping. Starting at $169,000 for the Performance model (reservations are closed), the Lucid I sampled packed 1,111 hp and 471 miles of range. From the precise steering to the comfortable suspension, the dynamics were spot-on. It's a formidable product, and all the more impressive given it¬ís Lucid¬ís first. Chevy Bolt EV The Bolt was the most pleasant surprise for me. It handled well, offered low-to-the-ground hot hatch dynamics and the steering was dialed-in. Adding a crossover variant for the new generation was a smart play. On a summer morning where I went to a first drive of the Ford Bronco at an off-road course, my hour-long commute in the Bolt was an enjoyable appetizer.¬† The Bolt was also my biggest disappointment due to its extensive recalls for fire risk. Ironically, I had the Bolt in my driveway when the initial recall went out for the previous generation (2017-19).

Lamborghini could be sold or spun off from the Volkswagen Group

Sat, Oct 12 2019Volkswagen is reportedly considering a sale or stock listing for its high-end Lamborghini brand. The German automaker is looking to fold the Italian supercar brand into a separate legal entity, reports Bloomberg, which cites "people familiar with the matter" who don't want to be identified "because the deliberations are confidential and no decisions have been made." Any of this sound familiar? The goal of spinning off Lamborghini would be to stockpile more cash and other resources for VW's massive planned push into electric vehicles. Back in March, reports circulated that Volkswagen's "Vision 2030" corporate plan might include plans to focus on the brand's core brands ó VW, Audi and Porsche. That means the futures of fringe players like Lamborghini, Bentley, Bugatti, motorcycle brand Ducati and design firm Italdesign (and note this isn't a comprehensive list of brand's under the expansive VW Group umbrella) are up in the air. VW, according to the report, is targeting a market value of $220 billion, which is a big jump from the brand's current $89 billion valuation. Bloomberg pegged Lamborghini's valuation at around $11 billion back in August, buoyed by sales and profits generated by the introduction of the Urus sport utility vehicle. On the flip side, Lamborghini is currently grappling with how best to update its supercar lineup in the face of ever-increasing emissions regulations.

VW Diesel Scandal Wrap-up: Time for bullet points

Thu, Sep 24 2015Here we go again. If you were not pegged to your RSS reader yesterday, scoping out all of the VW diesel scandal news, here's a brief rundown of what happened: Just how much extra pollution did VW's little problem cause in the US? New estimates suggest it's as bad as having an additional 19 million cars on the road, or "12,000 additional tons of nitrogen oxide pollutants per year." NOx can create smog and acid rain. The diesel scandal is also reshaping some online ads. Sponsored content in WIRED that talked about clean diesel has been taken down. The advertisement was a partnership between Volkswagen and the Wired Brand Lab and claimed to have, "created an experience that will inform, educate, surprise, and change the way you think about diesel." Canada says it might start up its own governmental investigation and that "enforcement action will be taken," if the automaker is found to have broken the law. The German government says it did not know about VW's subterfuge until recently, and is going to start a fact-finding process this week. It turns out that the first hints of this scandal were discovered by independent researchers in 2012 and 2013. Whatever happened, Renault-Nissan CEO Carlos Ghosn said that it's hard to hide something like this. Following CEO Martin Winterkorn's departure yesterday, speculation is running rampant to see who will replace him. Automotive News says it should be current Porsche CEO Matthias Mueller. Don't feel too bad for Winterkorn, though, as he's still likely to get his $32 million pension, Bloomberg says. Oh, and this isn't even the first time VW has tried to cheat the EPA. It's a problem in the auto industry. We'll see how many bullet points we have tomorrow. Government/Legal Green Volkswagen Emissions Diesel Vehicles vw diesel scandal martin winterkorn matthias mueller pension