1978 Volkswagen Karmann Edition on 2040-cars

Hasbrouck Heights, New Jersey, United States

Body Type:Convertible

Engine:1.6 Air Cooled Injection System

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Used

Make: Volkswagen

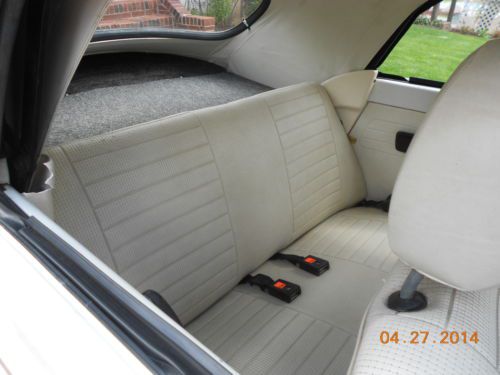

Interior Color: wh

Model: Beetle - Classic

Number of Cylinders: 4

Year: 1978

Trim: Stock

Drive Type: RWD

Options: Convertible

Mileage: 85,000

Exterior Color: wh

|

FUN CAR TO DRIVE THROUGHOUT THE WARMER MONTHS COVERED WHEN NOT BEING USED 36 YEAR OLD VEHICLE WITH MINOR NICKS NO DENTS AS SEEN IN PICTURES NEW BLACK CONVERTIBLE TOP WHITE LINER INSIDE 4 BRAND NEW TIRES CONSOLE ADDED FOR CONVENIENCE STOCK AM/FM STEREO RADIO WORKS FRESH AIR FAN WORKS NO ISSUES WITH ANY WORKING PART OF THIS VEHICLE MAINTAINED AT ALL SCHEDULED INTERVALS VEHICLE HAS PASSED NJ STATE INSPECTION RECENTLY TUNED, OIL CHANGE, BRAKES CHECKED ACCELLERATOR CABLE REPLACED SHIPPING: Buyer's responsibility for vehicle pickup or shipping. PAYMENTS: Deposit of $500.00 within 48 hours of Auction close, and full payment within 7 days of Auction close. |

Volkswagen Beetle - Classic for Sale

1970 volkswagen bug sedan, 4-sp, 31,802 original miles

1970 volkswagen bug sedan, 4-sp, 31,802 original miles 1969 volkswagen beetle

1969 volkswagen beetle Volkswagen classic beetle 1972 super

Volkswagen classic beetle 1972 super 1966 vw volkswagen beetle 1500cc ruby red restored bug(US $6,999.00)

1966 vw volkswagen beetle 1500cc ruby red restored bug(US $6,999.00) 1973 volkswagen super beetle base 1.6l(US $2,500.00)

1973 volkswagen super beetle base 1.6l(US $2,500.00) 1978 volkswagen super beetle base convertible 2-door 1.6l(US $9,500.00)

1978 volkswagen super beetle base convertible 2-door 1.6l(US $9,500.00)

Auto Services in New Jersey

Yonkers Honda Corp ★★★★★

White Dotte ★★★★★

Vicari Motors Inc ★★★★★

Tronix Ii ★★★★★

Tire Connection & More ★★★★★

Three Star Auto Service Inc. ★★★★★

Auto blog

2021 Ford Mustang Mach 1 revealed, plus driving the BMW M8 Convertible | Autoblog Podcast #632

Fri, Jun 19 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Producer Christopher McGraw and News Editor Joel Stocksdale. Before they get to this week's big news, they talk about the cars they've been driving, including the Toyota Land Cruiser, Range Rover Velar SVAutobiography Dynamic Edition, BMW M8 Convertible and BMW 840i coupe. Then they talk about Ford's big reveal of the 2021 Mustang Mach 1. Finally, in lieu of the regular Spend My Money segment, they talk about how Joel recently spent his own money on the newest edition to his personal fleet, a 2013 Volkswagen Beetle. Autoblog Podcast #632 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: 2020 Toyota Land Cruiser 2020 Range Rover Velar SVAutobiography 2020 BMW M8 Convertible 2020 BMW 840i Fords reveals 2021 Mustang Mach 1 Spend Joel's Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Recharge Wrap-up: AutoNation CEO calls anti-Tesla laws unnecessary, Common Pence donates subway money

Thu, Nov 13 2014Volkswagen has presented a list of near-term technologies to improve fuel economy and decrease emissions. The list includes an addition to a coasting function in its stop-start system, a 10-speed DSG transmission and a more power-dense four-cylinder TDI engine. Volkswagen aims to be the world's most sustainable automaker by 2018 through electric mobility, improved design and increased environmental performance from internal combustion vehicles. Volkswagen also announced other technologies for increased interactivity and connectivity in its vehicles. Read more at Green Car Congress. Commence Pence is a system that allows subway riders in London to donate their unused transit money to charity. People visiting the city often load up enough on their subway card (called Oyster Card) to get them through their trip and end up with unused funds leftover. Zander Whitehurst, a British designer, has created a device that can use the card's RFID to accept leftover funds, which then get diverted to charity rather than reverting back to the agency in charge of running the subway fare system. See the video below or read more at Wired. Mike Jackson, CEO of AutoNation has called Michigan's efforts to ban Tesla's direct sales in the state "unnecessary protectionism." The statement comes as a bit of a surprise, as it dissents from the majority of auto dealers who support a franchise model, as well as laws that forbid automakers selling directly to the consumer. "If Elon Musk wants to make a mistake and go with an inefficient distribution system, that's his right as an American," says Jackson, showing he feels he has little to fear from the electric automaker. Jackson has more to say on the matter, which you can read over at Green Car Reports. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Featured Gallery Tesla Stores Around The World View 22 Photos News Source: Green Car Congress, Wired, Green Car ReportsImage Credit: Rick Bowmer / AP Government/Legal Green Tesla Volkswagen Fuel Efficiency Transportation Alternatives Electric recharge wrapup

FCA to pay buyers $1,700 to swap out of scandal-mired VWs

Tue, Oct 6 2015FCA is trying to gain some sales from arch-rival VW in the competitive European market by offering potential buyers in Italy up to $1,700 to swap into an FCA group car. While the promotion isn't specifically targeted at TDI owners affected by the emissions scandal, it is clearly intended to turn dissatisfaction with VW's defeat device cheat into additional sales, Bloomberg reports. The 500-1,500 euro incentive (roughly $560-1,700, depending on vehicle) stacks on top of any other rebates or deals applicable, and applies if a buyer brings in any of Volkswagen Group's cars – including Audi, Skoda, and SEAT, among (many) others. As Bloomberg notes, it's normal for automakers to offer "conquest" deals – giving a buyer cash for trading in a competitor's vehicle. Those deals aren't usually limited to one company's products, however; FCA's program looks specifically to take advantage of VW's legal and public relations nightmare. FCA isn't the only automaker trying this trick in Italy. Automotive News Europe also reported that Ford is offering approximately $840 in incentives across its entire range to owners of VW vehicles seeking to trade in for a Ford. No word of yet as to whether these incentives will spread beyond Italy or to other automakers.Related Video:

2040Cars.com © 2012-2026. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.044 s, 7977 u